Will the third halving of Bitcoin be the emphatic start of a bull run for the original cryptocurrency?

Price Watch

The crypto market has had a significant week as the hype continues to build over the forthcoming halving and at the time of writing, Bitcoin (BTC) was trading at US$8,826.91 / GB£7,126.19; Ethereum (ETH) is at US$205.90 / GB£166.12; Ripple (XRP) is at US$0.2178 / GB£0.1751; Binance (BNB) is at US$16.95 / GB£13.69 and Cardano (ADA) is at US$0.04951 / GB£0.03998. Overall Market Cap is up circa US$20.0bn from last week at US$246.42bn / GB£178.59bn (data source: www.CryptoCompare.com)

City AM’s Crypto Insider

All eyes are on Bitcoin this week as the looming halving event is on track to take place in a week’s time on 12th May (Source: https://www.bitcoinblockhalf.com) allied to which, Bitcoin’s hash rate has, like the market, also surged taking it to an all time high effectively reversing the damage instigated by the crash in March. I don’t intend to explain all of this as the subject matter is very much the theme for Crypto AM articles this week. In Crypto AM: In Conversation, Jason Deane of Quantum Economics discusses whether or not the Halving will change everything or not. In Crypto AM: Technical Research, James Bennett, CEO of ByteTree addresses three things to expect from the halving as seen on-chain. Speaking of ByteTree it is hosting a live ‘Halving Webinar’ to coincide with the exact timing. A terrific roster of speakers has been lined up including Danny Masters, Chairman of Coinshares Group; Mona El Isa, Founder & CEO of Avantgarde Finance and Jon Matonis, Chief Economist at Cypherpunk Holdings.

Yesterday I spoke with Josh Goodbody, Director of Growth for Binance who commented “In the run up to Bitcoin’s Halving event this month, we have observed a strong organic increase in Bitcoin’s price. The upcoming Halving has made the general public more aware that there is an impending reduction in the rewards given to Bitcoin miners. Goodbody further notes that “Since the beginning of 2020, we have seen month on month highs in volume across both our spot and futures markets. Our exchange saw an all-time high on 30th April with US$12 billion of daily trading volume. We believe this is a clear demonstration of the increasing strength of interest in crypto assets, especially as traditional assets suffer during the macroeconomic shock caused by COVID 19. Investors are increasingly seeing Bitcoin as an alternative asset, like Gold, for hedging against the increasing inflationary pressures caused by quantitative easing.”

London-based digital asset OTC broker, Digital RFQ who featured in Crypto AM: Shines its Spotlight on 20th March 2020, announced this week that it has chosen Koine to act as custodian for their first commodity financing token, PGX, launched earlier this month in partnership with Atom Asset Exchange.

Koine was chosen for its ultra-secure Digital Airlock® solution – a unique model which replaces the cold store and hot wallet model that exposes private keys and leads to poor operational scalability. Its role as custodian for DigitalRFQ further signals the arrival of institutional-grade market infrastructure and opens the way for the participation of institutional capital in digital asset trading. You can read more about Koine today in Crypto AM: Shines its Spotlight on Koine.

Mike Greenacre, co-founder at DigitalRFQ, said: “Koine was the obvious choice to custody our first digital asset offering, PGX. Their understanding and focus on solutions for institutional investors is exactly aligned to the business we are building at DigitalRFQ. We are looking forward to adding more and more digital asset offerings onto Koine’s world class custody solution as we launch them.” You might remember from last week that I asked Mike to pen Crypto AM: Industry Voices

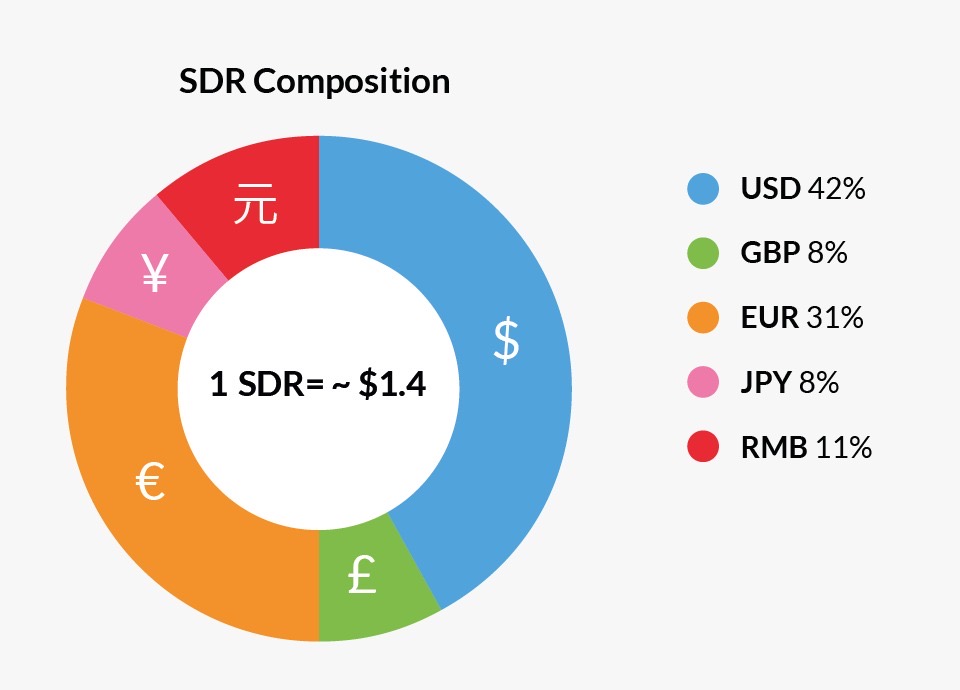

In late 2019, London saw the arrival of Saga who is the issuer of SGA, a token tethered to the value of a basket of currencies replicating the composition of the IMF’s SDR (Special Drawing Rights) basket, which has been used as an effective stabilisation mechanism by the world’s central banks for over five decades.

