Bitcoin sees major retrace

Crypto at a Glance

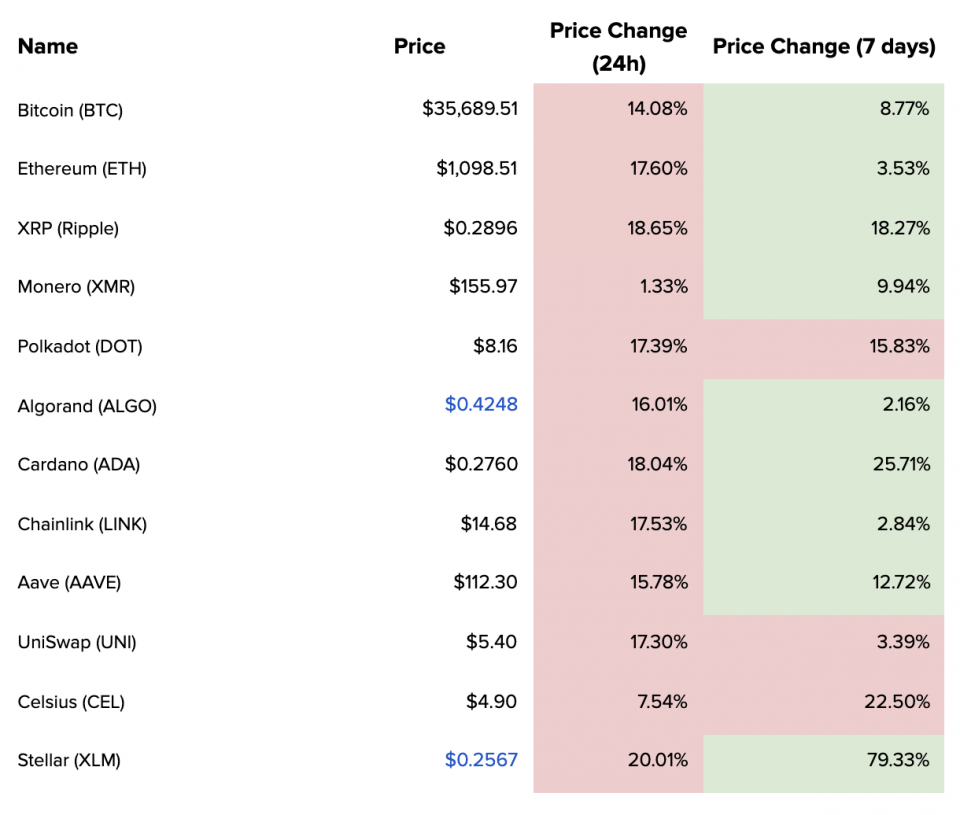

After the parabolic excitement of last week, it was back down to Earth with a bang last night for bitcoin fans – albeit somewhat predictably.

The leading cryptocurrency by market cap dropped more than $7,000 in a matter of hours – a fall that was echoed across the space, as many alt coins saw 15% or more knocked off their value. It was particularly disappointing for Ethereum, which had seen a huge rise earlier in the day to well over $1,200 and looked on course to set a new all-time high before the retrace.

These kinds of drops are to be expected in a bull market and many consider them to be healthy in the long-term. The drop also by no means eliminates the major gains made in the last week alone. The question now is whether this is the end of the correction or just the beginning? Can bitcoin bulls muster the energy for another push to $50,000 and Ethereum to a new all-time high? The fall echoes wider worsening market conditions, with traders waking up to significant drops across the FTSE amidst talk of even harsher lockdown measures being introduced. Bitcoin and the stock market were closely correlated for much of last year, before cryptocurrency managed to extricate itself and soar to near highs. Will this pattern emerge again?

In the Markets

What bitcoin did yesterday

We closed yesterday, 10 January, 2020, at a price of $38,356.44 – down from $40,254.55 the day before. It’s now been nine consecutive days that the price has closed at over $30,000.

