Pushing the Gas

New Record?

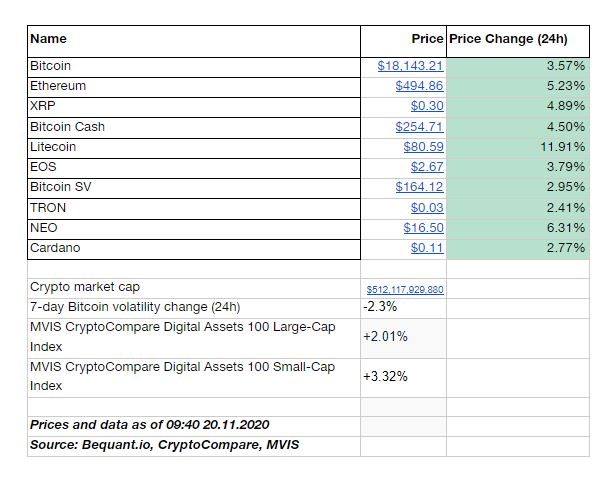

The market showed a lot of resilience and dip buying interest to shake off any immediate questions about the sustainability of the recent upside. So much that Bitcoin moved above the $18,000 level and remains on track to retest the highs from earlier on in the week.

In addition, the demand for risk saw the open interest (OI) rise yet again to a new record high. In particular, the trend of turning to stablecoin margined products is particularly supportive for the price action and removes some of the unfavourable price action, since Bitcoin margined futures can amplify downside due to convexity.

Similarly, in the options market, the OI also recorded a new all time high, with the skew showing plenty of evidence of bullish market positioning. Elsewhere, Ethereum looks set to break through the key $500 level.

Farming Yield

Despite the recent liquidity exodus from Uniswap, the overall levels of liquidity has since stabilised. In addition, instead of flooding the market with Ethereum, yield farmers turned to Sushiswap and others, to look to alternative yield plays. This in itself is very supportive for Ethereum.

Also, as a reminder earlier in the week, Ethereum co-founder Vitalik Buterin recently answered a number of community questions as part of an “ask me anything,” or AMA, session on Reddit.

During the AMA, hosted by the Ethereum Foundation’s ETH 2.0 research team, Buterin said that he expects noticeable network improvements sooner rather than later. “TLDR: merge happens faster, PoS happens faster, you get your juicy 100k TPS faster,” Buterin said on Wednesday as part of the foundation’s fifth AMA on ETH 2.0.

In the Markets

Ask me anything

Similarly, in the options market, the OI also recorded a new all time high, with the skew showing plenty of evidence of bullish market positioning. Elsewhere, Ethereum looks set to break through the key $500 level.

Despite the recent liquidity exodus from Uniswap, the overall levels of liquidity has since stabilised. In addition to that, instead of flooding the market with Ethereum, yield farmers turned to Sushiswap and others, to look to alternative yield plays. This in itself is very supportive for Ethereum.

Also, as a reminder earlier in the week, Ethereum co-founder Vitalik Buterin recently answered a number of community questions as part of an “ask me anything,” or AMA, session on Reddit.

During the AMA, hosted by the Ethereum Foundation’s ETH 2.0 research team, Buterin said that he expects noticeable network improvements sooner rather than later. “TLDR: merge happens faster, PoS happens faster, you get your juicy 100k TPS faster,” Buterin said on Wednesday as part of the foundation’s fifth AMA on ETH 2.0.

Crypto AM: Longer Reads

Crypto AM: Market View in association with Ziglu

Crypto AM: Technically Speaking in association with with Zumo

Crypto AM: Talking Legal in association with INX

Crypto AM: Inside Blockchain with Troy Norcross

Crypto AM: Definitively DeFi

Crypto AM: Founders Series

Crypto AM: Industry Voices

Crypto AM shines its Spotlight on ByteTree Asset Management