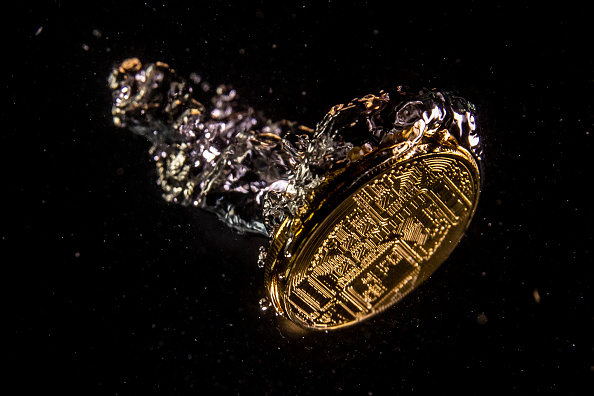

Inflation is on a collision course with world economies… while Bitcoin looks steady

The week in review

with Jason Deane

Bitcoin remains in what has become its favourite trading range of around $40k where it has been for, well, pretty much all of 2022 so far, while the headlines have been dominated by Netflix, Twitter and Elon Musk and the apparent atrocities being wrought on the Ukrainian people by the invading Russians.

The economic impacts of the latter subject continue to play out. The Russian rouble has now regained almost all the losses it made in the first days of the war when it dropped 50 per cent on the news. And, while it seems at first glance that Russia is weathering the economic storm imposed by the rest of the world, all is not well.

Russia’s stock market, the MOEX, has lost 44 per cent of its value and is still falling, inflation is off the charts, shortages are now appearing in the real economy and the country looks like it will default on international bond payments on May 4.

Meanwhile, the head of Russian Bank, Elvira Nabiullina, has made it clear that her country’s reserves are almost exhausted and the proverbial really is about to hit the fan. This was probably why she wanted to step down at the end of her tenure recently, but was refused permission to do so by Putin himself.

While it’s tempting to slip back to the playground position of “serves you right” this will affect everyone in some way or another. Like it or not, Russia is an important world economy, as is Ukraine’s, and the pain the world has felt recently with financial fallout from Covid is nothing compared to what now lies ahead. Inflation caused by expanding the global money supply is now being compounded by demand pull inflation caused by supply chain issues.

This is going to get very, very messy.

Bitcoin, meanwhile, remains solid and steady against this backdrop of madness, quietly producing block after block at an annual inflation rate of 1.79 per cent. It is now almost exactly two years until the next halving takes place, at which time Bitcoin’s annual inflation rate drops to mere 0.83 per cent. I’ll bet you a Bitcoin right now there won’t be a single fiat currency on the planet that can compete with that.

On chain data shows that exchange supply continues to fall while more holders than ever are securing Bitcoin for the long term. At the same time, more countries, regions, states and towns are adopting or looking to adopt Bitcoin, and this week Australia became the eighth country in the world to launch a spot ETF. US investors, however, remain ‘protected’ by Gary Gensler’s team, a position that is clearly becoming increasingly difficult to justify.

Finally, just yesterday, Morgan Stanley published a statement via a report that they now believe Bitcoin’s Lightning Network to be superior to Visa and “more practical” for small payments.

The world is changing fast – keeping tabs is now becoming a full time job.

But also, more than ever, an essential one.

Have a great weekend!

Not started your Bitcoin journey yet? Get going with £10’s worth of Bitcoin FREE from Luno*! Simply download the app, verify and enter code BPJDEANE

*18+, UK resident, new to Luno

Would you like to help spread the adoption and education of Bitcoin in the UK and even stack some Sats while you’re doing it? Well, now you can!

The Bitcoin Pioneers community, backed by Barry Silbert’s Digital Currency Group, was created to introduce Bitcoin to a mainstream audience in a meaningful way and now has members right across the UK.

We share tips, stories and ideas on how to encourage others to try Bitcoin for the first time. And, thanks to support from Luno, each Pioneer gets £500 of Bitcoin a month to share with beginners, helping them get started.

