Institutional money buys the dip

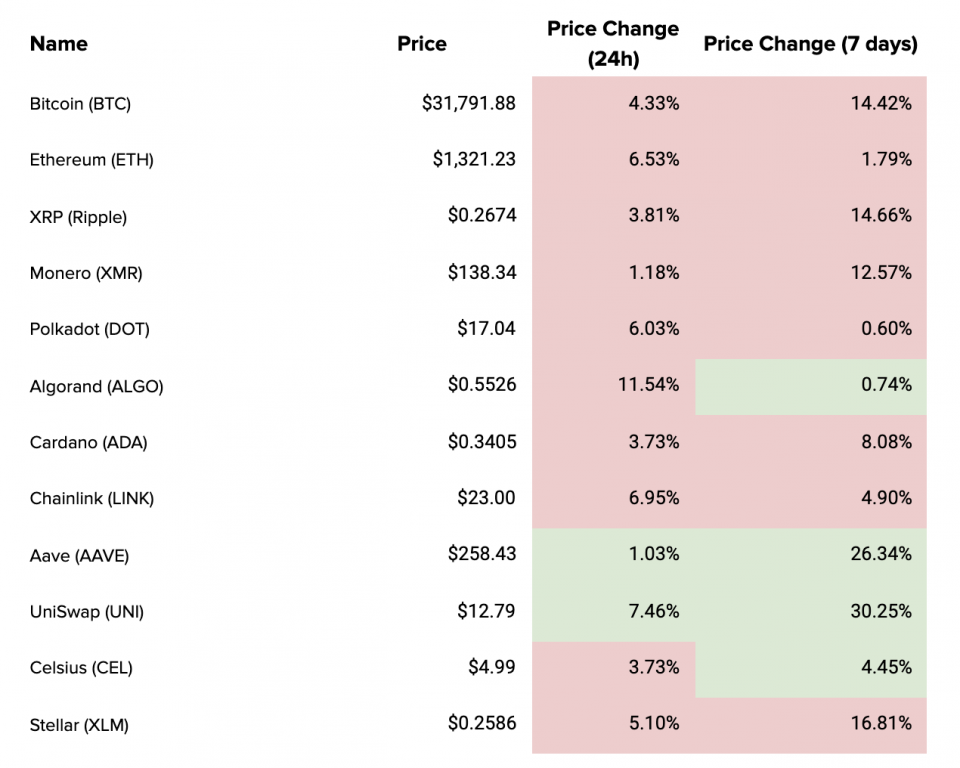

Crypto at a Glance

It was another volatile day in the neighbourhood yesterday, though we don’t seem to have moved all that much. It kicked off with Bitcoin chilling at just over $32,000, before a rally to almost $35,000 set pulses racing. It looked set to continue its charge, but swiftly fell back to finish more or less exactly where it started. Where to next?

