Booming

Record Highs

Bitcoin maximalists proved the world wrong was the general tone of conversations across social media channels as the bulls were seen parading their price target calls in the wake of Bitcoin finally printing a new record high on Monday.

The fact that many financial institutions, investors and economists, have remained sceptical of the asset even as inflows surged into products such as those offered by Grayscale and 21Shares, adds even more significance to the price development. Still, there have also been a number of firms that have the benefits and interest to invest in the fast-growing asset class.

The most recent being Guggenheim Macro Opps fund which filed an amendment with the U.S. Securities and Exchange Commission to allow its $5 billion Macro Opportunities Fund gain exposure to Bitcoin via the Grayscale Bitcoin Trust (GBTC). The fact that GBTC was chosen over other venues is also of great significance, because it demonstrates that above all else the fund chose security and regulatory stamp of approval.

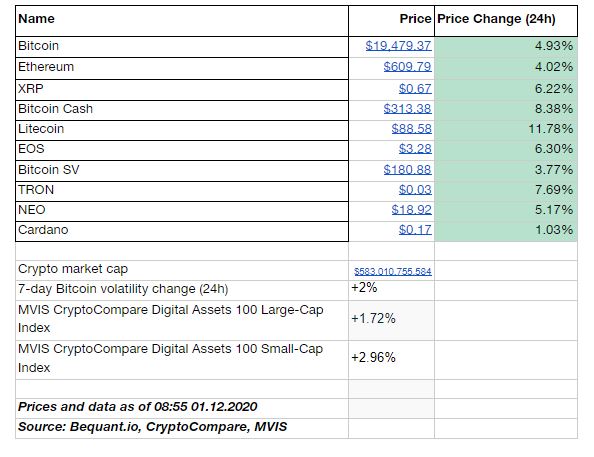

In the Markets

Sushi SWAMP

Elsewhere in the world of DeFi, SushiSwap (SUSHI) surged over 20% in reaction to the news that Sushiswap and Yearn (YFI) are to merge development resources.

Announced by Andre Cronje, the alliance between the two would include Sushiwap & Yearn TVL increases, Sushiswap will complete and launch Deriswap in collaboration (as a reminder, Deriswap is a protocol that combines different DeFi services, including options, loans, and swaps into a single contract).

Crypto AM: Longer Reads

Crypto AM: Market View in association with Ziglu

Crypto AM: Technically Speaking in association with with Zumo

Crypto AM: Talking Legal in association with INX

Crypto AM: Inside Blockchain with Troy Norcross

Crypto AM: Definitively DeFi

Crypto AM: Founders Series

Crypto AM: Industry Voices

Crypto AM shines its Spotlight on OneCycle