Risk vs reward

BTC Euphoria attracts Risk

MicroStrategy’s recent commitment to Bitcoin has turned the company and its CEO into a fully blown celebrity in the eyes of digital assets market participants. The fact that the company’s share price has performed so well since its venture into the Bitcoin market has only aided its cause.

So much so that back in late November, Citron Research published a report titled “MicroStrategy The Best Way to Own Bitcoin in the Stock Market”. However, Citi analyst Tyler Radke lowered his recommendation on MicroStrategy to “sell” from “neutral,” warning investors in a Tuesday research note the company’s recent bitcoin euphoria may be overextended.

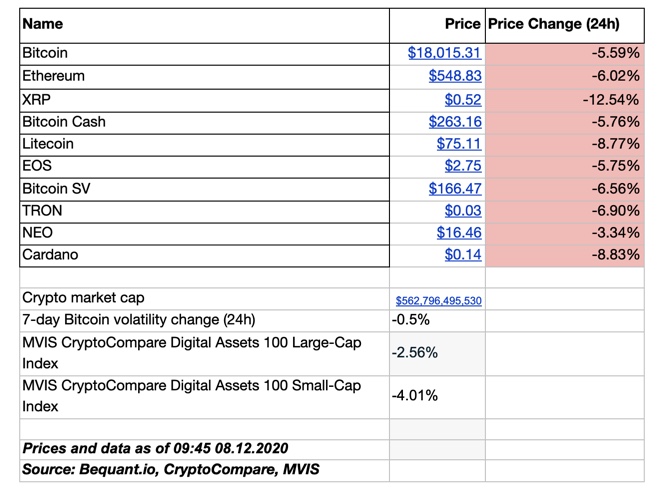

In the Markets

CoinDesk further noted citing Radke, that CEO Michael Saylor’s “disproportionate focus” on Bitcoin as a potentially troubling trend for the business intelligence company, while also adding that MicroStrategy’s planned $400 million debt offering to fund additional bitcoin purchases signals “incremental risk to the story.”

As a result, MicroStrategy stock slid almost 14% and with that, Bitcoin also dipped below $18,000. The concerns are that MicroStrategy’s recent foray into digital asset space will raise questions from regulators about its purchasing spree and also, some shareholders may voice their discontent about the move. If indeed the company’s underlying position is much less rosy and the company’s financial health comes into question, it is the Bitcoin holding that will be forced to be sold.

Crypto AM: Longer Reads

Crypto AM: Market View in association with Ziglu

Crypto AM: Technically Speaking in association with with Zumo

Crypto AM: Talking Legal in association with INX

Crypto AM: Inside Blockchain with Troy Norcross

Crypto AM: A Trader’s View with TMG

Crypto AM: Definitively DeFi

Crypto AM: Founders Series

Crypto AM: Industry Voices

Crypto AM shines its Spotlight on Coinrule

CoinDesk further noted citing Radke, that CEO Michael Saylor’s “disproportionate focus” on Bitcoin as a potentially troubling trend for the business intelligence company, while also adding that MicroStrategy’s planned $400 million debt offering to fund additional bitcoin purchases signals “incremental risk to the story.”

As a result, MicroStrategy stock slid almost 14% and with that, Bitcoin also dipped below $18,000. The concerns are that MicroStrategy’s recent foray into digital asset space will raise questions from regulators about its purchasing spree and also, some shareholders may voice their discontent about the move. If indeed the company’s underlying position is much less rosy and the company’s financial health comes into question, it is the Bitcoin holding that will be forced to be sold.

Crypto AM: Longer Reads

Crypto AM: Market View in association with Ziglu

Crypto AM: Technically Speaking in association with with Zumo

Crypto AM: Talking Legal in association with INX

Crypto AM: Inside Blockchain with Troy Norcross

Crypto AM: A Trader’s View with TMG

Crypto AM: Definitively DeFi

Crypto AM: Founders Series

Crypto AM: Industry Voices

Crypto AM shines its Spotlight on Coinrule