Time to buy the dip, or have the crypto markets got further to fall?

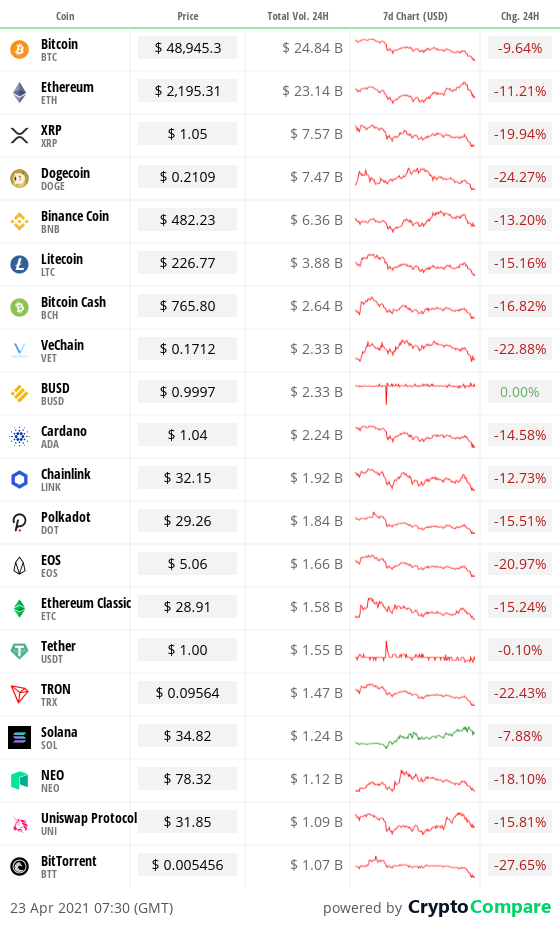

Crypto at a glance

It’s a sea of red this morning, as a tough week in the crypto markets continues to get tougher. More than $400 billion has now been wiped off the cryptocurrency market over the last seven days – almost 20 per cent of its total value. Is it time to buy the dip, or is there still further to fall before we can talk about a recovery?

The Bitcoin price has extended its recent decline, falling to below $50,000 for the first time since March 8. The leading cryptocurrency is currently trading at just below $49,000 and looking for support. Will it find it here and recover back to the $50-60k range it’s been in for so long now?

All other major cryptocurrencies have also experienced significant losses over the last 24 hours, with the vast majority seeing double-digit drops. Even Ethereum (ETH) is now down over the last 24 hours, despite setting a new all-time high of more than $2,600 yesterday. It’s still trading over $2,000, but can it hold?

There have been many causes speculated for the sudden drop. Bitcoin has certainly been running hot lately, and many have been saying that it was due a correction. Others are also attributing the drop to US President Joe Biden’s reported comments about the introduction of capital gains tax reform that would affect the country’s ultra-wealthy and mean investors paying more on their Bitcoin profits.

It’s important to zoom out at times like these and look at the massive gains this year, even if we include the recent fall. BTC has also done this before. In late February, the coin dropped from $57,000 to $45,000 a week later. Two weeks after that, it was above $60,000 for the first time. Will history repeat itself this time?

All feedback on Crypto AM Daily in association with Luno is welcome via email to James.Bowater@cityam.com ??

In the markets

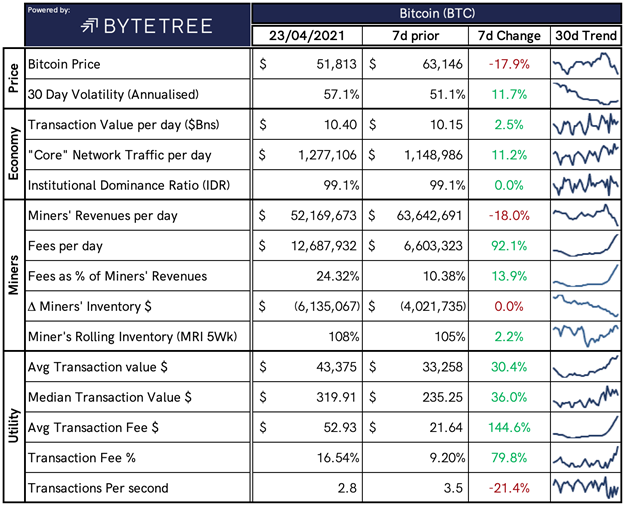

The Bitcoin economy

*Definitions and insights can be found at https://bytetree.com/insights/

Total crypto market cap

The total capitalisation of the entire cryptocurrency market at time of writing is currently $1,785,127,735,290, down from $2,018,845,657,456 yesterday.

