SEC Lawyers Resign After Censure for Abuse of Power

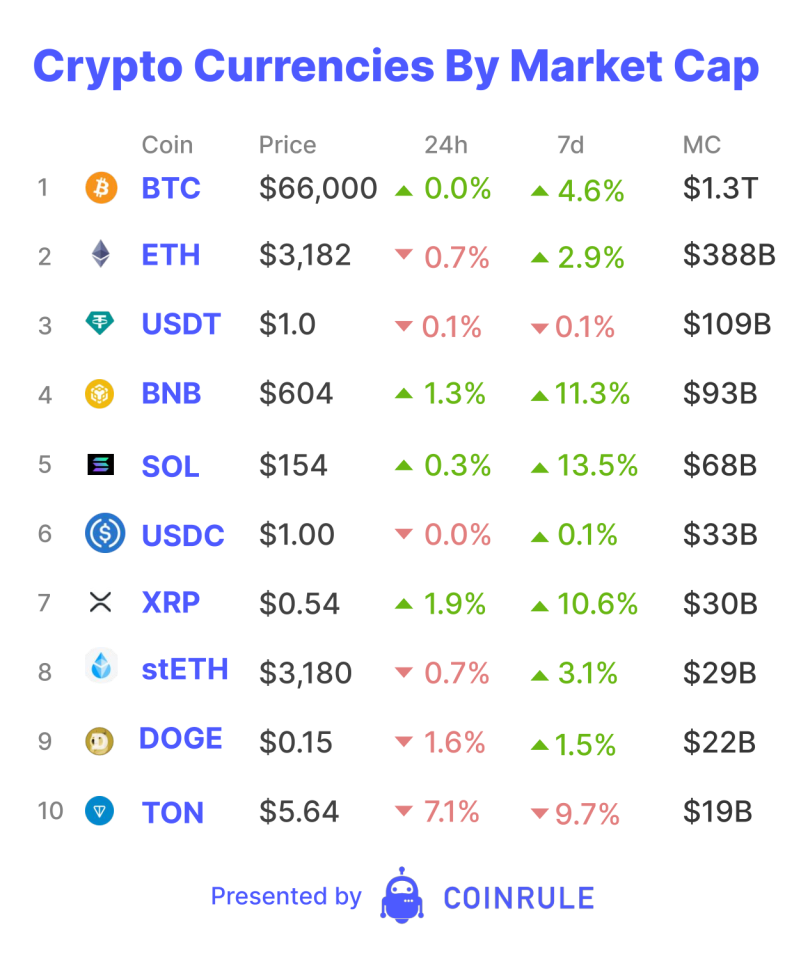

Each day, Coinrule will run through the state of the digital assets market for Blockbeat, your home for news, analysis, opinion and commentary on blockchain and digital assets.

The SEC’s failed case against Digital Licensing Inc., a crypto platform known as DEBT Box, is continuing to make waves. Michael Welsh and Joseph Watkins, the SEC’s lead trial attorney and the agency’s lead investigative attorney on the case, stepped down this month after SEC officials told them they would be terminated otherwise. This follows Chief District Judge Robert Shelby sanctioning and sharply rebuking the financial regulator for “gross abuse” of power.

As Judge Shelby wrote in his 80-page ruling, the evidence used by the SEC to obtain a Temporary Restraining Order (TRO) against DebtBox “lacked any basis in fact.” According to the SEC, individuals named in the case had moved $720,000 overseas in order to hide the assets and were also planning on fleeing the country. The judge dismissed this outright. The SEC had “advanced that evidence in deliberately false and misleading ways” according to Judge Shelby.

This is a further embarrassment for an agency that has struggled to position itself as a fair and neutral regulator vis-a-vis the Crypto industry. It also shows the pressure under which SEC attorneys operate to get convictions. After disastrous cases again Ripple and LBRY did not go anywhere, the SEC also missed the elephants in the room including FTX and Celsius, two US companies. In the meantime, US investors are largely shunned and excluded from crypto investment opportunities. The legal risks for projects that may want to open to US investors are simply too high.

Unfortunately, this is unlikely to make SEC Chair Gary Gensler change course in his crusade against crypto. As a US election approaches, Biden-appointee Gensler is either on the way out or likely to be firmly in place, depending on the outcome. Until then, prospects for the approval of an Ethereum ETF seem to get lower by the day. The SEC will continue to build its case against Ethereum and various Ethereum-aligned tokens and projects, including Uniswap. At least in the US, crypto builders will have to continue leading the legal fight. This will continue until finally, policymakers and regulators put clear and fair rules in place that protect innovation as well as retail investors.