Some more good news: Liquidations and personal insolvencies fall in second quarter

The number of personal insolvencies and corporate liquidations in England and Wales both fell in the second quarter of the year, building on respective short and long term trends.

The number of personal insolvencies fell to 25,717 – a decrease of 6.1 per cent on the same period last year.

Bankruptcies were down 20.1 per cent to 6,469 and debt relief orders down 10.4 per cent to 7,132, but individual voluntary arrangements were up 6.8 per cent to 12,116.

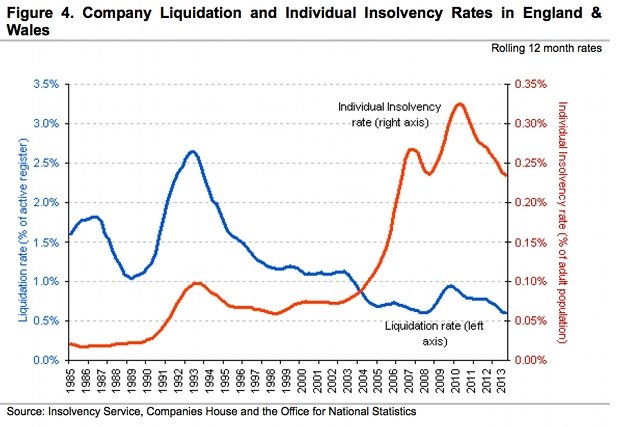

It appears that the rate of individual insolvencies is beginning to recover with some conviction from the sharp rise between 2004 to mid-2010 – but is still far above the long term average. In the year ending the second quarter 2013, one in 427 adults became insolvent – down from one in 418 the year before.

Meanwhile, corporate liquidations fell 2.l per cent in the period to 3,978 – but were up 10.5 per cent on the previous quarter. Compulsory liquidations fell 6.5 per cent to 961 while creditors’ voluntary liquidations fell 0.6 per cent to 3,017.

Corporate liquidations appear to be building on a long term downward trend, with just 0.6 per cent, or one in 166 companies liquidating in the quarter, down from one in 64 the previous quarter. This compares to a peak of 2.6 pere cnet in 1993 and the 25 year average of 1.2 per cent.