Although reliant on fiat currencies, SGA is technically not a stablecoin: SGA is a “stabilised coin”. This is because, while initially 100% backed by the SDR reserve, the SGA smart contract is modelled to enable the currency to acquire independent value as market cap grows. The goal of SGA is to provide individuals and business entities with a proven, secure and transparent means to maintain and protect the value of their money against external volatility.

Saga is a UK company, limited by guarantee, working under not-for-profit principles. It is governed by applicable UK laws and regulations and has adopted KYC/AML procedures compliant with the strictest international standards and regulations. Ido Sadeh Man founded Saga in 2017, and among his team today are Barry Topf, Chief Economist and Dr. Ron Sabo Chief Scientist.

Senior members of the Saga Advisory Board include Prof. Jacob A. Frenkel, PhD, chairman of JPMorgan Chase International and former governor of the Bank of Israel; Prof. Myron Scholes, Nobel laureate in economic sciences and professor emeritus at Stanford University; Leo Melamed, former chairman of the Chicago Mercantile Exchange (CME); and Prof. Dan Galai, PhD, former Dean of the School of Management at Hebrew University Jerusalem.

Saga has become a sponsoring partner of On Yavin’s Cointelligence Academy as they share the foundational belief that transparency and technological literacy are crucial to promote the blockchain industry, and to drive technology’s acceptability and usage in mainstream money markets.

On Saturday just gone, I watched ‘New Kids On The Blockchain’ a feature documentary by the award-winning filmmakers and channel of the same name, run by Ashley Pugh and Lisa Downs. (Source: https://www.youtube.com/watch?v=MoAW5asXPss)

It explored the ICO boom (and bust) between 2017-2019 talking to thought leaders in the industry such as Roger Ver, Jeff Berwick, Craig Wright, John McAfee, David Siegel, Reggie Middleton, Omar Bham Nicholas Merten (DataDash), Peter Schiff and many more.

Yesterday I caught up with Ashley who told me: ‘This film is our version of fear and loathing but this time in cryptocurrency, we drank the Crypto Kool-Aid and got sucked into the ICO / crypto boom of 2017-2020. It was a wild ride into the heart of the blockchain dream of decentralised freedom. Was it a mirage or the start of a new way to do capitalism Whatever it was – it was crazy!’

Along the journey the film follows three ICO’s from inception until now. Including The Pillar Project, the Next Generation Smart Wallet and Payment Network, that raised over $23M in 2017 as one of the first ICO’s. Also featured are Populous World invoice factoring utilising the blockchain and Funfair who are creating the world’s first decentralised casino ecosystem.

The Pillar Project was one of the first companies I met in London’s Blockchain industry when I launched Crypto A.M. in partnership with City A.M. David Siegel, Rob Gaskell and Tomer Sofinzon have moved on from the company but I spoke yesterday with co-founder & CEO of the Pillar Project Michael Messele to find out how everything is going.

He explained “finding our feet as a company was not straightforward. The euphoria following the sudden rise in valuation of our treasury due to the late-2017 crypto price boom was tampered with the realisation that the ecosystem was yet to mature. We therefore had to experiment with our management approach as well as the technical implementation. As a result of our experiences, not only have we survived the market downturn but now have a wallet with around 70k downloads that is integrated with more than 34 partners including exchanges, aggregators and fiat-on-ramp providers. We are helping a huge online community to take advantage of the DeFi services via Pillar. We also have exciting services going live imminently, such as our referrals campaign taking advantage of the smart wallet release enabling fees payment in Pillar tokens, a new web-based account recovery mechanism and our Pillar Payment Network where off-chain transactions take a fraction of a second and eliminate network fees. This feature has the potential to offer fiat based alternatives to the cards dominated payments ecosystem. The above community based features coupled with the upcoming 2020 roadmap make up the bulk of our promises to our community prior to the ICO.”

Sticking with documentaries, useful during lockdown, I met with Torsten Hoffmann and Oliver Krause in January at the World Economic Forum in Davos. Torsten is an award winning filmmaker with his latest documentary film ‘Cryptopia’ Taking six years to make it features interviews with notable industry figures. Obviously due to COVID-19 the long planned premiere at the Cannes Film Festival and instead will make its debut this Thursday, 7th May at https://cryptopiafilm.com I know that I have been eagerly waiting to see it since watching the trailer in January which gave us a glimpse even of Crypto AM Awards finalists Xapo’s ultra secure ‘Fort Knox’ bunker in Switzerland!

Competition time now! You might remember a few weeks ago Cryoto AM: Shines its Spotlight on NGRAVE? Well it is launching its flagship hardware wallet ZERO on Indiegogo on 26th May and is celebrating this with a giveaway where you can win one of 10 free hardware wallets as well as the metal backup solution. You can enter the giveaway through this link: https://www.ngrave.io/pre-launch-giveaway.

Finally as I do every week during London’s Lockdown, I’d like to remind you again about my ongoing local community effort for the elderly and vulnerable living on the Isle of Dogs. I teamed up with BABB (Bank Account Based Blockchain) to raise money to pay for food and care parcels. It’s really even more essential now with the added difficulties that Ramadan timings produce. BABB has added a light registration for web donation which otherwise allows you to download the app and donate direct to the campaign via www.bit.ly/IoDFoodCare