Renting in London might finally be about to get a bit easier

Almost everyone in London knows someone who has a horror story about the capital’s rental market. Since the pandemic, demand has skyrocketed, and so have costs.

According to the data, the rate at which London rental costs are rising slowed in April, but tenants are still paying an average of £2,112 to landlords each month.

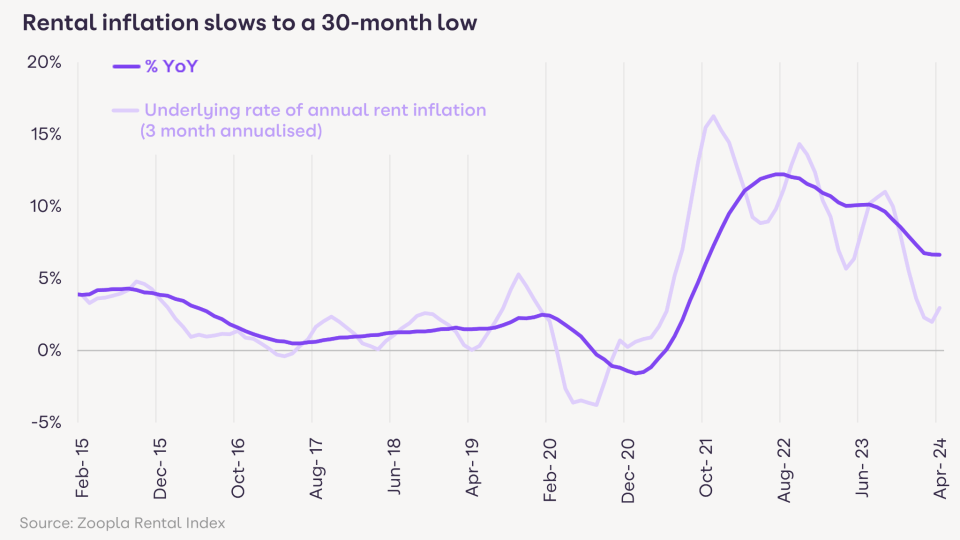

Rental inflation, the rate at which prices are rising, has cooled to 3.7 per cent compared to 13.1 per cent in the prior year period.

Richard Donnell, executive director at Zoopla, told City A.M. the fast growth in rents over the last three years has “taken the unaffordability of rented homes in London, relative to earnings, back to the highs last seen in 2014/2015”.

“This is why rental inflation is slowing, particularly in inner London where rents are highest.”

The cost of renting in the capital has skyrocketed over the last few years due to factors such as landlords selling up to avoid rising mortgage and energy rates.

Tenants are also stuck renting for a longer period of time because they can not afford rising house prices, limiting the pool of supply.

Still, green shoots have started to appear.

For example, Zoopla said rental supply in London is increasing—up by a quarter in the last year—but remains below the pre-pandemic average.

Adam Jennings, head of lettings at Chestertons, told City A.M. “Over the past weeks, we have seen an increasing number of rental properties being put on the market which has been positive news for tenants.

“Although demand still outweighs supply and tenants continue to face a competitive property search, the larger pool of properties to choose from has resulted in some landlords being more open to rent negotiations. In turn, we are seeing fewer people feeling the need to put in higher bids in order to secure a property.”

Across the wider UK, data on private landlords selling shows “a continued steady flow of homes for sale on Zoopla that were previously rented”.

This averages circa 31,000 a quarter, a level that has remained broadly constant for the last four years. Two-fifths of these homes stay in the rental market, and just over half return to home ownership.

Zoopla said current trends are expected to continue with low new investment by private landlords, meaning the stock of rented homes will remain broadly unchanged.

“Corporate landlords will continue to invest but it will take some years for this group to grow ownership levels enough to impact on supply at a macro level,” it added.