Risking it all

Disproportionate Focus

MicroStrategy updated its initial statement and announced that it now anticipates raising $537.2 million in net proceeds from a debt offering to buy even more Bitcoins. This is significantly higher than the original target of $400 million.

Furthermore, its unsecured, convertible senior notes will pay out 0.750% in interest annually to qualified institutional buyers – investors with at least $100 million under management – who buy in. Even without capital appreciation of Bitcoin, MicroStrategy can still structure asset lending or another yield earning strategy which will ensure that investors are not at a loss per se.

The pricing document may be bullish for Bitcoin as it shows clear interest from institutional investors but the argument raised by analysts at Citi earlier in the week that CEO Michael Saylor’s “disproportionate focus” on Bitcoin is a potentially troubling trend for the business intelligence company, also still stands.

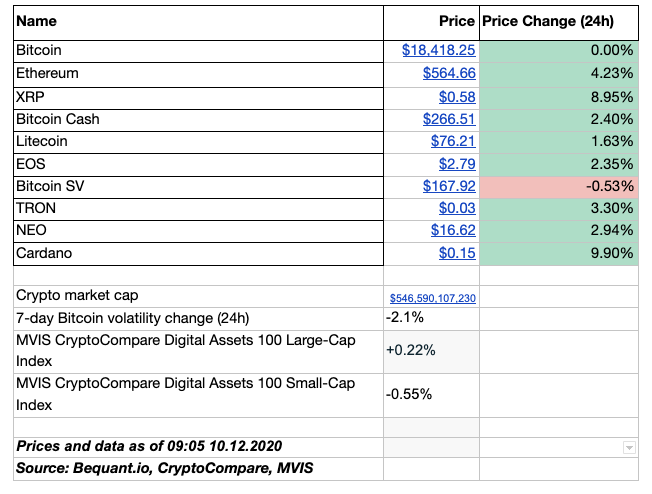

In the Markets

In the long game…

Looking at the market and the price action remained choppy, even if the fundamental play is widely expected to remain net positive for the asset. After all, entry by the likes of Guggenheim will not go unnoticed even if the fund doesn’t touch Bitcoin as such and will use GBTC.

The ever-increasing size of assets under management by some of the high profile ETPs highlights exactly that and this long-only component will be crucial for Bitcoin not only to successfully navigate past $20,000 but also to stay there.

The aggregate futures open interest remains near record highs, even though the price action in the options market has turned south slightly, with the skew shifting higher as a result of put buying around $17-18,000 levels.

Crypto AM: Longer Reads

Crypto AM: Market View in association with Ziglu

Crypto AM: Technically Speaking in association with with Zumo

Crypto AM: Talking Legal in association with INX

Crypto AM: Inside Blockchain with Troy Norcross

Crypto AM: A Trader’s View with TMG

Crypto AM: Definitively DeFi

Crypto AM: Founders Series

Crypto AM: Industry Voices

Crypto AM shines its Spotlight on Coinrule