Why is London’s rental market so crap?

London’s renting nightmare is not showing any signs of abating.

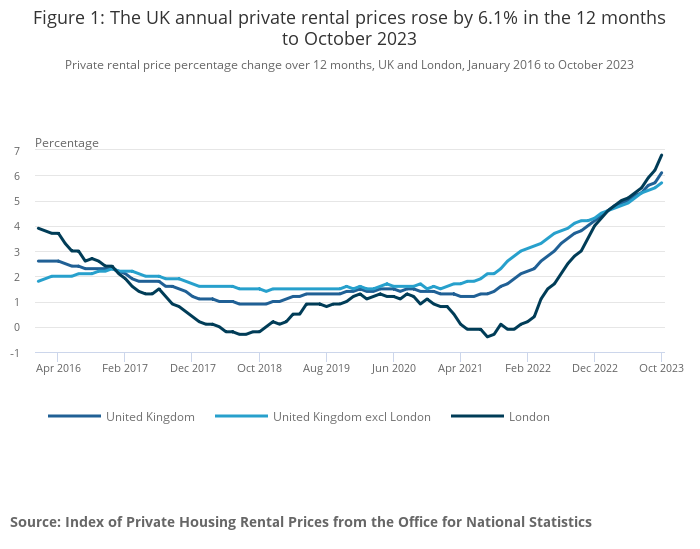

Rents in London jumped at their fastest rate since 2006 in October, rising 6.8 per cent year-on-year up from 6.2 per cent the prior month, according to the latest figures from the Office for National Statistics.

The price of a bedroom in a home in London is on average £1,030, up from £933 in the same period last year and up from £797 in 2021, according to Spareroom.

The economic crisis and subsequent demise of London’s rental market has played a critical role in the rents skyrocketing over the past year.

Consistent rate hikes by the Bank of England have led to higher borrowing costs, which have been blamed for a slowdown in the housing market.

A host of London landlords have put their properties on the market as a result, to offset higher payments. Other landlords have hiked rents to cover the increasing costs.

A cocktail of dwindling supply and rising demand has also led to bidding wars amongst potential tenants as they offer more to secure homes.

However, the Bank of England’s recent decision to keep interest rates at a record 15 year high of 5.25 per cent, following months of hikes, has provided some relief for the sector.

Richard Donnell, executive director at Zoopla said: “Rents in London continue to grow at a higher rate than earnings.”

“Although the shortage of rental supply has been putting continued pressure on rents, there are signs that this may be improving due to new build sales to corporate investors.”

He added: “We expect rental growth to slow further towards the end of 2023, particularly in inner London where rents are highest.”

News that house prices are beginning to drop, could however provide a glimmer of hope for the market. Would-be buyers currently stuck in the renting game may jump at the opportunity to buy a pad at a discounted price.

Earlier this week, figures from Rightmove showed that the average price of a home coming on the market fell by more than £6,000, over the last four-week period.

Rightmove said the fall indicates that new sellers are increasingly adopting more realistic price expectations from the outset of their marketing, to tempt potential buyers.