What Bitcoin did yesterday

We closed yesterday, April 22 2021, at a price of $51,762.27 – down from $53,906.09the day before.

The daily high yesterday was $55,410.23 and the daily low was $50,583.81.

This time last year, the price of Bitcoin closed the day at $7,117.21. In 2019, it closed at $5,399.37.

Bitcoin market capitalisation

Bitcoin’s market capitalisation at time of writing is $902.63 billion, down from $1.014 trillionat this time yesterday. To put that into context, the market cap of gold is $11.349 trillion and Alphabet (Google) is $1.524 trillion.

Bitcoin volume

The total spot trading volume reported by all exchanges over the last 24 hours was $87,573,106,119, up from $60,417,126,215 yesterday. High volumes can indicate that a significant price movement has stronger support and is more likely to be sustained.

Volatility

The price volatility of Bitcoin over the last 30 days is 47.04%.

Fear and Greed Index

Market sentiment remains in Greed, though it’s down from 65 to 55 today.

Bitcoin’s market dominance

Bitcoin’s market dominance today is 52.48, upfrom 51.28 yesterday. Its lowest ever recorded dominance was 37.09 on January 8 2018.

Relative Strength Index (RSI)

The daily RSI is currently 30.28, down from 39.55yesterday. Values of 70 or above indicate that an asset is becoming overbought and may be primed for a trend reversal or experience a correction in price – an RSI reading of 30 or below indicates an oversold or undervalued condition.

Convince your Nan: Soundbite of the day

“By combining miners with renewables and storage projects, we believe it could improve the returns for project investors and developers, moving more solar and wind projects into profitable territory. [And] allow for the construction of solar and wind projects even before lengthy grid interconnection studies are completed… [and] provide the grid with readily available ‘excess’ energy for increasingly common black swan events like excessively hot or cold days when demand spikes.”

– ‘Bitcoin Is Key To An Abundant, Clean Energy Future’

What they said yesterday

True?

Protect your Bitcoin…

Did someone say ‘pastel de nata’?

Philosophical as always…

Crypto AM Editor writes

Bitcoin could pull back to $20,000 claims global investment boss

Bitcoin gets seal of approval as Baillie Gifford ploughs $100m into London crypto firm

API3 and Open Bank Project team up for decade-long blockchain venture

Intelligence dossier finds Bitcoin is outperforming gold but Ethereum is outshining Bitcoin

Crypto AM: Longer Reads

City AM Markets: What is Decentralised Finance (DeFi) by Aave

Crypto AM: Conversation with James Bowater

Crypto AM: Market View

Crypto AM: Technically Speaking

Crypto AM: A Trader’s View with TMG

Crypto AM: Mixing in the Metaverse with Dr Chris Kacher

Crypto AM: Talking Legal

Crypto AM: Spotlight

Crypto AM: Founders Series

Crypto AM: Industry Voices

Crypto AM: Tiptoe through the Crypto with Monty Munford

Crypto AM: Definitively DeFi

Crypto AM Parliamentary Special

April

Part one…

March

Part five…

Part four…

Part three…

Part two…

Part one…

Crypto AM: Recommended Events

AIBC World

May 25 to 26 2021 – Dubai

https://aibc.world/events/uae/general-info/

Crypto AM City of London Roundtable

Crypto AM DeFi & Digital Inclusion Summit

&

Crypto AM Awards 2021 (announcement soon)

Cautionary Notes

It’s definitely tempting to get swept up in the excitement, but please heed these words of caution: Do your own research, only invest what you can afford, and make good decisions. The indicators contained in this article will hopefully help in this. Remember though, the content of this article is for information purposes only and is not investment advice or any form of recommendation or invitation. City AM, Crypto AM and Luno always advise you to obtain your own independent financial advice before investing or trading in cryptocurrency.

All information is correct as of 08:30am GMT.