Overcoming fear: why you need to take some risk

Most of us are programmed to be afraid of taking too much risk. Yet when it comes to our money, not taking an appropriate amount of risk can be damaging to our wealth.

It’s logical to assume that leaving money in a savings account is the best risk-free way to look after our money. While it’s true that this approach may better protect our money from short-term stresses in the stock market, there are other factors to consider when it comes to maintaining and growing our capital’s value.

The risk of not doing anything

India’s first Prime Minister Jawaharlal Nehru once said, “The policy of being too cautious is the greatest risk of all.”

This sentiment should also apply when managing your money – for a simple but powerful reason: the effect of inflation. While inflation means that prices will generally increase over time, this attribute also means that the purchasing power of your money reduces over time.

So while the value of £100,000 in a savings account, for example, will not fall below this nominal figure (and will rise slightly due to interest), what you can buy for this sum can erode meaningfully as years pass.

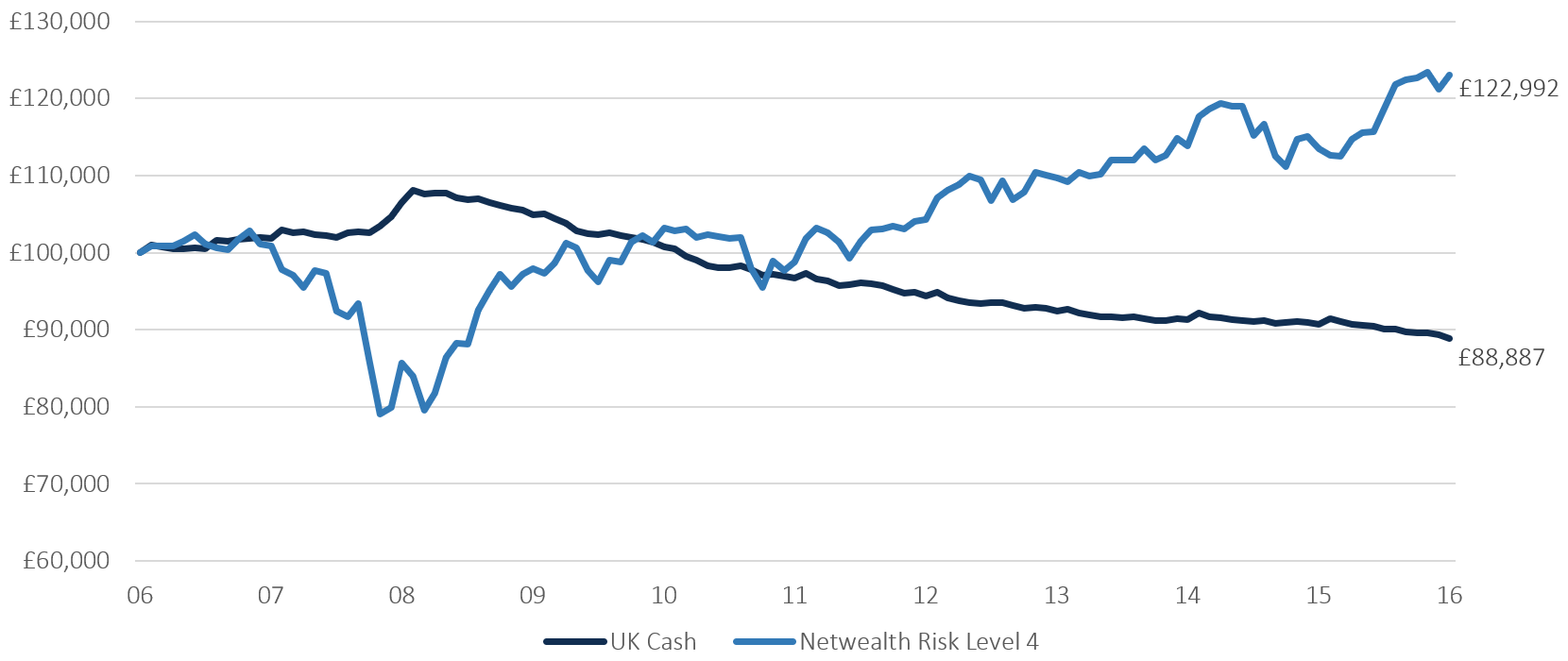

Let’s take the period from the end of 2006 to the end of 2016, a time of strong growth for the stock market overall, but also involving a considerable decline. If you had left your nominal £100,000 lounging in a bank account its actual purchasing power – after retail price inflation – would have slumped to £88,887. By investing in a balanced portfolio on the other hand, such as Netwealth’s medium risk portfolio (Risk Level 4), your capital would have risen to £122,992 over the same period.

While savings erode over time, a balanced portfolio could be the solution

How savings suffer over the long term, and how even a medium risk portfolio could prevent serious capital loss

How savings suffer over the long term, and how even a medium risk portfolio could prevent serious capital loss

Return series are calculated as the total return on the UK 1m LIBOR Cash Index, deflated by RPI, for UK Cash. The Netwealth Risk Level 4 return series is the simulated historical performance of the current strategic allocation, net of management fees and underlying fund costs, deflated by RPI. Past performance is no guarantee of future performance.

Why we are fearful of taking risk

As well as making intuitive sense, the psychology professor Nicholas Carleton has posited that the fundamental fear we possess is fear of the unknown.¹ Investing money comes with a great deal of uncertainty – with issues further clouded by an excess of noise. This explains why we are often slow to do something positive with our money, even in the face of diminishing capital in a savings account.

The influence of behavioural psychology may also account for our inertia. For example, an effect known as hyperbolic discounting causes us to consider the effects of our decisions less the further they fall in the future. Likewise, if many investors seem to be getting out of the market – or are simply talking about it – the ‘thinking trap’ of herd behaviour may lead us to copy the actions of others, causing the fundamental strengths of investments to be ignored.

How choices can help you to overcome risk

You can be invested at different levels of risk. And having professionals to invest on your behalf can alleviate much of this risk, lessening your uncertainty as a result.

“We give investors a choice of seven diversified portfolios with different risk levels,” says Iain Barnes, Netwealth’s head of portfolio management. “This means that investors can choose from very low risk, which invests mainly in high quality, often short-dated bond funds, to a portfolio that is concentrated in growth assets like equities – with various mixes of investments, and therefore levels of risk, in portfolios between these two poles.”

Because you can tailor risk levels to suit your preferences, choosing to invest, therefore, is not a binary choice of yes or no. To avoid the depletion of your funds due to inflation, a low-cost, diversified portfolio managed for you could be an ideal option to coincide with how much risk you are comfortable taking.

¹Research paper by Professor Nicholas Carleton ‘Fear of the unknown: One fear to rule them all?’ http://www.sciencedirect.com/science/article/pii/S0887618516300469