Bullish week sees Bitcoin recover market dominance, but will it last?

Switzerland is very much open for business when it comes to Blockchain, Crypto and Digital Assets. One of the leading lights there is CV Labs in the Crypto Valley of Zug, led by my friend Ralf Glabischnig.

This coming Monday, I am very much looking forward to attending his event, The Crypto Valley’s Top 50 Round Table, which gathers the founders and senior executives from the top 50 most influential companies in Crypto Valley to provoke meaningful discussion.

It will also provide a forum for me to finally share details of an exciting stealth project whom I advise. Watch out for next week’s Spotlight!

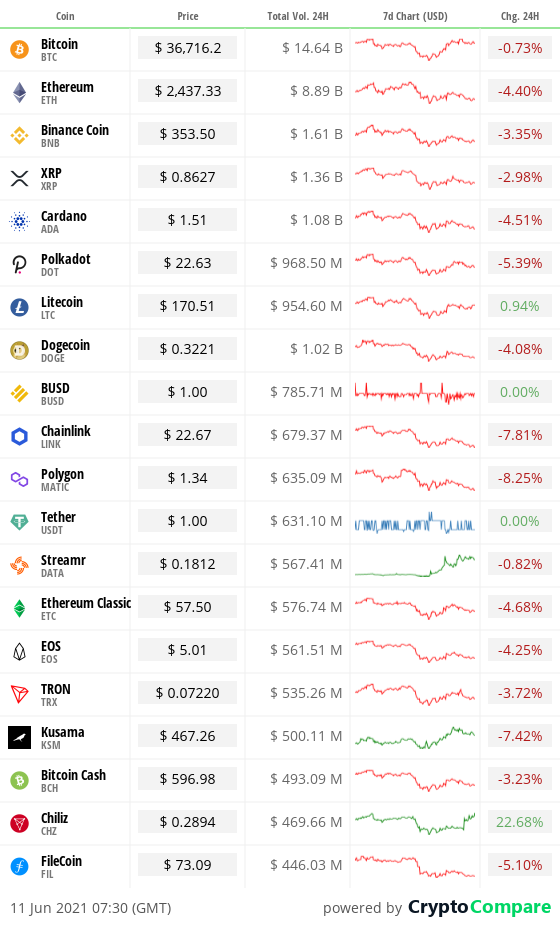

Crypto at a glance

Bitcoin continues to look strong while the alt markets flounder, as bullish news pours in from every direction. The leading cryptocurrency by market cap hit a high of $38,334.33 yesterday, though it’s since fallen back to just above $37,000 this morning. Can it ride the wave through the weekend?

Yesterday’s bullish news was brought to you courtesy of the Basel Committee, the arbiter of international banking standards. They have now formally recognised Bitcoin as an asset class, proposing rules for banks to hold the cryptocurrency that put it in the highest risk category. Bitcoin saw an immediate jump in price of $2,000, rising five per cent in under two hours.

The Basel Committee’s recognition is a major milestone for Bitcoin into the world of traditional finance. But that wasn’t the only foray into traditional finance for Bitcoin yesterday, with two major players announcing moves into the space.

Victory Capital, which manages nearly $160 billion in assets, announced they will launch a private fund for accredited investors that will track the Nasdaq Crypto Index (NCI). State Street, the second oldest bank in the US, also announced plans to launch a “multi-asset platform” that will support cryptocurrency trading, citing rapidly-rising customer demand.

It tops a bullish week of news for Bitcoin, which has recovered well from Tuesday’s $31k. Weekends have not been kind to the crypto markets lately, but will this be different?

Bitcoin seems to be out on its own somewhat at the moment, with stagnation down the rankings enabling the market leader to recover some of the dominance it lost recently. It currently accounts for almost 45 per cent of the market again, with Ethereum changing hands for below $2,500 at time of writing – down four per cent over the last 24 hours. Cardano (ADA), Binance Coin (BNB) and Dogecoin (DOGE) are all down around four per cent at time of writing. Can they follow Bitcoin’s lead again?

For those of you who missed the Crypto AM DeFi & Digital Inclusion online summit – you can now watch the event in two parts via YouTube…

Part one:

Part two:

All feedback on Crypto AM Daily in association with Luno is welcome via email to James.Bowater@cityam.com ??