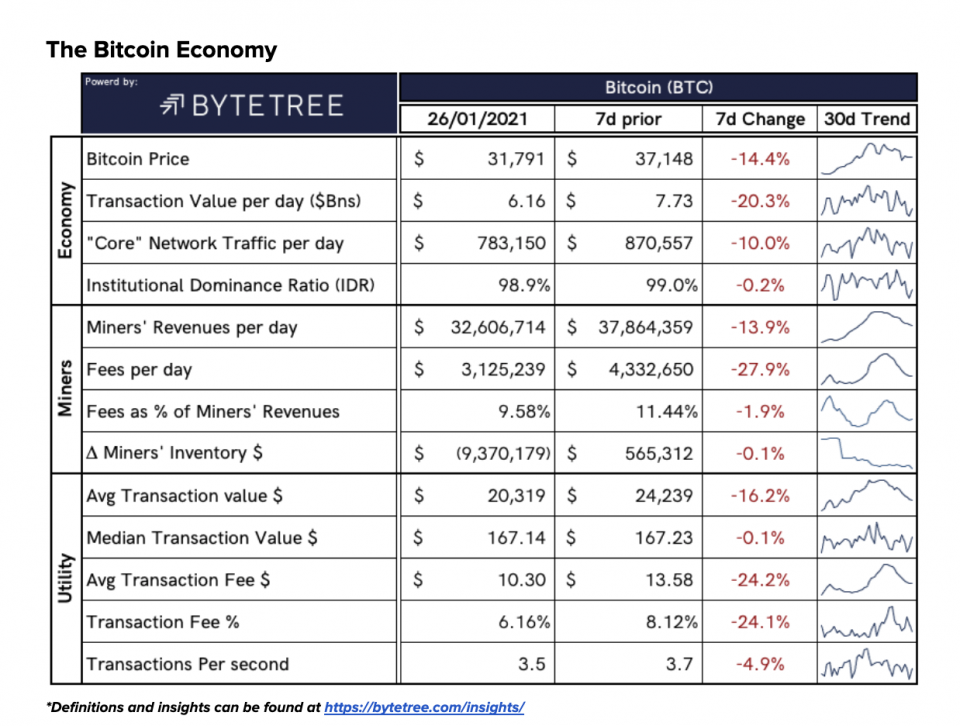

There appear to be a lot of buyers willing to pay in the low $30,000s at the moment, suggesting that strong support is being built around that level. Among them is another Nasdaq-listed giant in Marathon Group, which yesterday announced a $150 million bitcoin purchase as part of its treasury reserve strategy. They’re just the latest in a long line of organisations to make the same decision. Merrick Okamoto, Marathon’s chairman & CEO, explained that: “By purchasing $150 million worth of bitcoin, we have accelerated the process of building Marathon into what we believe to be the de facto investment choice for individuals and institutions who are seeking exposure to this new asset class.”

Elsewhere, Ethereum also failed to push on from its new all-time high and instead tumbled gently back down to the $1,300 level. Uniswap saw gains and continues to hover around its $13 all-time high.

In the Markets

What bitcoin did yesterday

We closed yesterday, 25 January, 2020, at a price of $32,366.39 – up from $32,289.38 the day before. The daily high yesterday was $34,802.74 and the daily low was $32,087.79.

The price of bitcoin has now stayed above $30,000 for longer than it stayed above $15,000 in the last bull run.

This time last year, the price of bitcoin closed the day at $8,367.85. In 2019, it was $3,599.77.

As of today, buying bitcoin has been profitable for…

99.9% of all days since 2013-04-28.

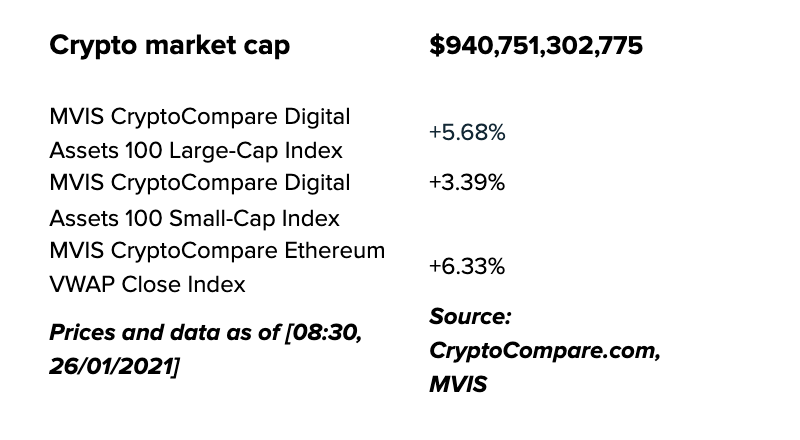

Bitcoin market capitalisation

Bitcoin’s market capitalisation is currently $584,239,934,626, down from $619,298,519,742 on Friday. That means Bitcoin is back below Taiwan Semiconductor Manufacturing Company again. Silver currently has a market cap of $1.398 trillion and gold has a market cap of $11.765 trillion. GameStop’s market cap is $5.356 billion.

Bitcoin volume

The volume traded over the last 24 hours was $59,643,260,798, up from $56,314,242,010 yesterday. High volumes can indicate that a significant price movement has stronger support and is more likely to be sustained.

Volatility

The price volatility of bitcoin over the last 30 days is 97.38%.

