Bitcoin holds $30,000 after worst drop since March

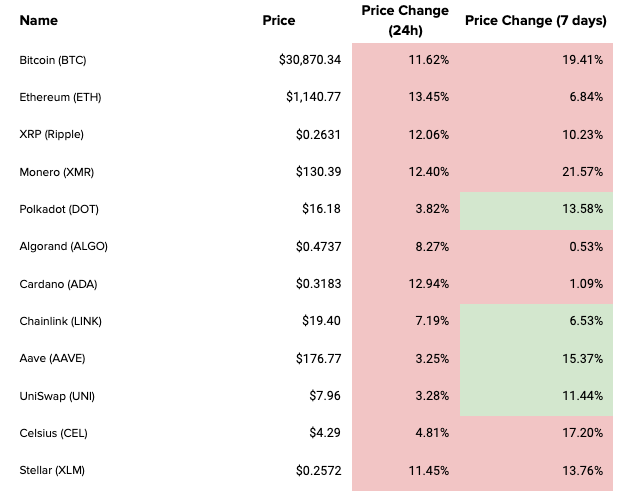

Crypto at a Glance

The price of Bitcoin fell 13% yesterday, erasing the majority of the gains made so far in 2021. It was the largest daily drop since the market crash of March 2020. Is this just a dip, or is it the start of a more prolonged correction? Encouragingly, Bitcoin is still holding $30,000 for now, and this could prove a pivotal level moving forward.

The drop comes amid a sea of FUD this week, as critics throw the kitchen sink at crypto – from old tin-foil hat Tether conspiracies to erroneous and disproven news of a double spend being reported by people who really should know better. It’s likely, however, that this drop is also simply part of the natural ebbs and flows of the market, after an extraordinary month of gains saw Bitcoin rise from $20,000 to $40,000. It’s always important to zoom out a bit and remember that it was just three weeks ago that everyone was celebrating $30,000.

It was bad news across the board yesterday, with no coin escaping unscathed. There were double digit drops for Ethereum, Cardano, and XRP, although Dot looks to be coping best at the minute and continues to look strong. Where will the markets take us today?

In the Markets

What bitcoin did yesterday

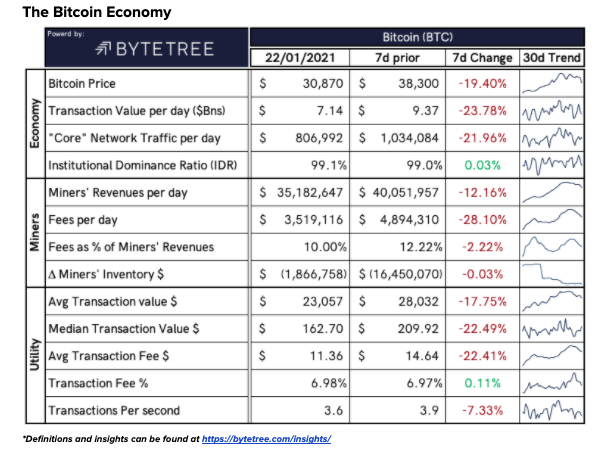

We closed yesterday, 21 January, 2020, at a price of $30,825.70 – down from $35,547.75 the day before. That’s the lowest closing price since 1 January. It’s now 20 days since the price of bitcoin was last below $30,000 and 36 since it was below $20,000.

The daily high yesterday was $35,552.68 and the daily low was $30,250.75.

This time last year, the price of bitcoin closed the day at $8,745.89. In 2019, it was $3,576.03.

As of today, buying bitcoin has been profitable for…

99.9% of all days since 2013-04-28.