So, if you’re passionate about Bitcoin, why not join today? Click here to find out more!

All feedback on Crypto AM Daily in association with Luno is welcome via email to James.Bowater@cityam.com 🙏🏻

Yesterday’s Crypto AM Daily in association with Luno

In the markets

The Bitcoin economy

*Definitions and insights can be found at https://bytetree.com/research

Total crypto market cap

The total capitalisation of the entire cryptocurrency market at time of writing is currently $1.878 trillion.

What Bitcoin did yesterday

We closed yesterday, April 21 2022, at a price of $40,527.36. The daily high yesterday was $42,893.58 and the daily low was $40,063.83.

Bitcoin market capitalisation

Bitcoin’s market capitalisation at time of writing is $770.89 billion. To put it into context, the market cap of gold is $12.401 trillion and Tesla is $1.042 trillion.

Bitcoin volume

The total spot trading volume reported by all exchanges over the last 24 hours was $37.3 billion. High volumes can indicate that a significant price movement has stronger support and is more likely to be sustained.

Volatility

The price volatility of Bitcoin over the last 30 days is 38.1%.

Fear and Greed Index

Market sentiment today is 26, in Fear.

Bitcoin’s market dominance

Bitcoin’s market dominance today is 41.74. Its lowest ever recorded dominance was 37.09 on January 1 2018.

Relative Strength Index (RSI)

The daily RSI is currently 46.10. Values of 70 or above indicate that an asset is becoming overbought and may be primed for a trend reversal or experience a correction in price – an RSI reading of 30 or below indicates an oversold or undervalued condition.

Convince your Nan: Soundbite of the day

“A lot of the dismissals, criticisms and attacks on Bitcoin come from people who have the luxury of having a stable financial system.”

Alex Gladstein, Chief Strategy Officer at the Human Rights Foundation

What they said yesterday

Morgan Stanley knows…

Suspicious…

Just keep hodlin’…

Crypto AM: Editor’s picks

‘Let people invest’: Matt Hancock makes case for liberal crypto rules

Explained: Why the Treasury is so sold on stablecoins

Fears crypto is used to avoid sanctions ‘misplaced,’ says Matt Hancock

Meet the hackers helping people recover lost crypto assets

The cryptocurrency fundraisers behind Ukraine’s military effort

Exclusive: Fireblocks valuation climbs to $8bn in $550m funding round

Crypto crazy couple name baby after favourite digital asset

Bitcoin hashrate touches new all time high

Peter McCormack: Transforming Bedford FC into a global Bitcoin brand

Crypto AM: Features

Crypto AM: Founders Series

Crypto AM: Industry Voices

Crypto AM: Contributors

Crypto AM: In Conversation with James Bowater

Crypto AM: Tomorrow’s Money with Gavin S Brown

Crypto AM: Mixing in the Metaverse with Dr Chris Kacher

Crypto AM: Visions of the Future, Past & Present with Alex Lightman

Crypto AM: Tiptoe through the Crypto with Monty Munford

Crypto AM: Taking a Byte out of Digital Assets with Jonny Fry

Crypto on the catwalk

Crypto AM: Events

For those of you who missed the Crypto AM DeFi & Digital Inclusion online summit 2021 – you can now watch the event in two parts via YouTube

Part One

https://www.youtube.com/watch?v=dvqNMNZTIDE

Part Two

https://www.youtube.com/watch?v=WXhX_-Tr5j0

Cautionary Notes

It’s definitely tempting to get swept up in the excitement, but please heed these words of caution: Do your own research, only invest what you can afford, and make good decisions. The indicators contained in this article will hopefully help in this. Remember though, the content of this article is for information purposes only and is not investment advice or any form of recommendation or invitation. City AM, Crypto AM and Luno always advise you to obtain your own independent financial advice before investing or trading in cryptocurrency.

All information is correct as of 08:00 BST