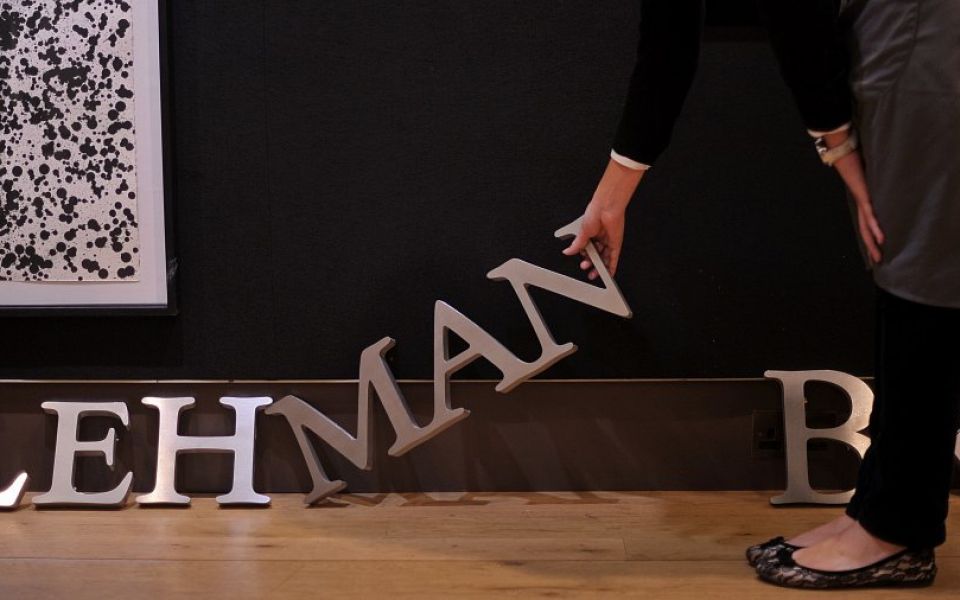

Lehman lives: Administrators approach the end of the road a decade on

It is known as one of the biggest corporate collapses ever, so it will probably surprise some people that Lehman Brothers still employs a significant number of people. The firm still occupies office space in Citi’s headquarters in Canary Wharf, after moving out of 25 Bank Street in 2009, as the more than decade-long task of winding down its complex operations continues – with billions of pounds at stake.

“Going in and shutting the factory gates might be ok if what you’re making is cars,” said Michael Thomas, a financial services partner at Hogan Lovells. “For finance just shutting up shop is not an option.”

The administration of Lehman Brothers International Europe, the London unit which housed most of its trading operations, hit the headlines again this year after investors finally won a payout of £6bn – on top of £36bn already disbursed.

Creditors are expected to recoup 140p for every pound of debt, including big-name distressed debt hedge funds Elliott Advisors, King Street, Carval and Baupost – but the debt traded as low as 20p at points, delivering staggering returns for the boldest investors.

Accountants PwC had the gargantuan task of winding down an investment bank – for fees of just over £1bn in the last decade. Legal costs have mounted to £400m, with another £1bn in operational costs such as property, computer systems, and data. Coming in straight after the bankruptcy, administrators found chaos.

“Everything was up in the air, the servers were down, there was no data,” says Russell Downs, the partner leading the administration for PwC. “The world was a bit upside down at that point.”

Some 400 Lehman staff plus 200 from PwC were kept on to run the bank’s assets – although that has reduced to 30 at the moment. “We truly were an investment bank, albeit we weren’t doing any new stuff,” says Downs.

The administration is expected to finish within the year, leaving the people who have given years to the project to find something else.

“I’ll sit and wait for something else to come along,” says Downs, comparing himself to a surfer waiting for the next wave.