Bitcoin rebounds strongly after a tough week, refusing to drop below $50K

Data by CryptoCompare shows that the Bitcoin price reached $61,749, which is its all-time high, on March 13.

Bitcoin (BTC) started the previous week at $57,374 and ended it at $56,500. Currently, BTC is trading around $58,100.

Although on Thursday Bitcoin was trading as low as $50,406, it managed to hold its ground and refused to go below $50,000 despite selling pressure created by billionaire investor Ray Dalio’s comments, the US dollar index (DXY) reaching 92.88, its highest level since November 2020, and a record amount (more than $6 billion) of Bitcoin options expiring last Friday.

As for Ether (ETH), the second most valuable cryptoasset by market cap, it reached its all-time high – $1,943 – on the same day as Bitcoin, on March 13. As usual, Bitcoin’s difficulties during the previous week translated to losses for most other cryptoassets, and Ether was no exception. ETH started the week at $1,783 and finished it at $1,699. Currently, it is trading around $1,760.

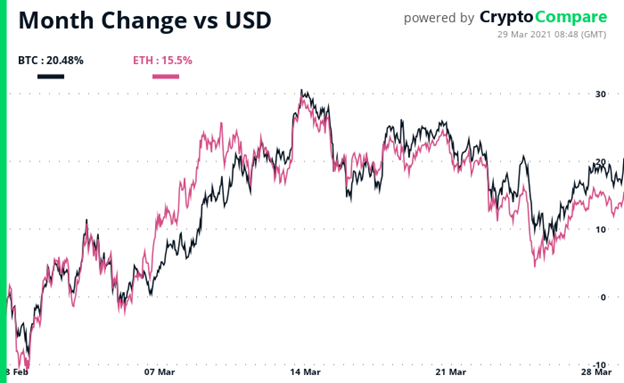

Over the last 30 days the price of Bitcoin moved up nearly 20.5%, while Ether went up 15.5%.

On March 22, Anthony Pompliano, who is a co-founder of Morgan Creek Digital as well as the host of the “Pomp Podcast”, released episode #517 of his podcast; this featured an interview with Jim Cramer, the host of CNBC show “Mad Money with Jim Cramer”, who said during this interview that the best way to prepare for the upcoming post-Covid “boom” was to buy Bitcoin.

During what was his second appearance on the podcast, Cramer talked about his disappointment with gold: “I have for years said that you should have gold… but gold let me down.“

Pomp then asked if Cramer thinks people are going to drop gold and buy Bitcoin.

Cramer replied: “If they listen to me, they’re going to drop half of their gold. I’ve been saying 10% in gold since 1983. And now I say 5% in gold, 5% in Bitcoin.“

However, perhaps, the most interesting part of the interview was near the end when Cramer talked a little about his “boom thesis”. In short, he said that in the US he expected to see in the second half of 2021 the kind of economic boom that we witnessed in the 1990s, and that he believes this will be even “better” than what happened in 1946 (which was the start of a massive economic expansion that ended in 1953).

As for how his boom thesis relates to Bitcoin, Cramer explained: “If my boom thesis is true… you are crazy not to have Bitcoin… I don’t care if it is $70,000 right now. I’d be saying the same thing… the boom means Bitcoin.”

On March 24, Tesla co-founder and CEO Elon Musk, announced on Twitter that the U.S. electric car maker is now accepting payments in Bitcoin in the US. Furthermore, unlike most people/companies that accept Bitcoin payments (usually, with the help of crypto payment processor BitPay), Tesla intends to keep all the BTC it receives rather than convert them immediately to fiat currency.

On the same day that Musk delivered one of the most bullish pieces of news in Bitcoin’s history, one of the world’s most famous investors, Ray Dalio, the founder, chairman, and co-chief investment officer of Bridgewater Associates, the world’s largest hedge fund with around $150 in assets under management, offered his take on Bitcoin during an interview with Yahoo Finance Editor-in-Chief Andy Serwer

Dalio was asked by Serwer if Bitcoin was in a bubble and also what is the likelihood of the US government one day outlawing Bitcoin.

“Bitcoin has proven itself over the last ten years,” Dalio answered.

“It hasn’t been hacked. It’s by and large therefore worked on an operational basis. It has built a significant following.

“It is an alternative, in a sense, of storehold of wealth. It’s like a digital cash. And those are the pluses…

“Every country treasures its monopoly on controlling the supply demand. They don’t want other moneys to be operating or competing because things can get out of control. So, I think that it would be very likely that you will have it under a certain set of circumstances outlawed the way gold was outlawed and you’re watching that question arise in India today.”

On March 25, Dawn Fitzpatrick, chief investment officer at Soros Fund Management (which is structured currently as a family office), gave an interview to Erik Schatzker on Bloomberg’s “Front Row”, during which she said that the Soros family had invested in crypto infrastructure, sang Bitcoin’s praises (especially in relation to its superiority over gold as a store of value), and generally gave the impression that they had invested in Bitcoin.

“We think the whole infrastructure around crypto is really interesting, we’ve been making some investments into that infrastructure and we think that is at an inflection point,” Fitzpatrick told Schatzker.

“I’d say it’s everything from custodians to the mundane, like tax reporting on your on your crypto gains and everything in between…

“So, there’s a real fear of debasing of fiat currencies and when you think about Bitcoin, I don’t think it’s a currency. I think it’s a commodity, but it’s a commodity that’s easily storable. It’s easily transferable.

“The IRS classifies it as a physical asset. It has a finite amount of supply and that supply halves every four years.”

On the same day, Robert Gutmann, CEO of New York Digital Investment Group (NYDIG), revealed during a conversation with Real Vision CEO Raoul Pal that his firm has had enquiries from several sovereign wealth funds about potential investments in Bitcoin.

Pal revealed on Twitter that one of the sovereign wealth funds that has recently been buying Bitcoin is Temasek Holdings, which is owned by the Government of Singapore:

And finally, on March 26, we found out via a news outlet in New Zealand that one of the largest wealth management firms over there had invested in Bitcoin.

According to James Grigor, CIO at New Zealand Funds Management, the KiwiSaver Growth Strategy fund, which had investments worth around NZ$350 million (approximately, US$245 million) at the end of December 2020, “had around five per cent of its money in Bitcoin”.

Featured Image by “SnapLaunch” via Pixabay.com