Mobile surge coming as reserve currencies reach life expectancy

Britain’s reserve currency status lasted 105 years. France’s reserve currency status lasted 95 years. Spain’s reserve currency status lasted 111 years. USA’s reserve currency status is on year 99.

Logically, Bitcoin should be next. But when it comes to authoritarian governments steeped in thought control and bureaucracy, logic is last in line.

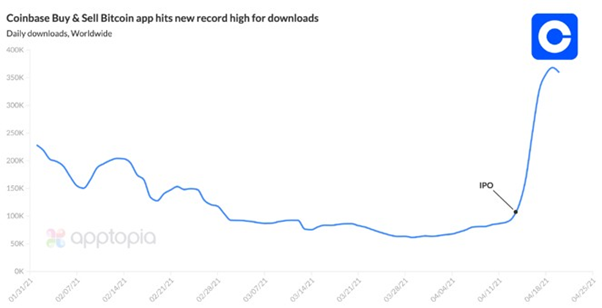

Nevertheless, a mobile tsunami is coming. Mobile devices will economically empower the masses. The Coinbase IPO propelled its app into soaring, record breaking usage. In its first week as a public company, Coinbase’s four main apps were downloaded about 2.7M times total, 2.3M of which were for its Coinbase – Buy & Sell Bitcoin app.

All of its apps, except Coinbase Card, broke their lifetime records for single-day downloads and daily active users (DAU).

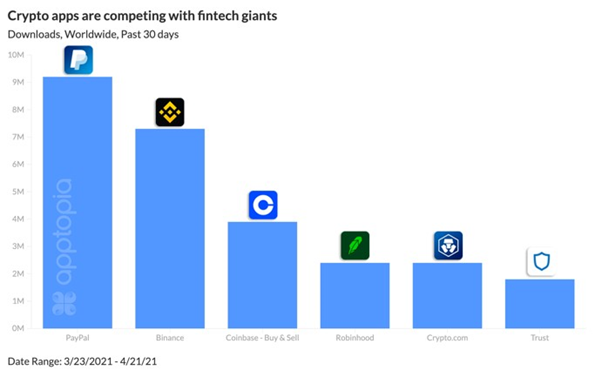

This surge of activity spurred downloads across other platforms. In fact, the Binance app was downloaded more than Coinbase. Other popular platforms such as eToro, Trust, and Crypto.com also had surges in downloads.

Binance isn’t far behind fintech giant PayPal in terms of new user acquisition. Over the last 30 days, Binance was downloaded 7.3M times compared to 9.2M times for PayPal.

One billion Bitcoin users by 2026

These stats imply 10M new Bitcoin holders per month, and with this number accelerating each month, more than 250M by year end. Within five years, Bitcoin should reach a billion people. By then, Bitcoin should be well above $1,000,000 and the cryptospace should have a valuation in the tens of trillions. Bitcoin at $54k has a valuation of roughly $1 trillion with the cryptospace valuation at roughly $2 T. At $1 M/BTC, this is almost a 20x move, or a BTC valuation of $20 T with the cryptospace valuation at $40 T.

Of course, five years is an eternity in crypto so it is possible that Bitcoin’s dominance either falls toward 30% at it did in 2017 in which case the cryptospace valuation could be around $60 T. This will depend on how the utility of alt coins plays out which will somewhat depend on regulations.

At some point in the years ahead, should Bitcoin’s scalability, speed, and cost issues approach that of Ethereum 2.0, its dominance may increase well beyond 80 per cent. Nevertheless, Ethereum 2.0 is deflationary since ETH are destroyed while Bitcoin is disinflationary since Bitcoin minted continues to slow, thus both may co-exist. Other layer 1 technologies which have greater speed at lower cost than Ethereum such as Solana (SOL) and Harmony (ONE) may also co-exist since some smaller companies may opt for speed and cost over the security of Ethereum.

Bitcoin Bull Market Over?

Many have asked if we have hit a market top in crypto. BTC and other major leaders like LINK, SNX, and AAVE seem to be struggling.

Based on my metrics, we have not hit a major market top, but a minor top within a bull run. This is our fourth minor top this year. Minor tops occur with regularity during bull runs where Bitcoin can correct by as much as -40 per cent and alts a lot more as correlations remain high.

Other coins such as Ethereum and alt coins get pulled down along with Bitcoin. Usually, it is negative news or profit taking or whales gunning for complacent investors especially in the futures markets that cause the correction.

Indeed, nearly $10bn in liquidations occurred shortly after the April 13 breakout in Bitcoin. Two major tells were excessive futures open interest and elevated funding rates.

Some of the other metrics I use that can cause swings in price including Grayscale lock-up expirations, major mining pool activity, Coinbase premiums, and the flow of Bitcoin, Ethereum, and USDT onto and off of major exchanges, all of which are viewable on the blockchain.

This gives me insight into whether there is a big bout of buying/support or selling ahead which can cause a correction of several per cent or more in Bitcoin within a few days or less.

Coinbase et al

Spurring thoughts of a market top have been the poor showing of Coinbase since it went public. Keep in mind that its performance should correlate to some extent with the price of Bitcoin since other cryptoassets correlate to some extent with Bitcoin even though the leading cryptocurrencies can well outperform Bitcoin at times. Many of these are shown in our Crypto Picks.

So even though Coinbase can only offer non-security tokens due to US law, such that the number of coin listings is a tiny fraction of available coins that can be bought on exchanges outside the US such as Binance, Huobi, or Kucoin, Coinbase will likely get regulatory approval to list security tokens but the date of the approval remains unclear.

Nevertheless, the IPO should help major competitors such as Binance (BNB) rise as the valuation on BNB is around $84 billion since it trades far more coins with far greater liquidity than Coinbase in addition to having launched its Binance Smart Chain which dramatically cuts transactions fees compared to Ethereum.

Still, given soaring app usage of Coinbase, Binance, and others as a consequence of Coinbase’s listing, these companies should do well, assuming Bitcoin continues to sail to new heights given the on and off-chain metrics which have proven reliable so far when taken together.

Dr.Chris Kacher, nuclear physicist PhD turned stock+crypto trading wizard / bestselling author / blockchain fintech specialist / top 40 charted musician. Co-founder of Virtue of Selfish Investing and Hanse Digital Access.

Dr. Kacher bought his first bitcoin at just over $10 in January-2013 and attended early Ethereum dev meetings in London hosted by Vitalik Buterin. His metrics have called every major top & bottom in bitcoin since 2011. He was up in 2018 vs the median performing crypto hedge fund at -46% (PwC) and is up quadruple digit percentages since 2019 as capital is force fed into the top performing alt coins while weaker ones are sold.

Virtue of Selfish Investing Crypto Reports

https://twitter.com/VSInvesting/ & https://twitter.com/HanseCoin

https://www.linkedin.com/in/chriskacher/