London house prices are falling – these are the boroughs where prices are down the most

London’s housing market is gearing up for “key selling season” with a reduction in prices, before an uptick in activity is anticipated during the autumn months.

Fresh data in Rightmove’s House Price Index shows there has been an overall monthly seller asking price rise by 0.4 per cent this month, which is 0.2 percent lower than the ten-year September average.

However, an “expected” -0.4 percent annual price fall continues on a downward trend, Rightmove said, which is the “biggest drop” since March 2019, pre-pandemic.

Rightmove reported that 36.3 per cent of current for-sale properties have seen a price reduction, following a subdued August, which was tied to “summer holiday distractions” and 14 consecutive interest rate hikes.

This comes as the Bank of England prepares to meet this Thursday, with a widely-touted 15th rise in the pipeline, while other experts have said the Bank may hold fire and pause its cycle, for now.

Buyers had to reconsider their budgets and financial situations due to higher rates and cost of living concerns this summer, Matt Thompson, head of sales at Chestertons, said, which led sellers to “reduce their initial asking price in order to secure a quicker sale.”

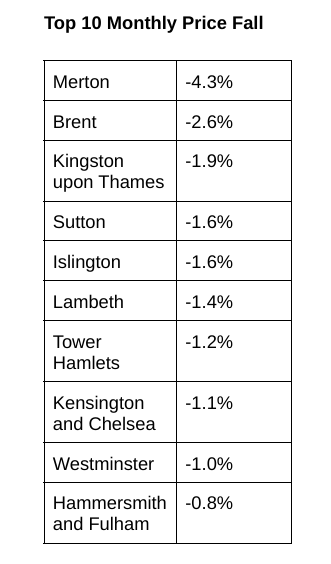

The London boroughs that have seen the biggest monthly price fall are Merton at -4.3 per cent and Brent at -2.6 per cent.

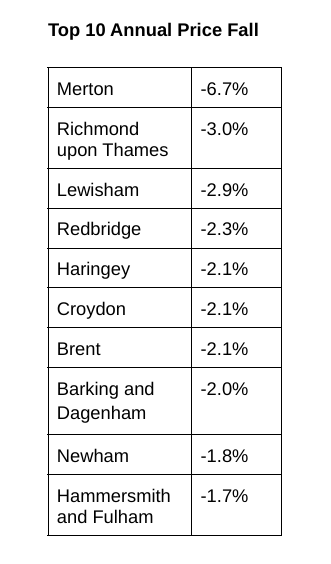

Merton remains with the largest annual price fall at -6.7 per cent, followed by Richmond upon Thames at -3.0 per cent.

Rightmove said this price reduction is the highest recorded since January 2011.

There have been a select few price rises, however, in boroughs such as Camden having an 2.3 per cent monthly increase and a 1.8 per cent annual increase as well as Southwark with a 1.1 per cent and 2.0 per cent increase.

“As we are now approaching what is known as one of the busiest times of year for the property market and rates have stabilised and prices have adjusted, we have already seen activity picking up over the past few weeks,” Thompson added.

Rightmove said improvement is on the horizon for those looking to buy homes, but Tom Bill, head of UK residential research at Knight Frank, said buyer confidence has been “badly damaged by the volatility of the last 12 months.”

“A strong jobs market, lender flexibility and the prevalence of fixed-rate deals in recent years will all curb price declines but stability is needed to improve sentiments, which is the all-important lubricant in the housing market.

“We don’t anticipate a cliff-edge moment for prices but a single-digit decline this year is likely to be repeated next year,” he added.