Thames Water woes expose wretched debt-plagued industry

Thames Water’s desperate scramble for cash and boardroom disarray reflects decades of mismanagement and cynical asset stripping from stakeholders – which has destroyed public trust in the industry and left Britain with creaking, leaking pipelines that will cost tens of billions of pounds to fix.

No wonder then, there is a deep sense of irony that Thames Water bosses are finding their own mess too toxic to handle, after years of customers having to wade through spilled sewage across Britain’s beaches and rivers.

Yet, any feelings of karmic justice at the travails of the UK’s largest water firm must be tamed, due to its growing seriousness.

Whitehall has drawn up contingency plans in case of Thames Water’s collapse amid a £10bn blackhole in its future finances, with the supplier getting out the begging bowl in protracted talks with stakeholders last week.

If the company folds, every choice taken would have serious consequences.

Bailing out Thames Water or renationalising the industry both come with immense costs which would eventually have to be paid by Britain’s squeezed taxpayers

This has even awoken politicians from their summer slumber, with MPs and peers now preparing to grill Thames Water over the coming weeks, including two Westminster committees preparing to put the industry under the microscope this month.

It’s not just Thames Water

There will be much for them to discuss.

Top of the agenda is the abrupt exit of Thames Water’s lucratively paid former chief executive Sarah Bentley and ex-chair Ian Marchant, the company’s £14bn debt pile, and growing concerns its turnaround plan for storm overflows and Victorian-era pipelines lacks liquidity.

If they have time left, it might also be worth asking how comfortable Thames Water is having a state-owned Chinese investment group among its stakeholders, and the lack of any new reservoirs in 30 years despite the company warning of an upcoming billion litre per day shortfall?

The most important question however, is whether this is just about Thames Water?

Thames Water’s record is wretched, but the supplier’s problems are not unique in the industry.

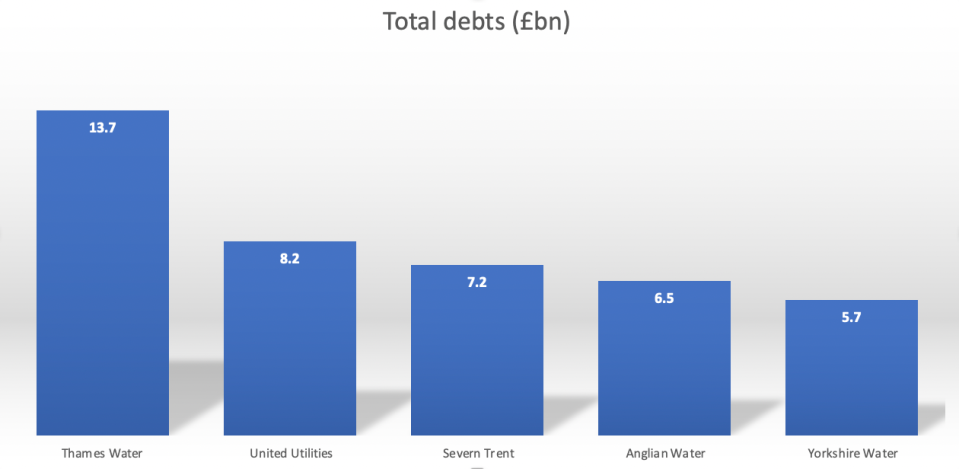

It might be top of the pops when it comes to debt levels, but that’s a competitive race, with suppliers drowning in £65bn of debt.

Rounding off the top five are United Utilities (£8.2bn), Severn Trent (£7.2bn), Anglian Water (£6.5bn) and Yorkshire Water (£5.7bn) – powered by inflation but initiated through dividend extraction and underinvestment.

On the disciplinary side, Thames Water is facing enforcement action over unauthorised sewage spills, but so are five other water companies.

It is also one of half a dozen firms ordered by Ofwat to return £120m to customers last year due to its poor operational performance, while the industry has also collectively missed its investment targets for wastewater improvements.

The House of Lord’s Industry Regulators Committee and House of Commons’ Environment, Food and Rural Affairs have both recognised the holistic nature of the problem.

Peers are planning to scrutinise Ofwat’s chairman and chief executive tomorrow, while next week MPs will take evidence from Ofwat’s senior team, environment under-secretary Rebecca Pow and Thames Water.

Westminster must hold industry to account

After all, the problems that have led to vast debts and underperforming suppliers came from many sources.

While Ofwat has improved its performance at a greater rate than the suppliers it oversees, its relentless focus on cheaper bills meant that it failed to assess the long-term viability of the industry for decades.

Damningly, there also appears to be a revolving door between the regulator and the industry, with two-thirds of England’s biggest water companies employing ex-Ofwat executives – according to The Observer.

Looking to Downing Street, Chancellor Jeremy Hunt held crunch talks with Ofwat last week, making demands for the regulator to do more to combat poor customer support across the industry.

However, there still seems to be no sense of urgency to tackle the escalating debt crisis in the sector from the government – and its modest sewage ambitions in the Plan for Water remain unchanged.

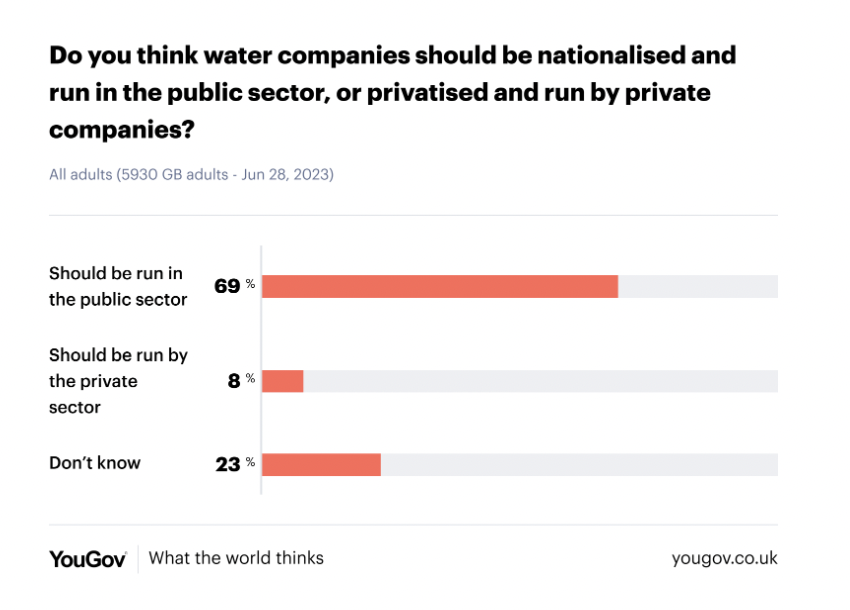

In such circumstances, it is no surprise to see YouGov polling recently revealing seven in ten Brits are now in favour of nationalising the water sector.

Public ownership of water suppliers is a worthy subject of debate, but competency and trust should not be.

Instead, this is meant to be a non-negotiable, with confidence in the sector vital amid the growing challenges of droughts and hot weather caused by climate change, soaring demand from population growth, and a lack of infrastructure to meet it.

Committees have shown themselves capable of grilling regulators and firms over the energy crisis and policy experts, politicians and supermarkets over runaway inflation with punchy questions and weighty reports.

With the industry, regulators, and Downing Street so far failing to act decisively – MPs and peers are now being left to find answers from an industry that has collectively failed the millions of people who depend on it.

Let’s hope they find some.