The dinosaur can’t evolve – it’s time for tech and crypto to take over

The multifaceted metaverse

Within the metaverse, crypto is laying the foundations for a self-sovereign financial system, also known as decentralised finance, or DeFi.

Such a system is quantum leaps ahead of traditional, centralised systems. Legacy banking has become a joke, a dinosaur that fails to cope with the fast paced, ever-changing technological climate. Since economics rules the day as people vote with their pocketbooks, the technologies that create utility with speed, scalability, and security will win the day.

At present, we have old school ways of handling monetary policy called central banks. A small group of people in suits guide the way, often divorced from technological trends. Meanwhile, fiat continues to debase, slowly robbing people of their savings, though faster in some countries such as Venezuela, South Africa, and Argentina. This has begged the question whether the world’s reserve currency could be vulnerable to systemic shocks brought about by the tipping point on which the planet sits given historically high levels of debt while interest rates plumb 5,000-year lows.

QE∞ : Is hyperinflation around the corner?

With two new massive stimulus packages on the way, concerns have risen that the US will repeat the hyperinflation of Germany’s Weimar in the 1920s. Inflation is coming but interest rates should head lower over the next 18 months to a few years. Once COVID recedes due to mass vaccinations enabling human beings to reach herd immunity, many more businesses will reopen to the public and people will start spending again.

Certainly, too much money chasing too few goods will induce accelerating inflation. This could cause a spike in inflation as demand surges which will force the Fed to try to raise interest rates but this will cause the stock and bond market to correct.

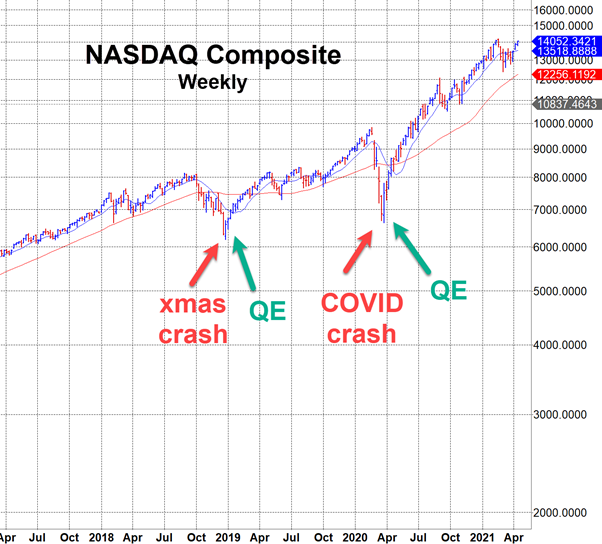

Each time the Fed has tried to do this, the stock market has gone into a correction of typically 10 to 20 per cent. The last time was in 2018 when the Fed was trying to tighten its balance sheet. This resulted in the first Christmas crash ever on Dec 24, 2018.

Powell had no choice but to once again loosen its balance sheet, which caused the stock market to soar. COVID also forced tons of stimulus which caused another soaring market that started last March.

Now with Biden in power and Dems loving stimulus, and with two massive stimulus packages on the way, interest rates should likely continue to fall (overall), and stocks/bonds/bitcoin/cryptocurrencies should continue to rise.

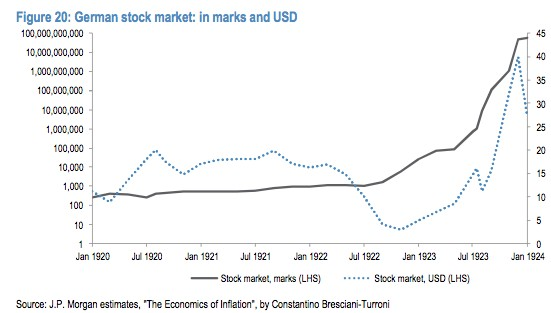

If history rhymes, today’s situation could shadow what happened in Germany in the early 1920s. There is no guarantee of this of course as exponential technologies create massive utility thus could partially offset the degree and severity of accelerating inflation.

Either way, it is interesting to see that stocks did very well during Germany’s bout with hyperinflation whether measured in German marks or US dollars. In 1923, stocks soared more than 1,700 per cent priced in USD but this paled in comparison to German stocks which soared above 50 million-fold priced in marks.

Hard assets and stocks don’t vanish even if a currency goes to zero. So in this incarnation of massive debt with historically low rates, hard assets, stocks, precious metals, real estate and bitcoin are safe havens against falling fiat.

The Inflation King

One individual Hugo Stinnes – dubbed “The Inflation King” – thrived. He borrowed heavily before hyperinflation hit then used the capital to buy hard assets. His coal, steel, and shipping vessels retained their value. He also bought companies abroad that earned in local currency, not worthless reichsmarks. He kept some profits offshore in the form of gold held in Swiss vaults to avoid both hyperinflation and German taxation.

Interestingly, the cause of hyperinflation was primarily due to the higher and higher prices of reparations demanded by the Allies after World War I ended. This forced the German government to accelerate their printing of banknotes to meet their debts. Hyperinflation was the result of these demands. Had the demands been moderated, massive sums of money would not have needed to be printed. Then, when the German economy stabilised and consumers started spending, all the excessive currency in circulation sparked hyperinflation.

Something similar could happen in today’s world given the massive sums of fiat that have been brought into circulation over the last decade, with COVID having been a striking accelerant of this trend.

One infamous outcome of the Weimar hyperinflation years was the “Zero Stroke” that plagued Germans who had to write endless amounts of zeroes in transactions. An article from Time Magazine in 1923:

“The last return of the Reichsbank gave the total German note circulation as 92,844,720,742,927,000,000 marks, nearly 93 quintillions.

Cipher stroke

“With the price of bread running into billions a loaf the German people have had to get used to counting in thousands of billions. This, according to some German physicians, brought on a new nervous disease known as “zero stroke,” or “cipher stroke,” which may, however, be classed with neuritis as cipheritis.

The persons afflicted with the malady are perfectly normal, except for a desire to write endless rows of ciphers and engage in computations more involved than the most difficult problems in logarithms.”

The lesson in today’s world is to make sure your capital is concentrated away from falling fiat. As we have been advising members at VSI for the last decade since we realized QE is here to stay, the places to put one’s investment capital include bitcoin/crypto, stocks especially big tech, real estate, precious metals, and for the more conservative, bonds. Cash is no longer the safe play it once was. As Ray Dalio, the founder of the world’s largest hedge fund Bridgewater has said: “Cash is trash.”

Dr Chris Kacher, nuclear physicist PhD turned stock+crypto trading wizard / bestselling author / blockchain fintech specialist / top 40 charted musician. Co-founder of Virtue of Selfish Investing and Hanse Digital Access.

Dr Kacher bought his first bitcoin at just over $10 in January 2013. His metrics have called every major top & bottom in bitcoin since 2011. He was up in 2018 vs the median performing crypto hedge fund at -46% (PwC) and is up quadruple digit percentages since 2019 as capital is force fed into the top performing alt coins while weaker ones are sold.

Virtue of Selfish Investing Crypto Reports

https://twitter.com/VSInvesting/ & https://twitter.com/HanseCoin

https://www.linkedin.com/in/chriskacher/