Coinbase UK Unit Fined for Insufficient Money Laundering Controls

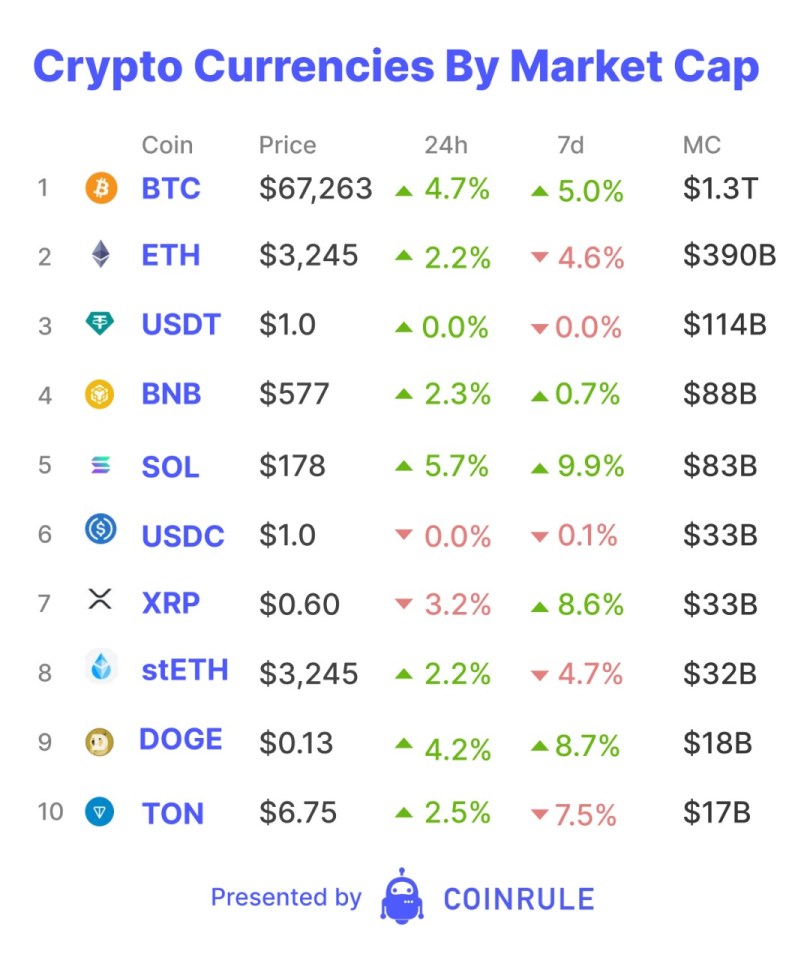

Each day, Coinrule will run through the state of the digital assets market for Blockbeat, your home for news, analysis, opinion and commentary on blockchain and digital assets.

Coinbase’s UK arm, CB Payments Limited (CBPL), has been fined £3.5 million by the UK’s Financial Conduct Authority (FCA) for breaching financial crime regulations. The fine was issued due to CBPL’s failure to adhere to a previous agreement with the FCA to prevent onboarding high-risk customers. This marks the first time the FCA has taken enforcement action under the Electronic Money Regulations 2011.

CB Payments Limited, an e-money institution and payments processor, is part of the Coinbase Group, a major global cryptocurrency exchange. CBPL entered an agreement with the FCA in October 2020, which restricted it from onboarding high-risk customers while it improved its financial crime controls. However, the FCA found that CBPL violated this agreement by onboarding 13,416 high-risk customers. Approximately 31% of these customers deposited a total of $24.9 million, which was then used for withdrawals and crypto transactions worth $226 million through other Coinbase entities.

The FCA criticized CBPL for lacking due skill, care, and diligence in adhering to the requirements. CBPL allowed high-risk customers to use its services over a three-year period. This led to significant financial transactions that posed a potential risk of money laundering according to the FCA.

In response to the fine, CBPL acknowledged the FCA’s findings and emphasised its commitment to regulatory compliance. The company stated that it is working to enhance its control mechanisms to prevent future breaches. Coinbase’s stock price is down by 3.5% following the news but this might also reflect overall market conditions rather than specific investor concerns.

This enforcement action is notable as constitues the first time the FCA has taken such steps against a cryptocurrency company. It raises important questions about how other crypto firms will respond to this increased scrutiny. The FCA’s decision highlights the broader intention to hold cryptocurrency firms accountable over compliance obligations. This fine serves as a clear warning that firms failing to comply with financial crime controls will face strict enforcement action. As a result, other cryptocurrency exchanges operating in the UK may need to reassess their compliance frameworks to avoid similar penalties.

Read more here for coinrule