London to power UK economy away from recession and clinch best growth across the country

London will power the UK economy out of recession and is poised to be the fastest growing area in the country over the coming years, new forecasts out today reveal.

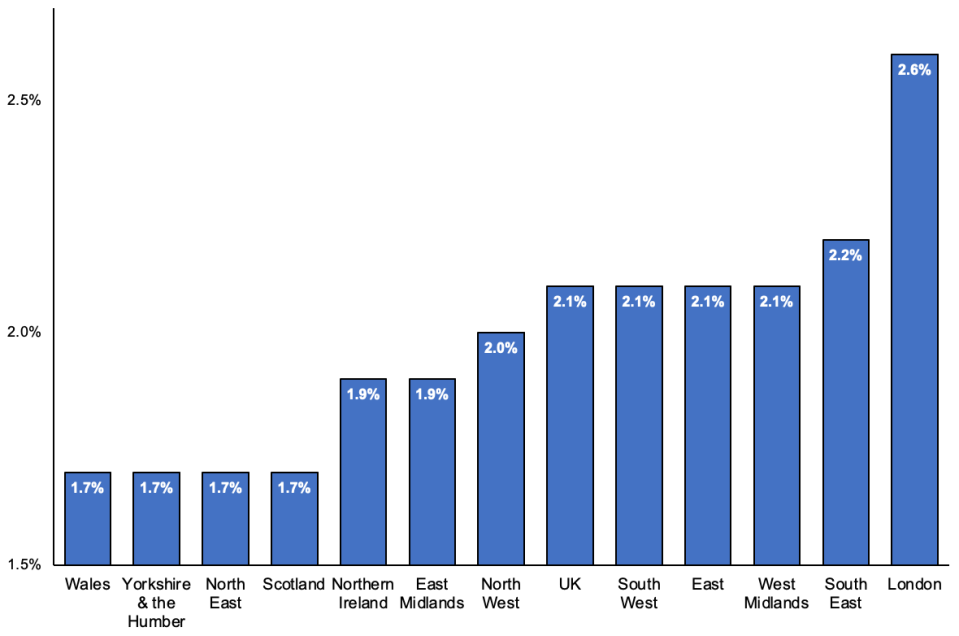

The capital’s economy is on track to expand 2.6 per cent each year between 2024 and 2026, pushing it to the top of the countrywide growth table, according to consultancy EY.

The City’s high performing financial and legal sectors will fuel London’s best in class economic growth over the coming years, the report said.

While London’s GDP is expected to undergo a minor blip, shrinking 0.2 per cent this year, also the lowest of any region, it is tipped to race past Britain’s average yearly growth of 2.1 per cent between 2024 and 2026.

Sadiq Khan, Mayor of London, told City A.M.: “As the engine of the UK economy, London’s resilience is good news not just for our city, but for the whole country.”

“This report confirms the strength of London’s long-term economic performance,” he added.

Experts said the report illustrates policymakers need to avoid making the capital a casualty of the government’s levelling up agenda or risk holding back the UK economy for years to come.

“London’s performance is dependable, but should not be taken for granted,” Julie Carlyle, managing partner for EY in London, said.

“While there is a need to level up the rest of the country, London will have its own investment needs to be met so that the capital can continue to help form the backbone of nationwide growth,” she added.

A Treasury spokesperson told City A.M. “Levelling up will provide the foundations for building a better future in communities across the UK. By working as one United Kingdom, the country is better able to collectively tackle the individual challenges faced by every region and nation across the country.”

London’s economy is tipped to outpace the rest of the UK notching average annual GDP growth of 2.6 per cent

Carlyle’s calls come as Britain is teetering on the edge of slipping into a recession driven by the cost of living crisis wreaking havoc on family and business finances.

Dire forecasts about the economy suffering a recession that could have knocked around three per cent off GDP now look slightly overcooked, although EY still suspects the UK economy as a whole will shrink 0.6 per cent in 2023.

The firm reckons the coming slump will be fuelled by “declines in services most dependent on household spending”.

High street retailers are set to bear the brunt of the spending slowdown, with the sector shrinking 3.3 per cent this year.

Pubs, bars and restaurants are on track to suffer a 2.7 per cent contraction, while arts and entertainment providers are set to shrink 1.8 per cent.

Inflation has raced to a 40-year high, but has dropped for three straight months from a peak of 11.1 per cent to 10.1 per cent.

Despite an expected fall in the rate of price increases this year, possibly back to the Bank of England’s two per cent, household real incomes have suffered a historic hit, prompting a spending slump.

The Bank’s ten successive interest rate rises to tame inflation has heaped more pressure on budgets.