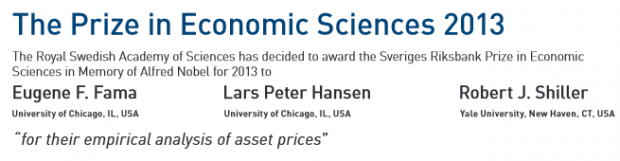

Fama, Hansen & Shiller awarded with Nobel prize for economics

Eugene Fama, Lars Hansen and Robert Shiller been announced the winner of the Nobel prize in economic sciences for their work in predictions. Or as the committee puts it "for their empirical analysis of asset prices."

There is no way to predict the price of stocks and bonds over the next few days or weeks. But it is quite possible to foresee the broad course of these prices over longer periods, such as the next three to five years. These findings, which might seem both surprising and contradictory, were made and analyzed by this year’s Laureates, Eugene Fama, Lars Peter Hansen and Robert Shiller.

But the winners come to different conclusions. Eugene Fama of the University of Chicago is the father of efficient market theory. His work, beginning in the 1960s, showed that stock prices are extremely difficult to predict in the short run – and that new information is very quickly incorporated into prices.

Yet Robert Shiller, of Yale University, is the father of inefficient market theory. Shiller's work showed that stock prices fluctuate more than corporate dividends, and that the ratio of prices to dividends tends to fall when it is high, and to increase when it is low.

Lars Peter Hansen, of the University of Chicago, has been involved in work more concerned with modern econometric techniques.

The Nobel committee believes that the three have between them "laid the foundation for the current understanding of asset prices."

The highly coveted prize comes with prize money of 8m Swedish krona (£773,000). That will be shared equally between the three winners.

Last year's joint winners with Alvin Roth and Lloyds Shapley "for the theory of stable allocations and the practice of market design." Some of their most interesting work involved the allocation of kidneys.

From 2006 the full name of the award has been The Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel.