Japanese business conditions up – but is this as good as it gets for Abenomics?

The Bank of Japan's Tankan survey has shown a further improvement in business conditions in the fourth quarter. However, the pace of improvement has flagging pointing to a slowdown in GDP growth, according to Capital Economics.

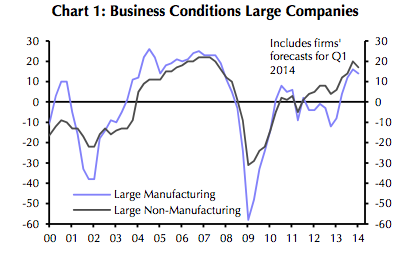

The headline index of business conditions for large manufacturers rose from +12 in the third quarter to +16 in the fourth quarter. Sentiment is now close to the highs reached in 2006/2007.

While optimism may be high at present, companies are forecasting a deterioration of conditions in the coming quarter. The slowing momentum in improvement suggests that GDP growth will not be as robust as previously hoped. However, GDP should remain strong due to increasing demand ahead of the introduction of a sales tax hike.

Some analysts remain sceptical that the improving conditions are sustainable.

Izumi Devalier, Japan economist at HSBC Holdings told Bloomberg television:

We still don’t find any evidence that corporates are really starting to get confident about the sustainability of the recovery and actually ramping up domestic investment.

The forecast for investment growth has also fallen. Large companies expect investment to rise by 4.6 per cent year-on-year, down from the 5.1 per cent predicted in the previous survey. This strongly contrasts with the Cabinet Office's Business Outlook Survey (BOS), which showed a 10.9 per cent rise in capital expenditure excluding land in the current fiscal year.

Last week, consumer confidence was found to be lower than when Prime Minister Shinzo Abe came to power.

Despite these negative assessments Capital Economics believe the survey still points to an improvement in business in capital expenditure in the second half of the fiscal year.

Capital Economics believes there are further reasons to be optimistic:

The ongoing decline in spare capacity also points to a rebound in business investment. Capacity utilisation in the non-manufacturing sector is at the highest level since the early 1990s, and continues to rise in the manufacturing sector.

Corporate profitability is exceptionally high as well. Firms in the non-manufacturing sector predict the ratio of profits to sales to reach an all time high of 3.6% in the current fiscal year, and manufacturers predict profitability to approach its 2007 highs.