In the markets

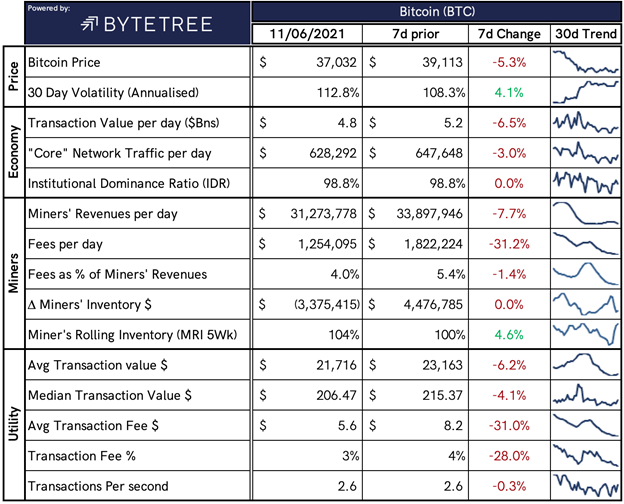

The Bitcoin Economy

*Definitions and insights can be found at https://bytetree.com/insights/

Total crypto market cap

The total capitalisation of the entire cryptocurrency market at time of writing is currently $1,572,300,540,517.

What Bitcoin did yesterday

We closed yesterday, June 10 2021, at a price of $36,702.60, down from $37,345.12 the day before.

The daily high yesterday was $38,334.33 and the daily low was $35,847.59.

This time last year, the price of Bitcoin closed the day at $9,321.78. In 2019, it closed at $7,927.71.

Bitcoin market capitalisation

Bitcoin’s market capitalisation at time of writing is $688.45 billion. To put it into context, the market cap of gold is $12.101 trillion and Facebook is $942.67 billion.

Bitcoin volume

The total spot trading volume reported by all exchanges over the last 24 hours was $43,224,623,214, down from $50,778,692,679 yesterday. High volumes can indicate that a significant price movement has stronger support and is more likely to be sustained.

Volatility

The price volatility of Bitcoin over the last 30 days is 96.79%.

Fear and Greed Index

Market sentiment today is 21.

Bitcoin’s market dominance

Bitcoin’s market dominance today is 44.52, Its lowest ever recorded dominance was 37.09 on January 8 2018.

Relative Strength Index (RSI)

The daily RSI is currently 43.54. Values of 70 or above indicate that an asset is becoming overbought and may be primed for a trend reversal or experience a correction in price – an RSI reading of 30 or below indicates an oversold or undervalued condition.

Convince your Nan: Soundbite of the day

“Bitcoin is a technical solution to give 8,000,000,000 people property rights… when their relatives remit money back to El Salvador they lose 10% through money transfer agents.”

– Part time MicroStrategy CEO + full time Bitcoin bull, Michael Saylor

What they said yesterday

Bitcoin is hope…

This is fun whether you like Bitcoin or not…

There’s bullish and there’s…

Big upgrade incoming…

Crypto AM editor writes

Ripple making waves against the SEC’s confusing crypto rule book

John McAfee faces dying in prison for the same thing Elon Musk does on Twitter, says his wife

Further pain ahead for Bitcoin as environmental groups queue up to reject cryptocurrencies

How are cryptocurrencies coping this weekend?

Bruised Bitcoin heads into an uncertain weekend

China’s CMB International and Nervos Foundation launch $50m blockchain fund

Cardano teams up with Save the Children for humanitarian initiative

HMRC: We’re not clamping down on crypto

Ethiopia overhauls its educational system with IOHK blockchain partnership

Crypto AM: Longer Reads

City AM Markets: What is Decentralised Finance (DeFi) by Aave

Crypto AM: Conversation with James Bowater

Crypto AM: Market View

Crypto AM: Technically Speaking

Crypto AM: A Trader’s View with TMG

Crypto AM: Mixing in the Metaverse with Dr Chris Kacher

Crypto AM: Talking Legal

Crypto AM: Spotlight

Crypto AM: Founders Series

Crypto AM: Industry Voices

Crypto AM: Tiptoe through the Crypto with Monty Munford

Crypto AM: Definitively DeFi

Crypto AM Parliamentary Special

Part one of two – April 2021

Part two of two – April 2021

Five-part series – March 2021

Part one…

Part two…

Part three…

Part four…

Part five…

Crypto AM: Recommended Events

Crypto AM City of London Roundtable

Crypto AM DeFi & Digital Inclusion Summit

&

Crypto AM Awards 2021

September 29 and 30 2021

Cautionary Notes

It’s definitely tempting to get swept up in the excitement, but please heed these words of caution: Do your own research, only invest what you can afford, and make good decisions. The indicators contained in this article will hopefully help in this. Remember though, the content of this article is for information purposes only and is not investment advice or any form of recommendation or invitation. City AM, Crypto AM and Luno always advise you to obtain your own independent financial advice before investing or trading in cryptocurrency.

All information is correct as of 08:30am GMT.