BlackRock join Bitcoin party

Crypto at a Glance

It’s been an inauspicious start for Bitcoin under the new Biden presidency, despite Bitcoin Biden being an awesome presidential nickname. The price continues to drop, with the Fear and Greed Index *only* flashing Greed-levels of sentiment for the first time since November – suggesting that yesterday’s inauguration didn’t drive as much enthusiasm among bitcoiners as it did among Tom Hanks and Lady Gaga.

It’s not all bad news, though. BlackRock, the world’s largest asset manager with $7.81 trillion under management, appears to have granted at least two of its funds the ability to invest in bitcoin futures, with its latest prospectus documents stating that “Certain Funds may engage in futures contracts based on bitcoin”. The news follows statements made last November by the company’s CIO for fixed income, Rick Rieder, who told CNBC that cryptocurrency may be “here to stay,” and could even replace gold “to a large extent,” noting that it was “much more functional” than the yellow metal. It certainly doesn’t look like institutional investors are done with crypto yet – if anything, it looks like they’re just getting started.

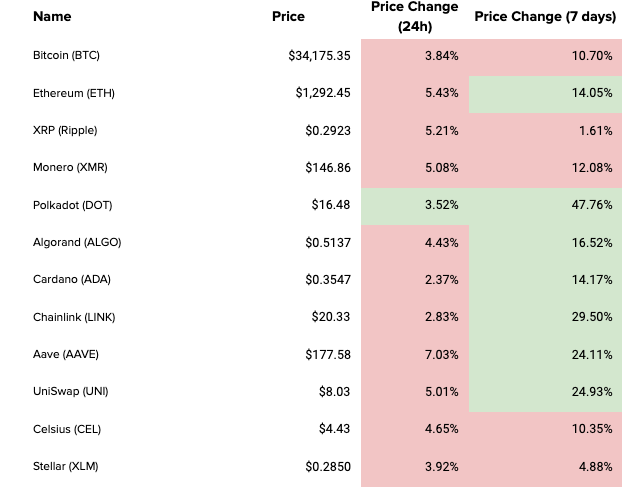

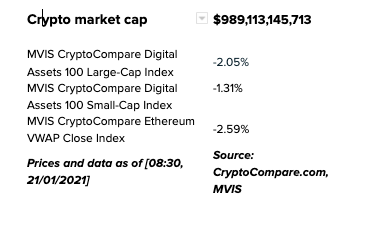

Elsewhere, other coins are suffering much the same fate as Bitcoin at the moment, with the 24-hour charts dominated by a sea of red. The last 7 days is still mostly in the green though, with recent parabolic rises still leaving the majority substantially in the black. The only exception at the moment is Polkadot, which continues to do well during the Asian session and remains a top 4 coin by market cap. Ethereum still has ground to make up to hit a universally-acknowledged all-time high – does this correction mean the champagne is back on ice yet again?

In the Markets

What bitcoin did yesterday

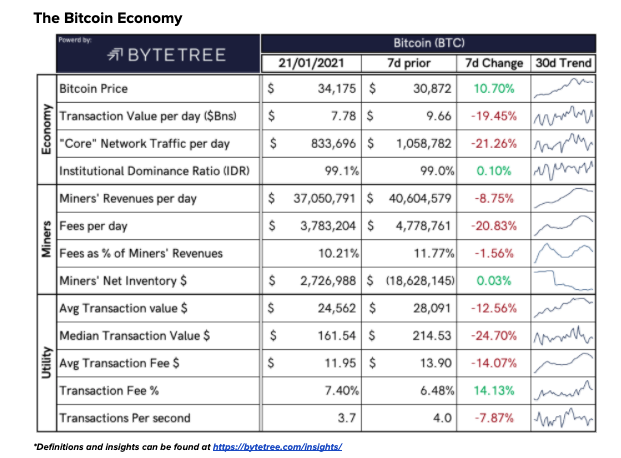

We closed yesterday, 20 January, 2020, at a price of $35,547.75 – down from $36,069.81 the day before. That’s the lowest closing price since 12 January. It’s now 19 days since the price of bitcoin was last below $30,000 and 35 since it was below $20,000.

The daily high yesterday was $36,378.33 and the daily low was $33,570.48.

This time last year, the price of bitcoin closed the day at $8,657.64. In 2019, it was $3,601.01.

As of today, buying bitcoin has been profitable for…

99.9% of all days since 2013-04-28.

Bitcoin market capitalisation

Bitcoin’s market capitalisation is currently $638,521,453,472, down from $665,061,660,451 yesterday. That makes Bitcoin the 12th largest asset in the world by market cap, dipping below Alibaba but sticking above the likes of Visa and Berkshire Hathaway.

Bitcoin volume

The volume traded over the last 24 hours was $65,665,249,085, up from $59,093,095,987 yesterday. High volumes can indicate that a significant price movement has stronger support and is more likely to be sustained.

Volatility

The price volatility of bitcoin over the last 30 days is 92.55%.

Fear and Greed Index

The Fear and Greed Index is out of Extreme Greed for the first time since November of last year, showing 75 today. This is still extremely high, though the drop out of Extreme Greed does feel somewhat symbolic. Equally, the market was certainly overheated and a cooling should be healthy in the long term.

Bitcoin’s market dominance

Bitcoin’s market dominance still stands tall at 65.55. Its lowest ever recorded dominance was 37.09 on 8 January, 2018.

Relative Strength Index (RSI)

The daily RSI is currently 52.56. Values of 70 or above indicate that an asset is becoming overbought and may be primed for a trend reversal or experience a correction in price – an RSI reading of 30 or below indicates an oversold or undervalued condition.

Convince your Nan: Soundbite of the day

“The most potent case for cryptocurrencies: banks are never there when you need them. And they are trying to bully the public so they avoid accountability and profit disbursements.”

- Nassim Nicholas Taleb, Author of The Black Swan

What they said yesterday…

Michael Saylor’s new Only Fans is worth every penny

Blackrock news making a splash

NOT FINANCIAL ADVICE – interesting chart though

And they say life begins at 70…

Crypto AM: Longer Reads

Crypto AM: Market View in association with Ziglu

Crypto AM: Technically Speaking in association with with Zumo

Crypto AM: Talking Legal in association with INX

Crypto AM reshines its Spotlight on CUDOS

Crypto AM: Focusing on Regulation

Crypto AM: Deeper Dives with Liam Roche

Crypto AM: A Trader’s View with TMG

Crypto AM: Tiptoe through the Crypto with Monty Munford

Crypto AM: Definitively DeFi

Cautionary Notes

It’s definitely tempting to get swept up in the excitement, but please heed these words of caution: Do your own research, only invest what you can afford, and make good decisions. The indicators contained in this article will hopefully help in this. Remember though, the content of this article is for information purposes only and is not investment advice or any form of recommendation or invitation. City AM, Crypto AM and Luno always advise you to obtain your own independent financial advice before investing or trading in cryptocurrency.

All information is correct as of 08:30am GMT.

Crypto AM Daily in association with Luno