The daily high yesterday was $41,420.19 and the daily low was $35,984.63. That’s the fourth day in a row we’ve seen a daily high over $40,000 – will we see a fifth consecutive day today?

This time last year, the price of bitcoin closed the day at $8,166.55 and in 2019 it was $3,678.92.

As of today, buying bitcoin has been profitable for…

99.9% of all days since 2013-04-28.

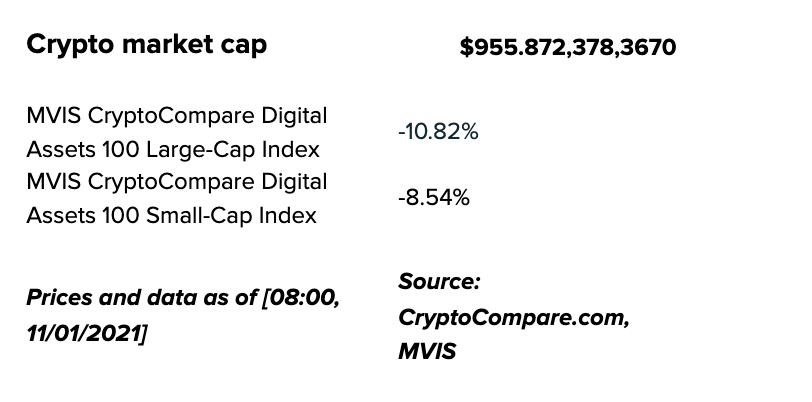

Market capitalisation

Bitcoin’s market capitalisation is currently $656,156,776,341. Last week saw Bitcoin flip Tesla, Tencent and even Facebook’s market capitalisation. Now, it’s back below all of those. Still above Berkshire Hathaway and Alibaba, though. Suck it, Buffett.

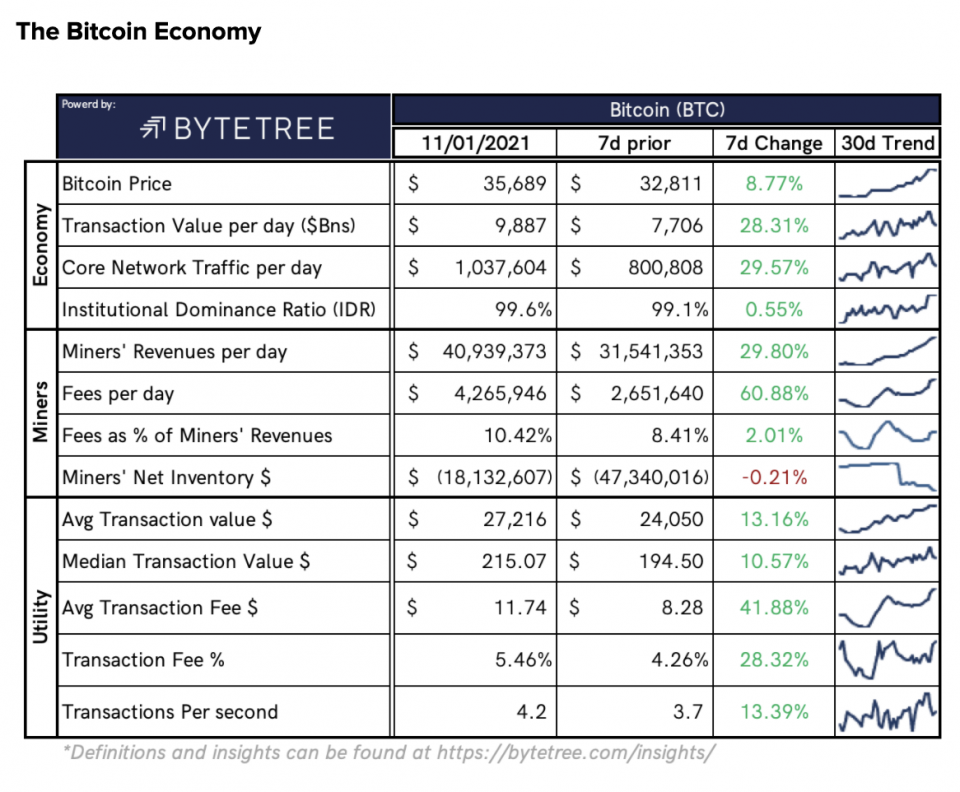

Bitcoin volume

The volume traded over the last 24 hours was $101,140,622,719. High volumes can indicate that a significant price movement has stronger support and is more likely to be sustained.

