Fiscal watchdog to hike growth forecasts to highest on record at budget

The government’s independent fiscal watchdog will make the biggest ever upgrade to the UK’s economic growth rate at the budget next Wednesday.

The Office for Budget Responsibility (OBR) will hike its forecasts for the British economy’s annual expansion rate to 7.5 per cent, according to the economic think tank the Resolution Foundation.

This would be the fastest annual growth rate outside of wartime in nearly a century. However, the elevated expansion rate is partly the result of the UK suffering one of the worst economic hits from the Covid-19 crisis.

According to the International Monetary Fund, the British economy shrank 9.8 per cent last year, the largest rate of contraction out of all G7 countries. The Office for National Statistics estimates the economy is still 0.8 per cent smaller than before the pandemic.

Despite the base measurement effects, three quarters of the OBR’s upward revision will be generated from the UK’s strong bounce back from the depths of the pandemic, driven by the rapid rollout of the vaccine programme allowing curbs on economic activity to lift relatively earlier than other rich nations.

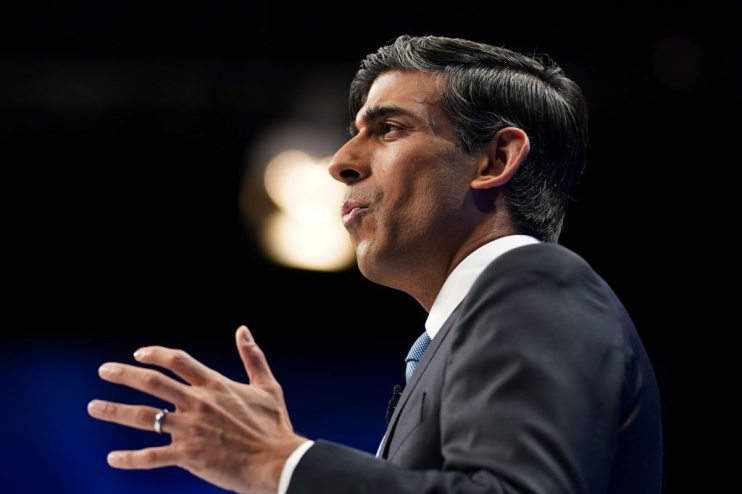

However, high inflation will restrict the degree to which Chancellor Rishi Sunak can wean the government off borrowing despite the tax windfall provided by the robust pandemic rebound, the Resolution Foundation said.

The Chancellor will borrow £30bn less this year than the OBR forecast in the March budget, but will have to allocate more funds to servicing debt due to a sharp rise in inflation since the last set of projections.

The Institute for Fiscal Studies, another economic think tank, estimates each additional percentage hike in interest rates swells the government’s interest bill by £10bn.

The proportion of the government’s stock of debt linked to inflation is historically high due to the large amounts of borrowing needed to respond to the pandemic, meaning the public finances are exposed to interest rate movements and volatile inflation.

Economists expect the retail price index – the inflation measure government debt is linked to – to reach about 5.5 per cent by the end of the year.

James Smith, research director at the Resolution Foundation, said: “The backdrop to the Budget will be a strong recovery from the pandemic that risks being derailed by rising inflation and economic disruption that will squeeze both the Chancellor’s borrowing windfall and family budgets.”