Are there “safe” returns in Defi?

Keeping up with which project is or is not a scam, staking, governance and incentive hunting might not be your thing and perhaps you want something on the more ‘boring’ side of crypto? Is there such a thing? Where would you start to look for the ‘safest’ yield?

Anything named after food or claiming ridiculous yields or giving away free tokens is probably out. You might start with some of the ‘biggest’ tokens that you perhaps own already and pair them together with some of the bigger ‘stable’ coins which link to a major currency.

Perhaps the volatility of even the biggest coins like Bitcoin and Ethereum is too much and you would prefer just to buy ‘synthetic’ versions of the US$ such as USDC, USDT and DAI? As covered in our previous article, automated market making (AMM) means that you in effect become ‘bag-holder-in-chief’ for whichever of the two tokens in the pair you are providing liquidity for does not keep up with the other one. This is (in theory) very limited for a pair of stable-tokens linked to the same currency, at least when measured in that currency.

But can you really make money from providing ‘automated market-making’ on two coins which do not change (much) in price?

With the newly-improved version of the Novum Defi-Calculator available at www.defi-calculator.novuminsights.com you can experiment for yourself. We have added thousands of new token-pairs to the site but only where liquidity was above $1000 on a consistent basis.

We can save you some of the effort and report on our findings – we looked at 7 consistently big token-pairs over a variety of timelines on UNISWAP; ETH paired with DAI, USDC, USDT and WBTC as well as three stable-stable pairs; DAI/USDT, DAI/USDC and USDT/USDC.

We can report that although no pair came out consistently on top throughout the time period there were some noticeable trends;

- Even the stable/stable pairs are giving double-digit yield over the full timeline of UNISWAP’s existence

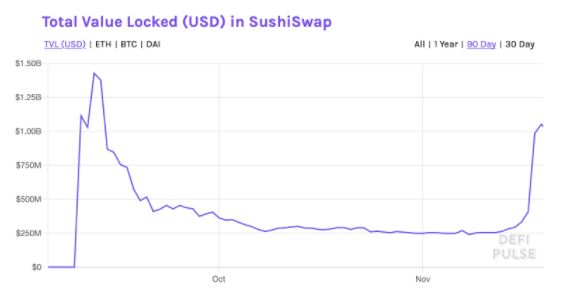

- Bigger volatility and activity periods (like the craze around SUSHI in October) drove higher yields

- ‘A rising tide floats all boats’, except if one of them is tethered to the floor – meaning that if one of the pair is stable and the other one rises significantly, you would have made more money having ALL of the funds in one coin (Bitcoin currently being a good example).

- Where activity has been low, gains across all pairs drop into single digit returns on an annual basis – so it’s true! Volatility really is good for market-makers!

The best proportionally returning pair so far in 2020 has been ETH to USDT, which would have made a 90% dollar return for providing liquidity, compared to a 62% return HODLing both coins. Of course were you to simply have held ETH during the period of 19 May to 18 November you would have made a 124% dollar return, yet the exposure to a more stable coin does de-risk your portfolio. You could have also ‘juiced’ your exposure to Bitcoin and Ethereum by providing liquidity for both pairs making a 124% return over a 104% return in the same period . For those wanting to take very limited risk, holding the pair USDT/USDC still made a 10% return.

Annualised returns, however have been declining. In the last two weeks the best performing trade was USDT/DAI securing only 0.3%, which annualised returns 8.1%. Yet relatively consistently during the period providing liquidity would be better than HODLING nearly all pairs.

If you have been reading this and feeling all this sounds a bit too boring for crypto.

‘SUSHI’ is back as ‘sushiswapclassic.org’. So if you did not get enough excitement the first time around, you can always play again. This time annual yields are (just!) double-digit however, the staking rewards which ended on Monday for UNISWAP started at SUSHI and it looks like a lot of the liquidity (>$1bn) switched straight away to just follow the ‘free money’.

We should also remember that there are of course many risks even on a decentralised exchange and even with ‘stable’ and big coins. If the uniswap.io website were to disappear suddenly, do you have access to your coins locked in the smart contract for the pair? Well, if you know enough about Ethereum, you can ‘call the contract directly’ to remove your funds if you kept a record of the address for your specific pair and know what you are doing. This is probably beyond most casual users and is indeed the utility which Uniswap brings.

This analysis was by Toby Lewis, David Henderson and David Layton of Novum Insights using the Defi Calculator www.defi-calculator.novuminsights.com

Toby Lewis has 12 years of analyst experience from the worlds of institutional finance, venture capital, blockchain and crypto. Lewis founded Novum Insights, an analyst firm of blockchain, crypto and other frontier technologies in 2016. Lewis began his career at Dow Jones and the Wall Street Journal, before co-founding a well known analyst firm of corporate venture capital Global Corporate Venturing.