Bank of England watchers eye Pill and Ramsden speeches

Bank of England watchers are in for a bumper week as several top rate setters provide hints on the trajectory of UK monetary policy after last week they said the economy is on course for the longest recession on record.

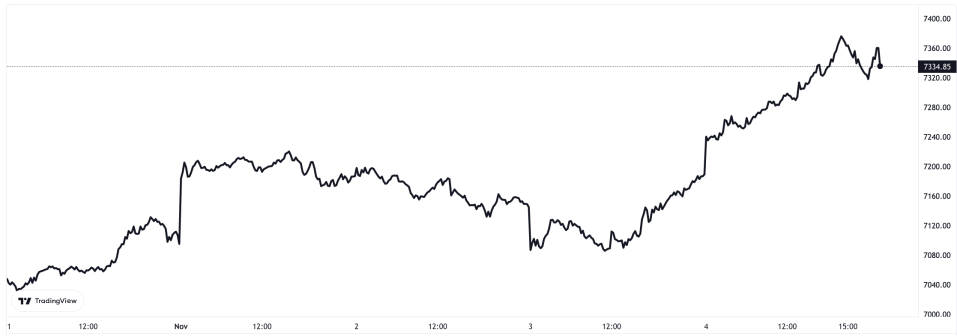

Despite the bleak projections by the Bank, London’s FTSE 100 fared well last week, climbing more than four per cent to close at 7,334.84 points.

The domestically-focused mid-cap FTSE 250 index, which is more aligned with the health of the UK economy, jumped 2.37 per cent to 18,341.57 points.

FTSE 100 performance over last week

On Tuesday, investors will be parsing through the Bank’s chief economist Huw Pill’s speech at an event examining the impact of the global economic turmoil on central banks, hosted by Swiss lender UBS in London.

Pill last week voted alongside governor Andrew Bailey and five other members of the monetary policy committee (MPC) to raise interest rates 75 basis points to three per cent, the largest hike in over 30 years.

Investors were given a stern warning by the Bank last week to not expect interest rates to rise too sharply. The Bank’s two year recession warning was based on rates topping five per cent.

Rates have climbed eight times in a row to tame inflation, running at a 40-year high of 10.1 per cent.

Other MPC members Dave Ramsden, who also backed a jumbo rise, and Silvana Tenreyro, who actually voted for a tiny 25 basis point jump, deliver speeches on Thursday and Friday respectively.

Fresh gross domestic product figures published by the Office for National Statistics on Friday are expected to show the UK economy softened in September, mainly due to the extra bank holiday for The Queen’s funeral.

“We expect to see activity drop by 0.5 per cent m-o-m. The fall in September output largely reflects the impact of the extra Bank Holiday due to the Queen’s funeral,” Sanjay Raja, senior economist at Deutsche Bank, said.

Raja also noted a slowdown in consumer spending in response to higher prices and weaker government consumption amid high inflation are also likely to weigh on third quarter GDP.

Primark owner Associated British Foods publishes final results on Tuesday.