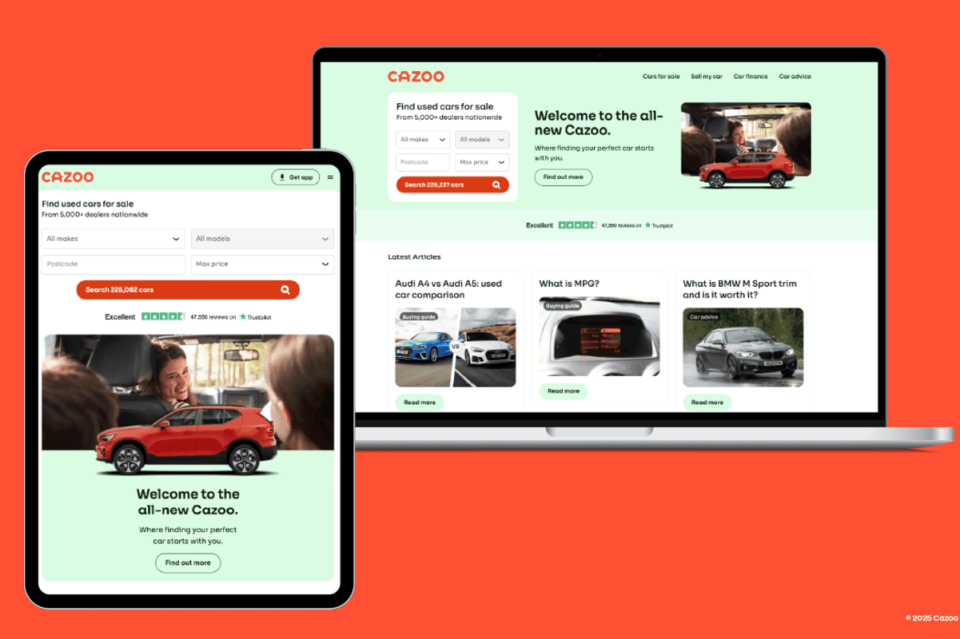

Can Cazoo go from collapse to Auto Trader’s ‘undisputed’ rival?

Cazoo can double in size over the next couple of years and become the undisputed number two to FTSE 100 giant Auto Trader, the man charged with its phoenix-like recovery has said.

Barry Judge, who helped rescue the brand after it collapsed in May 2024, added that the company is working on winning back the trust of the public and car dealers after its very public fall from grace.

The chief executive has also opened up about how Cazoo’s business model is different to its previous incarnation and what the use of artificial intelligence (AI) means for the business.

What happened to Cazoo?

Cazoo was founded in 2018 by Alex Chesterman and was once worth around $8bn after its listing on the New York Stock Exchange.

But the company collapsed into administration in May 2024 after racking up debts of more than £260m.

The business had previously announced a major change to its business model, plans to cut jobs and the departure of its chief executive in March.

Cazoo’s collapse led to more than 700 redundancies being made with the move to a marketplace model between 1 March and 17 May last year.

The Cazoo brand was sold for just £5m towards the end of June 2024 by Motors which announced plans to transform it into a digital marketplace.

Is the brand any different than before?

Speaking exclusively to City AM, Motors CEO Barry Judge said his company bought the name because of the brand recognition that the previous owners had built up.

He said: “Under the previous model and ownership they built a household name in a very short period of time, predominantly through investment in sports sponsorship.

“For all of the faults with Cazoo as a digital retailer, they did build quite a household name in a very short period of time – something that had not happened before in the marketplace space.

“So we acquired because of the reach and the potential of the brand and because we felt that Motors had always kind of existed, but over that seventeen-year period had grown into a healthy business that was understated with a lot of potential.

“We felt that by taking the one thing that Motors was missing – the brand and the investment – then taking that heritage of Motors and connecting it into the Cazoo brand that would give us an opportunity to create a challenger in the market.”

Subscribe to the Boardroom Uncovered podcast from City AM here.

Taking on FTSE 100 giant Auto Trader

Judge makes no bones about revealing his ambition for Cazoo – for the brand to become the “undisputed” number two to FTSE 100 giant, Auto Trader.

The CEO confirmed his group’s revenue is only a tenth of Auto Trader’s – which revealed last week that its sales had passed the £600m mark for the first time.

Judge added: “I think that dealers haven’t had an undisputed number two. There hasn’t been a challenger.

“You’ve had a plethora of brands that have competed against each other for the number two spot, but no one has been an outstanding performer.”

He added: “Auto Trader is quite a formidable business, a benchmarkable marketplace, not just for the UK, but for many across the globe.

