Industry 4.0 meets DeFi

The Historical Roots

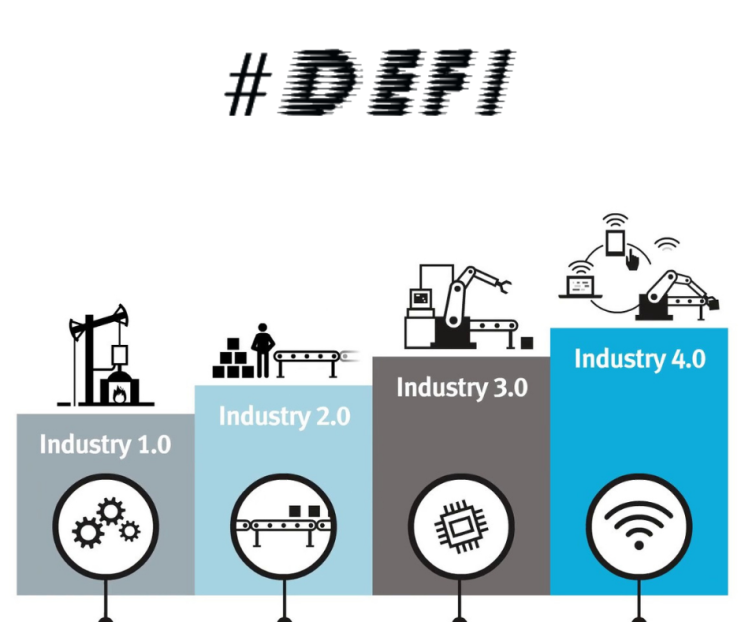

Over two centuries ago we learned that there is a more efficient way of manufacturing and we shifted from hand production to machines through the use of steam power and water power. That era was marked as the First Industrial Revolution in our history books. Followed by adoption of electricity, installations of extensive railroad and telegraph networks, which allowed for faster movement of people and ideas, the Technological Revolution inevitably took place.

This was a period of great economic growth, with an increase in productivity, although many factory workers were replaced by machines. The Third Industrial Revolution, also known as the Digital Revolution, occurred in the late 20th century. At this point there was large-scale use of computer and communication technologies in the production process. Machinery began to replace the need for human power. The ongoing automation of traditional manufacturing and industrial practices sparked a modern smart technology that takes us straight into the Fourth Industrial revolution, also known as Industry 4.0.

Automation has bent the evolutionary curve of the 4th industrial revolution to a steep hyperbolic trajectory, and it’s just the beginning. The same astounding similarities in the advancement stages of the digital era can be clearly seen today. The Internet evolved from basic protocols that allowed two-way communication, to the most secure open source payment network using decentralised and distributed public ledgers. Include programmable value transfer, and a financial system so decentralised that it doesn’t require trusting intermediaries like banks. Layer by layer, automation of blockchain and cryptocurrency applications have molded DeFi into what we know today.

DeFi Automation

Ethereum became the backbone of DeFi evolution due to its robust programming language called “Solidity.” It allows creating advanced smart contracts that contain all the necessary logic for DeFi applications. One of the pioneers of the DeFi space was a project called “MakerDao”. It allowed users to lock in collateral such as ETH and generate DAI, a stable coin that by using certain incentives follows the price of US Dollar. One of the main pillars of the traditional financial system – lending and borrowing, was finally brought to the emerging, decentralised ecosystem. DeFi started absorbing other components of the traditional financial system, and shortly, derivatives, margin trading, insurance and decentralised exchanges became inseparable parts of this ever-evolving industry.

Liquidity pool concepts and Automated Market Makers (AMM) was a new thing on the block and is now widely adopted by decentralised exchanges (DEXes). That was the time when Andre Cronje worked out how to automate the complex yield farming strategies to maximise the ‘harvest’ aggregating different protocols and launched Yearn Finance protocol. YFI – a native token value later skyrocketed to almost 40,000 USD per unit, surpassing the Bitcoin All Time High value (ATH). Yield farming is a craze like we’ve never seen before, and has just taken off within the past few months. New projects, disguised behind various food emoji memes, started popping out every other week.

The rapid growth of DeFi applications and various protocols brought a great deal of attention to this space, as well as highlighting the inefficiencies. Gas wars and Ethereum network congestion made trading on Uniswap almost a nightmare. Transactions were getting stuck, and one single transaction often would cost an arm and a leg. Imagine if you are trying to participate in one of those new yield farming pools, where you would be involved in 5 or more separate transactions just to get in. And remember, all of those transactions would have to be done manually. Due to uncertainty of what is going to happen with the project and when, you would have to have your eyes glued to the screen. In case the value of it drops drastically, to mitigate impermanent loss, you would have to quickly sell your staked LP tokens. Sounds pretty simple, doesn’t it??!

What’s Next?

2nd layer automation solutions give users the ability to have a smooth user experience. This is fundamentally essential so the DeFi and crypto markets as a whole will continue to climb the steep, evolutional curve. There are some teams working on solving these issues, as well as developing intelligent solutions, and we can’t wait to see them coming in fruition. DeFi Industry 4.0 has arrived kicking and screaming into 2020.

As always, remember that quality information is what will make you the most gains in this rapidly changing market. If you want to get into DeFi, invest your time wisely, and you will get rewarded.

DeFi Insiders MSH are a group of experts working in the heart of the movement. This is a live reflection of what is happening on a day to day basis. Nothing written in this article constitutes financial advice and does not reflect either the views of City AM or those of Crypto AM.