Talent crisis: Insurers are struggling to attract new staff. Could painting and TikToks be the answer?

Insurance firms are in need of new blood. But the industry – innovative and exciting once you’re in it – is struggling to cut through to the next generation. Maria Ward-Brennan finds out how specialty insurers are fighting back.

Put your hand up if you want to work at an insurance company when you grow up? It’ll be a rare sight to see any young person raise their hands to a question like this.

Why though? London is home to the largest insurance market in the world which is a crucial market to the UK economy. Could it be because insurance is not really seen to be a sexy industry and often viewed as dull? Probably because it doesn’t have the dedicated Hollywood shows based on it like those centred around lawyers and doctors that make those jobs look fun and important.

Or maybe its because the sector lacks awareness? When people think of insurance, they usually think about cars and home cover, when in reality, the market is so much more than that.

Such as specialty insurance, which covers important things that aren’t covered by traditional insurance such as marine, art, aviation and transport, political risk and credit and even entertainment.

This market is highly valuable as according to a Vantage Market Research report, globally, the market was worth $74.1bn in 2021. The same report stated that the specialty insurance market is going to see a huge increase as it predicts that this market will grow to $124.9bn in the next four years.

Despite that, talent in the insurance sector is dwelling, particularly at the younger level.

Speaking to City A.M., Caroline Wagstaff, CEO of the London Market Group (LMG) said: “We face a retirement cliff and a shortage of talent to take up the baton.”

According to a LMG London Matters report, it highlighted that insurance was a major employer in London by employing 32,000 people in 2018. However, despite that, the number of people employed by the sector in 2015 fell nearly 9 per cent from 35,000.

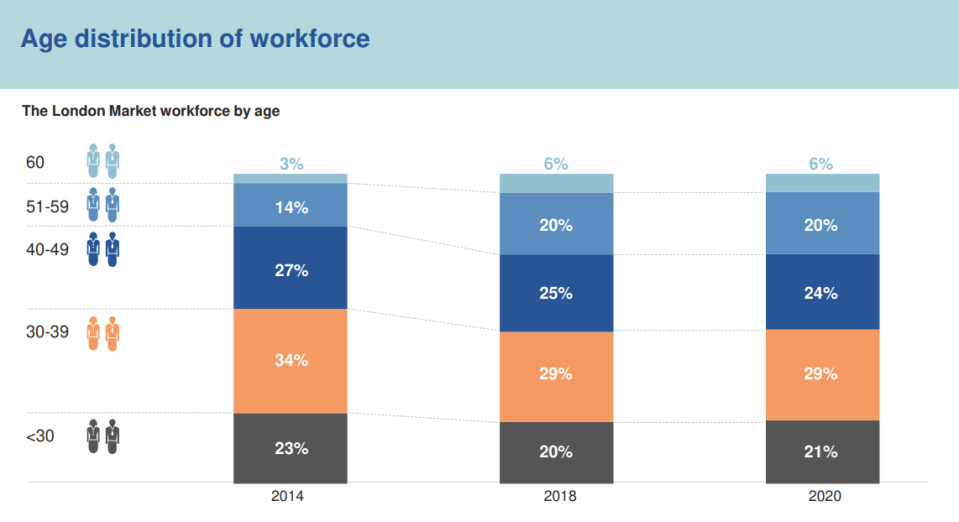

The market is ageing and failing to attract younger talent as there aren’t enough younger people coming into the field to replace those in their retirement stage. Rather than attracting younger people, the proportion of the workforce over 50 has jumped nearly 53 per cent from 2014 to 2020. While those under 30 have dropped over 12 per cent in the same time period.

Wagstaff said: “The London insurance market has been fighting a battle to attract young people into the industry for years. The critical data point is that our 2022 London Matters report found that there are more people working in the London market over 50 than under 30.”

One of its reports pointed out that back in 2018, only 4 per cent of UK graduates said that they were considering a career in insurance.

Speaking to City A.M., Louisa Blain, head of insurance for human capital at Aon stated: “Insurance firms face fierce competition from other sectors when it comes to attracting graduates with emerging skills.”

She explained that while attractiveness to graduates in the sector may fluctuate, it was noted that 28 percent believe it to be somewhat or very unattractive.

“We need to tell a better story”

Blain pointed out that “the challenges lie in raising awareness and understanding the industry, competing fiercely with other sectors on compensation packages and showcasing the nature and scope of opportunities available.”

This ‘talent crisis’ as it is often dubbed, is not a problem going unnoticed. LMG are working with Universities across the country to create awareness about careers in the specialty insurance market.

“We need to tell a better story about why specialty insurance is a great place to work and we need to tell it though the channels that young people use,” stated Wagstaff.

They start each academic year off with a digital advertising campaign, with the group targeting students using TikTok influencers. That in turn drives traffic to the London Insurance Life website and jobs board.

During term two, the group hosts ‘insurance themed events’ including ‘paint and sip’ which addressed insurance for famous art while the student sipped on some Prosecco. Another event was a centred around live event insurance as the LMG hosted students in a music venue where with a DJ and musicians.

The group has several events scheduled across the next two months across London, Leeds, Glasgow and even Bath. Later this month, the group will take a group of students to a match at Bath City FC as they play Truro City FC. The aim is to inform the students, who may have a passion for sports, about the world of insurance for football teams and players.

Wagstaff added that “last year we ran the first ever cross market work experience programme.”

The LMG identified 50 schools in areas of high socio-economic challenges and presented to 1,000 of their students. Of these, 115 joined its Futures Academy fortnight in the summer and in October the group ran a similar programme around apprenticeship opportunities. Over 50 market firms hosted students, provided volunteers and took part in their careers festivals.

She explained: “This cohort presented the hiring managers with a diversity they do not see from their usual applicants – 63 per cent of them came from an ethnic minority background and 35 per cent from low-income families, and they were evenly balanced between the sexes.”

“And in 2024 we will grow the programme by nearly 50 per cent,” she added.

Speaking on LMG’s efforts, Blain said their “efforts are commendable, as they lay the foundation for a bright and prosperous future.”

She pointed out that “it is high time we embrace these lessons and apply them to our own endeavors.”

“I am confident that telling a compelling story about risk and showing the vibrancy of the market environment through the right channels is paying off and that this autumn some of our programme alumni will be working in the London market,” Wagstaff added.