Bitcoin market capitalisation

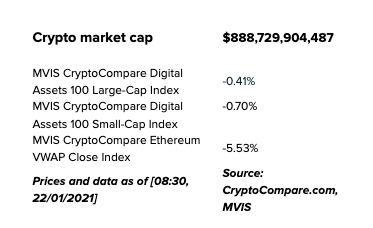

Bitcoin’s market capitalisation is currently $573,151,173,924, down from $638,521,453,472 yesterday. That means it’s now the 13th largest asset in the world by market cap, below the Taiwan Semiconductor Manufacturing Company. It is, however, still bigger than Visa, JP Morgan and Berkshire Hathaway. Tesla can probably stop looking over its shoulder for the time being, though.

Bitcoin volume

The volume traded over the last 24 hours was $94,861,602,828, up from $65,665,249,085 yesterday. High volumes can indicate that a significant price movement has stronger support and is more likely to be sustained.

Volatility

The price volatility of bitcoin over the last 30 days is 101.33%.

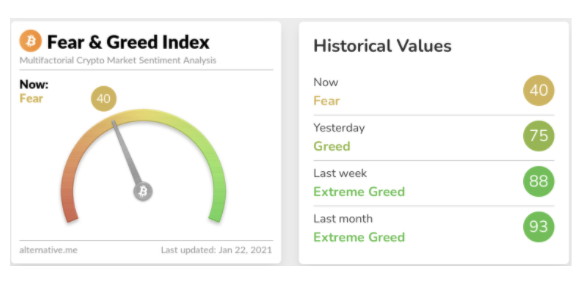

Fear and Greed Index

The sentiment Index is flashing Fear for the first time since November of last year, showing 40 today. That’s the first time we’ve been in Fear since last October.

Bitcoin’s market dominance

Bitcoin’s market dominance still stands tall at 65.19. Its lowest ever recorded dominance was 37.09 on 8 January, 2018.

Relative Strength Index (RSI)

The daily RSI is currently 44.41. Values of 70 or above indicate that an asset is becoming overbought and may be primed for a trend reversal or experience a correction in price – an RSI reading of 30 or below indicates an oversold or undervalued condition.

Convince your Nan: Soundbite of the day

“At the end of the day, bitcoin is programmable money. When you have programmable money, the possibilities are truly endless. We can take many of the basic concepts of the current system that depend on legal contracts, and we can convert these into algorithmic contracts, into mathematical transactions that can be enforced on the bitcoin network. As I’ve said, there is no third party, there is no counterparty. If I choose to send value from one part of the network to another, it is peer-to-peer with no one in between. If I invent a new form of money, I can deploy it to the entire world and invite others to come and join me. Bitcoin is not just money for the internet. Yes, it’s perfect money for the internet. It’s instant, it’s safe, it’s free. Yes, it is money for the internet, but it’s so much more. Bitcoin is the internet of money. Currency is only the first application. If you grasp that, you can look beyond the price, you can look beyond the volatility, you can look beyond the fad. At its core, bitcoin is a revolutionary technology that will change the world forever.”

- Andreas M. Antonopoulos, Author of The Internet of Money

What they said yesterday…

At least we’ve still got memes

Dips are only there to make bounces more satisfying 🙂

Excellent thread from Andreas Antonopolous disproving recent FUD

There’s always opportunity

Crypto AM: Longer Reads

Crypto AM: Market View in association with Ziglu

Crypto AM: Technically Speaking in association with with Zumo

Crypto AM: Talking Legal in association with INX

Crypto AM reshines its Spotlight on CUDOS

Crypto AM: Focusing on Regulation

Crypto AM: Deeper Dives with Liam Roche

Crypto AM: A Trader’s View with TMG

Crypto AM: Tiptoe through the Crypto with Monty Munford

Crypto AM: Definitively DeFi

Cautionary Notes

It’s definitely tempting to get swept up in the excitement, but please heed these words of caution: Do your own research, only invest what you can afford, and make good decisions. The indicators contained in this article will hopefully help in this. Remember though, the content of this article is for information purposes only and is not investment advice or any form of recommendation or invitation. City AM, Crypto AM and Luno always advise you to obtain your own independent financial advice before investing or trading in cryptocurrency.

All information is correct as of 08:30am GMT.

Crypto AM Daily in association with Luno