“All automotive marketplaces around the world will look towards Auto Trader.”

Can Cazoo be trusted again?

While Cazoo has undeniable brand recognition through its previous marketing strategies, its collapse last year was high profile and damaging for its reputation.

Asked whether he was worried about potential customers struggling to trust Cazoo again, Judge said: “I had those concerns early on but I don’t have them now.

“Cazoo built phenomenal levels of awareness and I think consumers see it as a destination to buy and sell a car.

“The trade and people like me and you probably pick up and read into that [its past struggles] a lot more than the consumer does.

“I think there’s still a unique opportunity for us to shape the narrative and I think the brand is undeniably strong.

“We ran tests with Cazoo under the previous ownership where we syndicated the content – we saw really good conversion rates and since launch direct traffic has grown steadily, week on week.

“I think there’s an opportunity for us to continue to invest into the brand, invest into not just awareness, but consideration of the brand.

“I think there’s a great opportunity for us to build on the trust that people have with that brand.”

But it’s not just the general public where the brand’s reputation took a sizeable hit in 2024.

Cazoo’s collapse led it to owe more than £260m to its creditors – many of whom are the car dealers it is now seeking to work with again – although through a different operating model.

Asked whether the brand can win those dealers back again, Judge said: “There seemed to be quite a bit of animosity towards Cazoo, but also towards the whole leadership team.

“I actually think the dealer’s digital proposition is probably stronger as a result of the competition that the Cazoo has brought.

“That is a positive thing for both for the trade and for the consumers.

“What is also undeniable over the last two years is that there’s a desire for the consumer to do some aspects of the transaction online, but there are many parts that still require human interaction and intervention.

“Therefore the consumer is more at ease dealing with an individual and the dealers are in the best position to be able to manage that.

“While the dealers at the start were quite apprehensive, our specialty is in a pure play marketplace, not in digital or in the transaction.

“So when we explain the proposition and our intentions to dealers, I would say 98 per cent of the dealers can get on board.

“What dealers really want is healthy competition in the marketplace.”

How acquisition has changed Motors

Judge also opened up about the “fatigue that crept into employees” at Motors as it bounced from three successive owners between 2019 and 2022.

Motors – which also includes Gumtree UK – had been owned by eBay which attempted to offload it to Adevinta – a move which was blocked by the Competition and Markets Authority – before it was sold to O3 Industries and Novum Capital.

The CEO said: “There’s a certain amount of fatigue that creeps into the people as a result of being caught in this continuous M&A process.

“[We now have] very good owners in the sense that they’ve invested into the business.

“We’ve had continuity in the business over the last three years. We’ve been able to kind of recover from that kind of M&A fatigue that kind of creeps into the team – get solid plan in place, get get a strong leadership team in place and then start kind of executing against that plan.

“We came out of eBay – that brought cultural challenges, beliefs and behaviours that didn’t align with what we wanted to be, which was a challenger brand.

“We were risk averse, fearful, quite formal in hierarchy, slow in decision making – behaviours that we expected in a public traded company like eBay.

“We’re trying to shake off that and get to a place where Motors is more experimental and fast, high risk, flexible with minimal bureaucracy.

“The acquisition of Cazoo has helped us accelerate in many areas – one being the kind of culture and the identity to be more start-up like, more of a founder mentality, a lot more fluid and quick in our decision making.”

‘AI not about job cuts – it’s about being able to punch harder’

Like so many tech-based companies in recent years, the use of artificial intelligence (AI) has been a hot topic of discussion.

Many business leaders have referred to AI as a way to boost efficiencies within their organisation – often, but not always, taken as code for job cuts.

On his approach to the use of AI at Cazoo, Judge said: “I think there have been actually quite a few cases where individuals have jumped the gun on AI and and have assumed that AI would do the role of people, and now we’re actually hiring back people.

“I view AI as in the sense that there are certainly efficiencies that you can gain in the business and improvements in terms of things like dealer onboarding and so I don’t necessarily think that, ‘oh, we’re going to be able to reduce our workforce by X percent as a result of AI’.

“I actually think that you could probably scale faster based on the resources we have.

“I think there are probably a lot of efficiencies that can be gained on consumer and dealer sites.

“AI can be quite supportive on kind of things like search and certainly from a dealer perspective, and in order to be able to provide them with actual insights around maybe demand and how that influences how to price cars.

“Then there’s probably a third part which is ‘can you be disruptive’?

“I don’t really think in a business of our size that AI is about reducing headcount.

“I actually think it’s about being able to punch harder and gain those efficiencies and to accelerate on our growth and our plans.”