London must be given power to direct its economy to arrest historic productivity decline, study urges

London must be given greater power to direct its economy by central government to arrest a historic productivity decline, a new report out today has urged.

Handing the capital more sway over tax and spending decisions, peeling back onerous planning rules and boosting graduate migration would help London return to being an economic growth engine for the rest of the UK.

That’s according to the think tank the Centre for Cities, whose chief, Andrew Carter, today has urged policymakers to launch policies to reverse a sharp decline in London’s economic performance.

“London plays a huge role within the national economy and as such its performance is vital to the future success of the UK,” he said.

The organisation’s research found that productivity growth in the capital after the financial crisis has fallen off a cliff and is lagging far behind its international competitors.

According to an analysis of Office for National Statistics numbers, the Centre for Cities reckons the rate of growth in output per job in London has collapsed to just 0.2 per cent a year between 2010 and 2019.

That is a huge decline from the average annual increase of 2.7 per cent between 2000 and 2008.

Rapidly falling productivity growth in the financial services sector has fuelled London’s overall decline, with the rate of improvement in output per job in the Square Mile swinging from an average annual increase of 5.9 per cent between 2000 and 2008 to minus 1.1 per cent in the decade after the banking crisis.

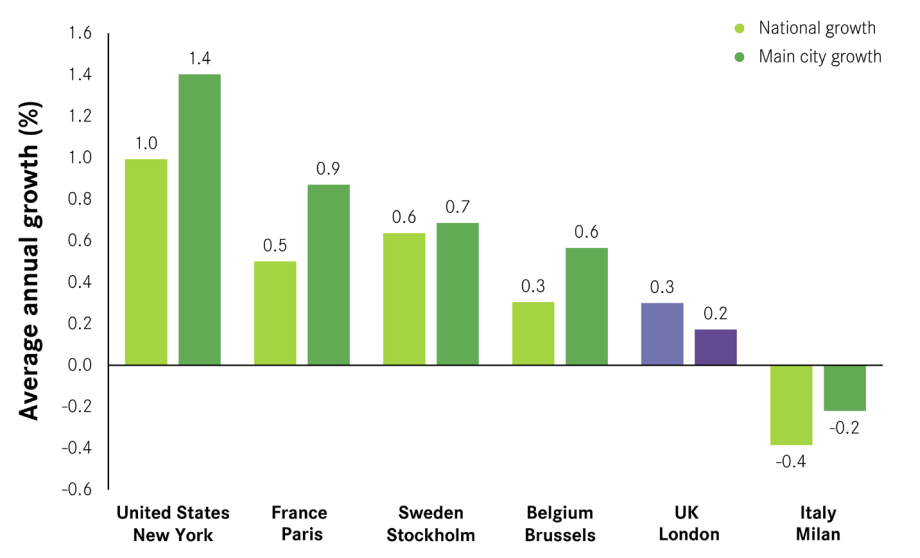

London’s productivity growth is trailing its major rivals

The research illustrates the UK’s broader productivity malaise, which has held back GDP growth for more than a decade.

But other international cities are racing ahead of London in the productivity race. “New York, Paris, and Stockholm saw annual growth between 2007 and 2019 at 1.4 per cent, 0.9 per cent, and 0.7 per cent, respectively,” the Centre for Cities said.

The think tank suspects sky high real estate costs in the capital have drawn investment away from things like intellectual property, training and skills, all of which tend to provide a relatively large productivity boost.

International companies are also shunning London due to its comparably high office bills.

“Growth of London’s intangible investment as a share of GDP has been relatively weak when it should be playing an ever-larger role in the economy as it becomes ever more knowledge-based,” the report said.

Rolling back overbearing planning laws to stimulate residential and office construction, extending the graduate visas to five years and providing a constant level of funding for London’s transport network were all tabled to reverse the capital’s productivity slowdown.

Handing power to Mayor Sadiq Khan to launch a payroll, tourism and sales taxes could generate cash to fund those initiatives, the Centre for Cities said.

A spokesperson for the Khan said granting London greater fiscal autonomy would help both London and the wider British economy.

“London has less control over the tax we generate than any other global city. If ministers truly wanted to level up it would give cities such as ours greater control over revenues to deliver economic growth and lasting social change for the benefit of the whole country,” a spokesperson for the mayor told City A.M.

“More of the same old one size fits all, command and control from Whitehall won’t do, and what’s needed instead is wholesale shifting of power from Whitehall to the Mayor and local authorities,” Nick Bowes, chief executive of the Centre for London think tank, told City A.M.

A Treasury spokesperson told City A.M. Chancellor Jeremy Hunt “has set out a plan to boost productivity by encouraging enterprise, boosting education and skills, getting people into better-paid jobs and ensuring the benefits of economic development are felt everywhere.”

“The government has also set out ambitious financial services reforms which will unlock over £100bn of investment, and we are reviewing EU derived rules in other critical growth sectors this year.”