UK Fintech Mode rolls out Bitcoin cashback reward scheme

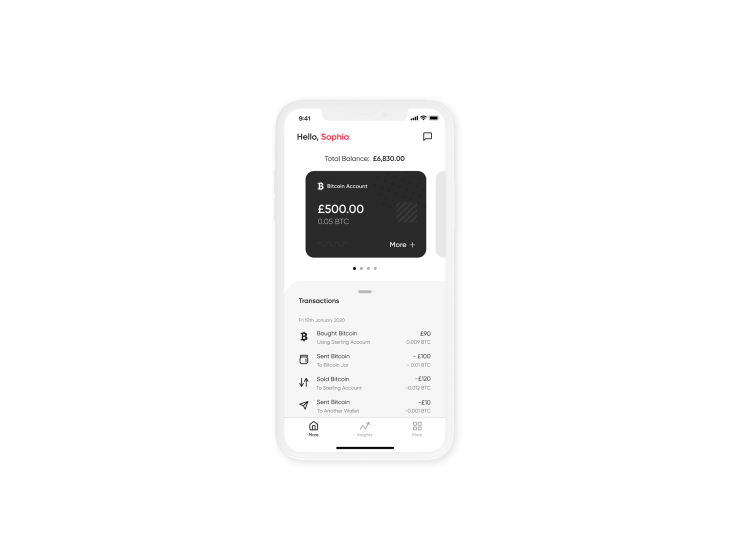

Mode, an open banking platform which lets users make cardless payments through its flagship mobile app, is rolling out Bitcoin rewards.

UK customers will be given the opportunity to build up a holding in Bitcoin via Mode’s FCA registered app as part of a loyalty scheme organised in partnership with THG, a digital consumer brands company which represents more than 30 companies.

When users make purchases at THG stores using Mode’s QR code based payments system they will be rewarded instantly with five to ten per cent cashback in Bitcoin.

Ryan Moore, CEO of Mode, said “we’re delighted to bring about the next generation of retail payments and loyalty, in partnership with THG’s globally renowned tech platform.”

“This marks a step forward in delivering on our aim to make Bitcoin accessible to all and put it in the hands of as many people as possible,” Moore added.

John Gallemore, CEO of THG Ingenuity, said: “We are constantly innovating and providing new solutions to THG brands and THG Ingenuity partners. Mode’s payments solution will provide our customers with additional payment opportunities to suit their needs and is another step in the platform’s evolution.”

It comes as both Mode and THG battle losses. Mode’s operating loss stood at £3.8m in 2020 with share price 13.35 per cent this year to date.

Formerly known as The Hut Group, THG raised a record breaking £1.88bn during its stock market IPO in 2020 – the strongest debut performance for a company since 2015. Since launch the picture has been less cheery with share price sliding by 46.32 per cent to stand at 427.40 GBX.

Read more: THG targets separate IPO for beauty business