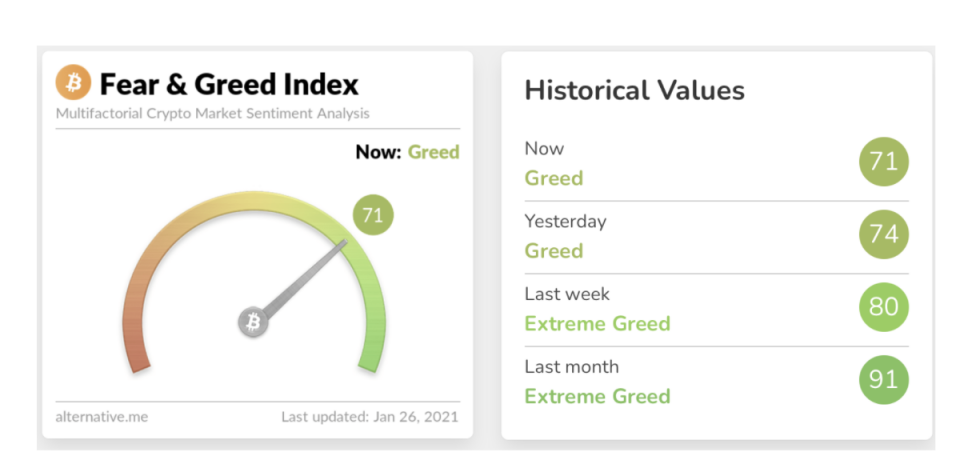

Fear and Greed Index

The sentiment Index remains in Greed, down from 74 to 71.

Bitcoin’s market dominance

Bitcoin’s market dominance still stands tall at 63.56. Its lowest ever recorded dominance was 37.09 on 8 January, 2018.

Relative Strength Index (RSI)

The daily RSI is currently 46.29. Values of 70 or above indicate that an asset is becoming overbought and may be primed for a trend reversal or experience a correction in price – an RSI reading of 30 or below indicates an oversold or undervalued condition.

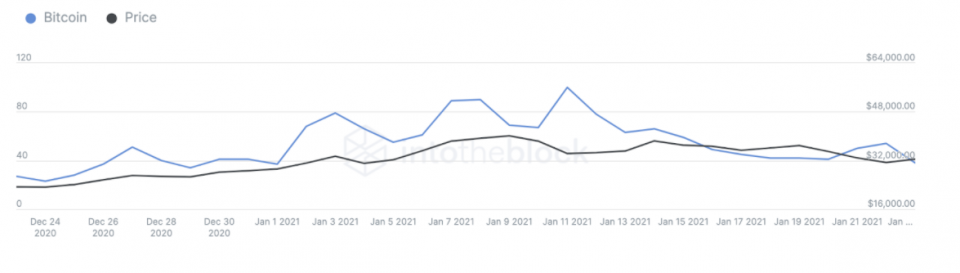

Google trends

The trend in Google searches over the last 90 days. Google shows this chart on a relative basis with a max score of 100 on the day that had the most Google searches for that keyword. The latest score is 38– taken from 23 January.

Convince your Nan: Soundbite of the day

“Bitcoin is a remarkable cryptographic achievement and the ability to create something that is not duplicable in the digital world has enormous value.”

- Eric Schmidt, Google CEO

What they said yesterday…

A worthy cause

One of us, one of us, one of us

Daily dose of Peter Schiff being completely wrong about everything

Main Street vs Wall Street takes a twist

Is GameStop

Crypto AM: Longer Reads

City AM Markets: What is Decentralised Finance (DeFi) by Aave

Crypto AM: Market View in association with Ziglu

Crypto AM: Technically Speaking in association with with Zumo

Crypto AM: Talking Legal in association with INX

Crypto AM reshines its Spotlight on CUDOS

Crypto AM: Industry Voices

Crypto AM: Deeper Dives with Liam Roche

Crypto AM: A Trader’s View with TMG

Crypto AM: Tiptoe through the Crypto with Monty Munford

Crypto AM: Definitively DeFi

Cautionary Notes

It’s definitely tempting to get swept up in the excitement, but please heed these words of caution: Do your own research, only invest what you can afford, and make good decisions. The indicators contained in this article will hopefully help in this. Remember though, the content of this article is for information purposes only and is not investment advice or any form of recommendation or invitation. City AM, Crypto AM and Luno always advise you to obtain your own independent financial advice before investing or trading in cryptocurrency.

All information is correct as of 08:30am GMT.

Crypto AM Daily in association with Luno