Fed fails to give markets clarity

MARKETS were in turmoil last night as the Federal Reserve’s latest minutes failed to give investors any clues to determine when the massive US bond buying programme will be trimmed.

Some of the board were guarded on the prospect of tapering, calling for patience and additional data, but other members “suggested that it might soon be time to slow somewhat the pace of purchases”.

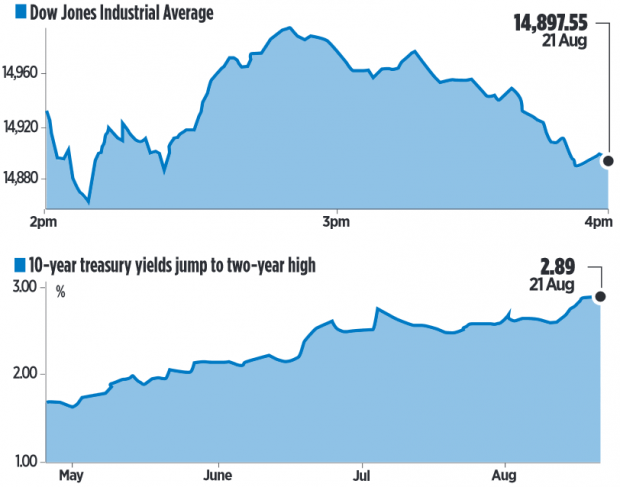

The split opinions threw markets into disarray, with the Dow Jones index plummeting and then spiking upward minutes later, before closing down 105.44 points at 14,897.55 – its lowest level since early July.

Emerging markets, which have suffered as hot money pours back into the US, took another beating after the release of the minutes, while the dollar gained against the yen and euro.

Yields on 10-year US treasury notes soared to 2.89 per cent, near the two-year highs seen on Tuesday, on fears the Fed could soon slow its $85bn monthly asset purchases programme.

“Bottom line: Wall Street traders are angry and confused by today’s release,” said Todd Schoenberger of LandColt Capital summing up the disorder.

The Fed’s committee continued to suggest that, assuming that economic data continue to show improvements, tapering would begin later this year, and that asset purchases would have finally ended by the middle of 2014.

But the exact beginning and end of the tapering scheme remains a mystery to markets, as it has since Federal Reserve chairman Ben Bernanke first raised the subject in late May.

According to the minutes, July saw no big divisions on tapering immediately last month: “almost all committee members agreed that a change in the purchase programme was not yet appropriate”.

But Capital Economics’ Paul Ashworth last night said that the taper was likely to begin soon: “An unexpectedly weak set of August employment figures could delay the taper but, with initial jobless claims trending even lower, we don’t anticipate a report that would be bad enough to do that”.

Jeremy Cook of World First added that if strong data emerged in the weeks ahead: “Then the vote to taper asset purchases in September will be a very close one”.