Volatility

The price volatility of bitcoin over the last 30 days is 76.23%.

Fear and Greed Index

The sentiment continues its marathon streak in Extreme Greed territory although it is back down 90 – its lowest level since 24 December, 2020. The last time the sentiment was not in Extreme Greed was 5 November, 2020. It’s important to remember that the index doesn’t stay this high very often and can mean a correction is on the cards.

Bitcoin’s market dominance

Bitcoin’s market dominance stands at 69.43. Its lowest ever recorded dominance was 37.09 on 8 January, 2018.

Relative Strength Index (RSI)

The daily RSI is currently 64.57. Values of 70 or above indicate that an asset is becoming overbought and may be primed for a trend reversal or experience a correction in price – an RSI reading of 30 or below indicates an oversold or undervalued condition.

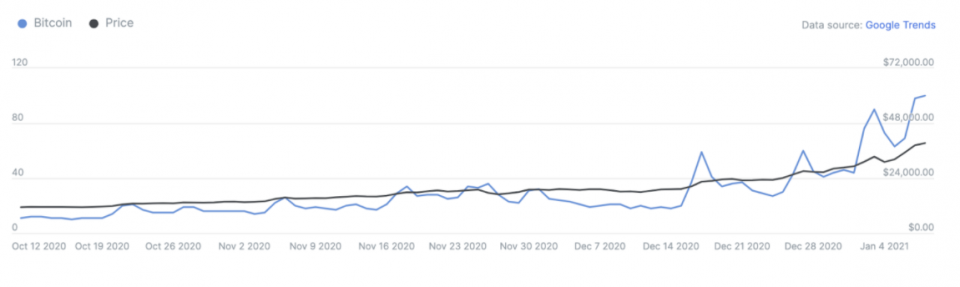

Google trends

The trend in Google searches over the last 90 days. Google shows this chart on a relative basis with a max score of 100 on the day that had the most Google searches for that keyword. The latest score is 100 – taken from 8 January.

Convince your Nan: Soundbite of the day

Yes, it’s volatile. Yes, there are some shadows in its past. But Bitcoin isn’t a fad, or a scheme, or a bubble. It’s an entirely new paradigm.

- Ben Mezrich, Author of The Social Network and Bitcoin Billionaires

What they said yesterday…

Thanks, Hal

Mezrich and Musk look to ditch fiat pay cheques?

Draper pointing the finger at banks for the dip

Good to see the community is still bullish though

Crypto AM: Longer Reads

Crypto AM: In conversation with James Bowater

Crypto AM: Market View in association with Ziglu

Crypto AM: Technically Speaking in association with with Zumo

Crypto AM: Talking Legal in association with INX

Crypto AM: Focusing on Regulation

Crypto AM: Deeper Dives with Liam Roche

Crypto AM: A Trader’s View with TMG

Crypto AM: Definitively DeFi

Crypto AM: Founders Series

Crypto AM: Industry Voices

Crypto AM shines its Spotlight on EdenBase & its ‘Cognitive Revolution’

Cautionary Notes

It’s definitely tempting to get swept up in the excitement, but please heed these words of caution: Do your own research, only invest what you can afford, and make good decisions. The indicators contained in this article will hopefully help in this. Remember though, the content of this article is for information purposes only and is not investment advice or any form of recommendation or invitation. City AM, Crypto AM and Luno always advise you to obtain your own independent financial advice before investing or trading in cryptocurrency.

All information is correct as of 08:30am GMT.

Crypto AM Daily in association with Luno