Tumbling down

Softer does it

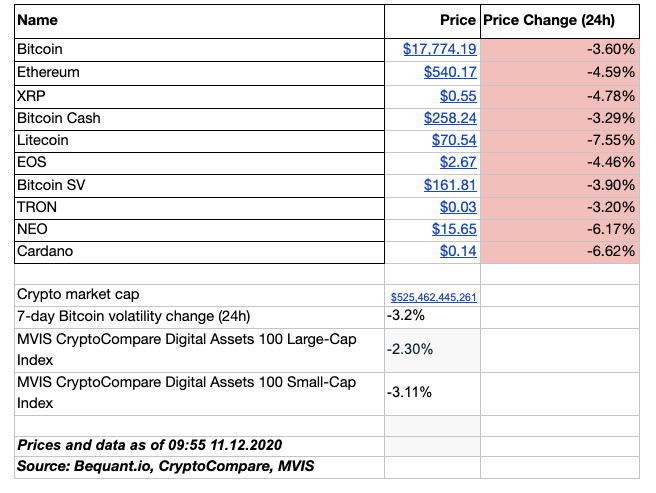

The market continued to trade softer and in early Friday trade, Bitcoin was trading below $18,000 level, while Ethereum fell below $550 level. Looking at the price action over this week and large cap MVIS index is down 7.5%, while the small cap index is down 10.2%.

The open interest (OI) across futures venues has dipped this week, although the decline has been steady and there is little evidence of panic. The OI on the CME is also below $1 billion, although the venue is still the third largest in terms of overall OI.

The flow in the options market has been a bit more melodramatic and the euphoric sentiment that saw dip buying of calls has turned into put buying between $17/18,000 area.

However, it is worth bearing in mind that positioning post December expiries is much more bullish, so either the market recovers aggressively and the recent downside is in part linked to profit taking or there is scope for further unwind in the new year.

In the Markets

Hand it over

In terms of news flow, CoinDesk reported that the New York Attorney General (NYAG) anticipates the handover of loan documents relating to an alleged $850 million cover-up will be completed in “the coming weeks.”

Crypto AM: Longer Reads

Crypto AM: Market View in association with Ziglu

Crypto AM: Technically Speaking in association with with Zumo

Crypto AM: Talking Legal in association with INX

Crypto AM: Inside Blockchain with Troy Norcross

Crypto AM: A Trader’s View with TMG

Crypto AM: Definitively DeFi

Crypto AM: Founders Series

Crypto AM: Industry Voices

Crypto AM shines its Spotlight on Coinrule