How world stock markets have performed in the 10 years since the financial crisis

It is hard to believe that a decade has passed since the start of the global financial crisis.

The 10th anniversary of the run on Northern Rock fell earlier this month. But the crisis was already well underway at that stage.

It was the August of 2017 when French bank BHP Paribas suspended three funds exposed to the US mortgage market, blaming a “complete evaporation of liquidity”.

It would have been impossible to predict what would have happened in the years that followed. The then Chancellor, Alistair Darling, said the UK was facing "arguably the worst" downturn in 60 years.

Few then, would have predicted the stock market returns that followed.

How stocks have performed since the crisis

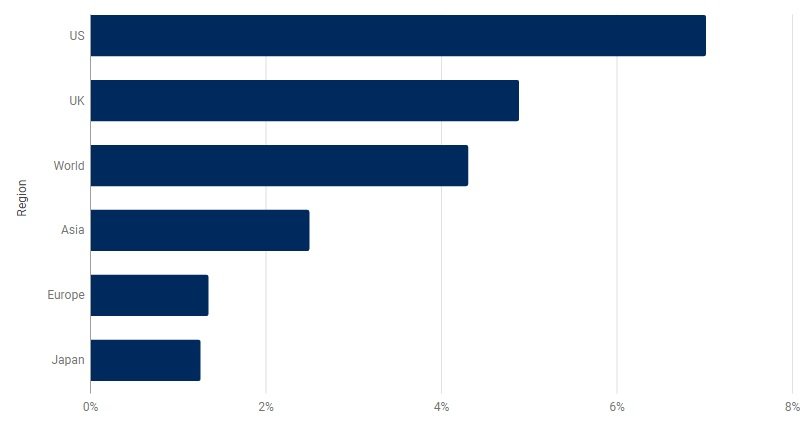

The chart below sets out the compounded annual returns of major market indices, with dividends reinvested, between the end of September 2007, when markets were at or near their pre-crisis highs, and the end of June 2017.

The US stock market returned 7% a year, ahead of the UK at 4.9% a year, based on MSCI data.

What makes the returns all the more remarkable is that this period spans the worst phases of the crisis – when Japanese and European stock market indices lost more than half of their value and world, US, UK and Asian indices all fell by more than 35%.

It also covers the tumultuous European government debt crisis that ensued after the financial crisis. Returns in Europe were far more modest, at 1.4%. Returns in Asia were a little better at 2.5%. Japan was the laggard, at 1.3%.

The average annual return across the six indices was 3.6%. By comparison, the interest on savings interest has been woeful during that period.

Average annual returns since 2007

Compound annual growth rate % (CAGR*)

CAGR is a measure of average annual returns

Source: Schroders, Thomson Reuters Datastream as at 30 June 2017. Data is total returns including dividends for MSCI USA, MSCI UK, MSCI World, MSCI ASIA All Country ex-Japan, MSCI Europe ex-UK and MSCI Japan. For information purposes only. The material is not intended to provide advice of any kind. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Please remember that past performance is not a guide to future performance and may not be repeated.

Is the stock market always the best option?

This is not necessarily so. The rally of recent years has been due, in part, to exceptional intervention. The prices of assets, including shares, bonds and property, have been inflated by central bank efforts to boost economies and stabilise markets.

The pattern of the last 10 years may not be repeated; past performance never guarantees future returns.

Furthermore, putting all your eggs in one basket is not considered to be good investment practice.

- Should income investors be concerned about rising interest rates?

- These seven invesmtent charts caught the eye in August

That said, stock markets have delivered decent returns for long spells, and often during times of strife. During both world wars, the US stock market plunged initially and then rebounded. The annual return for the Dow in the First World War, for instance, was 8.7%, according to Bloomberg.

The key is to stay calm in a crisis and invest for the long term. This gives more time for wild fluctuations to be ironed out.

Importantly, diving in and out of markets at the “right time” is impossible, requiring luck rather than judgement. Even in a crisis, remember your end goal and stick to your investment plan.

The expertise of a fund manager can help in difficult markets.

What if it happens again?

Joe Le Jéhan, a fund manager and member of the multi-manager team at Schroders, said: “The key to navigating the financial crisis was being alive to the warning signals that were evident across markets in the preceding months. In periods like this, our over-riding aim is to protect your investment.

“If we avoid significant losses, we should be in a position to take advantage of cheaper valuations when the opportunity arises, rather than nursing our wounds. We strongly believe that it’s this willingness to actively manage risk that allows investors to compound strong returns over the longer term.

“During the financial crisis, this meant holding very few economically sensitive equities, avoiding areas like financials and using assets like government bonds to provide some upside as most things fell in value.

“Whilst such a concentration on capital protection is vital at the end of all market cycles, this cycle has been quite different. So, what we can use to protect portfolios this time may well also differ.

“Government bonds – historically a more obvious safe haven – may not offer the same opportunity this time. This is why it is worth looking at the few assets that look relatively undervalued and/or have the potential to protect should markets enter another stormy patch.

“These assets might include cash to help dampen volatility and provide that option to invest at cheaper levels when the buying opportunity returns. Selective hedge funds and assets such as gold may also have the ability to make money should equity markets fall.”

Please remember that past performance is not a guide to future performance and may not be repeated. The value of investments and the income from them may go down as well as up and investors may not get back the amounts originally invested.

- For more investment views, go to Schroder Insights or follow on twitter.

Important Information: The views and opinions contained herein are those of David Brett, Investment Writer and Joe Le Jéhan, Fund Manager and member of the multi-manager team, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. The sectors and securities shown above are for illustrative purposes only and are not to be considered a recommendation to buy or sell. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The material is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a guide to future performance and may not be repeated. The value of investments and the income from them may go down as well as up and investors may not get back the amounts originally invested. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. The opinions in this document include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realised. These views and opinions may change. Issued by Schroder Investment Management Limited, 31 Gresham Street, London EC2V 7QA. Registration No. 1893220 England. Authorised and regulated by the Financial Conduct Authority.