Nobel Prize in economics: What is auction theory and why is it important?

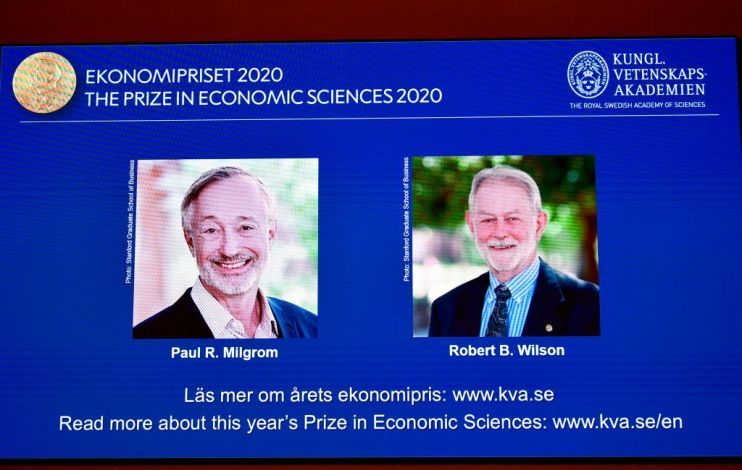

US academics Paul Milgrom and Robert Wilson have won the 2020 Nobel Prize in economics for their groundbreaking work on the theory and practice of auctions.

Milgrom and Wilson, 72 and 83 respectively, are both professors at Stanford University in California. They will split the 10m krona (£850,000) prize and each receive a gold medal.

The committee said the auction formats developed by the pair “are a beautiful example of how basic research can subsequently generate inventions that benefit society”.

But what is auction theory? And why is Milgrom and Wilson’s work seen as so important?

Auctions are everywhere

Auctions are simply public sales when property or goods are sold to the highest bidder. They influence our lives heavily and are all around us, from when we buy furniture on Ebay to when our governments sell important contracts to companies.

There are many different types of auction, which have pros and cons for the buyers and sellers involved. The economic study of these pros and cons and the best strategies is called auction theory.

It is a branch of game theory, which analyses strategies that people, companies or governments use in competitive situations. The discipline shot to fame in the early 2000s with the film A Beautiful Mind, in which Russel Crowe played Nobel Prize-winning game theorist John Nash.

‘Winner’s curse’

A famous insight of auction theory is the “winner’s curse”. It is the idea that in auctions the item goes to the person who overvalued it the most.

Someone might win a wardrobe with a £50 bid, for example. But if the person below them bid £45, they could have won the item while paying almost £5 less.

Wilson showed that because bidders were scared of paying too much, they tended to place bids below what they thought was the “common value”. A common value auction is when the item for sale is thought to be worth the same to everyone.

Let bidders learn more

Milgrom, who was advised by Wilson in his thesis, also worked on common value auctions. But he also formulated a theory of “private values”.

A private value auction is where values vary from bidder to bidder. For example, a house might be worth more to one person because they love the neighbourhood.

Milgrom showed that the seller is likely to get the highest price if bidders learn more about each other’s estimates during bidding.

Selling radio waves

Milgrom and Wilson helped generate a buzz around auction theory in the early 1990s. This was when they advised the US government on its sale of the electromagnetic spectrum – the radio waves on which broadcasters transmit.

The Federal Communications Commission (FCC) used to sell off the right to use the airwaves using a lottery. Yet this meant that firms that valued the licenses the most often failed to get them. It also prompted speculation.

The FCC decided to auction off the licenses, but was faced with new problems. For example, the value that a company put on owning the license for California might vary depending on whether or not they could also secure the license for New Mexico.

Budget limitations would also mean that companies would want to know how much they were going to spend overall when considering individual bids for certain areas.

In response, Milgrom and Wilson devised a kind of “English auction” – where bidding goes up until only one bidder is left – known as the “simultaneous multiple round auction”. They worked with Preston McAfee, who became chief economist at Microsoft.

Under the model, licenses were offered for all geographical areas at the same time. But there were numerous rounds during which competitors could learn about each other’s anonymous bids and adjust accordingly.

It was seen as a big success. The government maximised its revenue while the airwaves went to those who valued them most. It was widely copied around the world.

Ski boots from Ebay

Upon hearing of his win, Wilson said: “It’s very happy news, I’m very glad about it.” Yet he struggled to think of an auction he had participated in.

“My wife points out that we bought ski boots on Ebay,” he said. “I guess that was an auction.”

Milgrom and Wilson joined a long list of distinguished economists, among them Milton Friedman and Paul Krugman. Last year’s prize went to Abhijit Banerjee, Esther Duflo, and Michael Kremer for their work on development economics and poverty.

The prize was set up by Sweden’s central bank and first awarded in 1969. It is officially called the Riksbank Prize in Economic Sciences in Memory of Alfred Nobel and is widely seen as a Nobel Prize.