El Salvador’s Bitcoin adoption as legal tender triggers start of market recovery

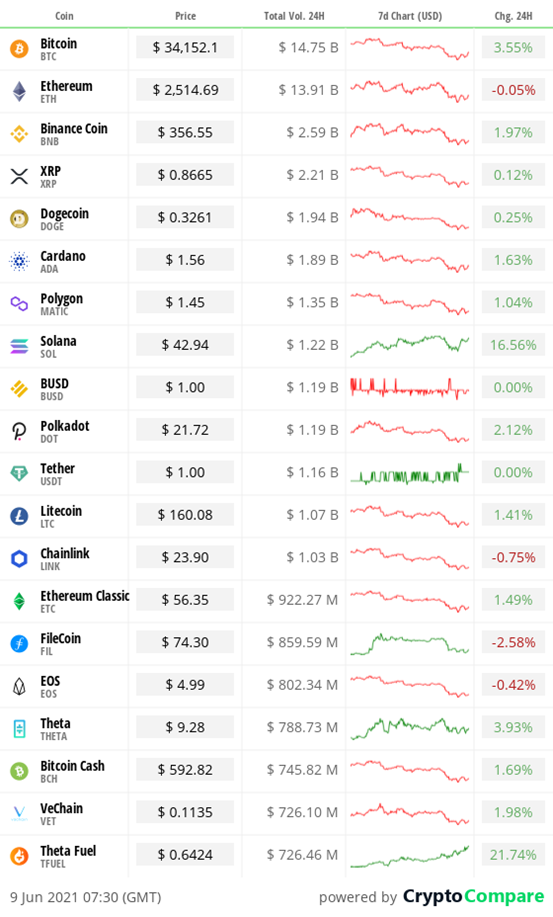

Crypto at a glance

The crypto markets continued to drop yesterday, with Bitcoin leading the way down. The flagship cryptocurrency by market cap fell to a low of $31,114 before finding strong support at this level. It’s since bounced back to over $34k again, where it’s currently trading. Can it sustain a recovery this time?

The turbulent price action comes amid an ongoing to-and-fro between FUD and bullish news. On the FUD side, there remains concerns about the regulatory regime for crypto in China, as well as the possibility of tighter monetary policy from the US Federal Reserve.

On the brighter side, increasing chatter about rising inflation is bolstering Bitcoin’s use case as a hedge against unfettered money printing, MicroStrategy has upped its corporate bond sale to buy Bitcoin from $400 million to $500 million. and El Salvador has now officially recognised Bitcoin as legal tender. The question now is whether bulls will be able to seize the narrative?

Elsewhere, the total market cap of the entire crypto market is back above $1.5 trillion again after hitting a low of $1.4 trillion yesterday. Ethereum fell to $2,300 before recovering to the $2,500 level where it’s been spending a lot of time recently. In all, despite yesterday seeing huge drops across the board, almost everything is recording sideways price action over the last 24 hours. But for how much longer?

For those of you who missed the Crypto AM DeFi & Digital Inclusion online summit – you can now watch the event in two parts via YouTube…

Part one:

Part two:

As I mentioned yesterday, I am attending the Coingeek Conference in Zürich where I will be taking on a panel “What the Media Thinks about Blockchain & Digital Currency”.

To watch this conference online you can register here – my panel will be on Thursday, 10 June at 14:30 CSET

All feedback on Crypto AM Daily in association with Luno is welcome via email to James.Bowater@cityam.com ??

In the markets

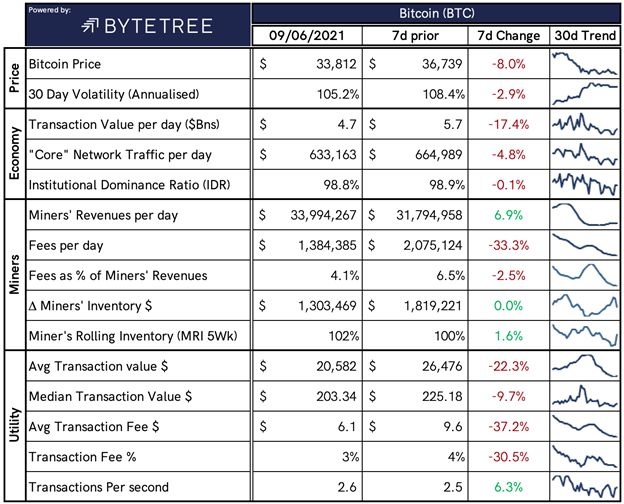

The Bitcoin economy

*Definitions and insights can be found at https://bytetree.com/insights/

Total crypto market cap

The total capitalisation of the entire cryptocurrency market at time of writing is currently $1,527,020,489,557.

What Bitcoin did yesterday

We closed yesterday, June 8 2021, at a price of $33,472.63, down from $33,560.71 the day before.

The daily high yesterday was $34,017.39 and the daily low was $31,114.44.

This time last year, the price of Bitcoin closed the day at $9,795.70. In 2019, it closed at $12,573.81.

Bitcoin market capitalisation

Bitcoin’s market capitalisation at time of writing is $640.71 billion. To put it into context, the market cap of gold is $12.022 trillion and Facebook is $946.13 billion.

Bitcoin volume

The total spot trading volume reported by all exchanges over the last 24 hours was $47,806,820,106, up from $41,274,613,763 yesterday. High volumes can indicate that a significant price movement has stronger support and is more likely to be sustained.

Volatility

The price volatility of Bitcoin over the last 30 days is 88.92%.

Fear and Greed Index

Market sentiment today is 14.

Bitcoin’s market dominance

Bitcoin’s market dominance today is 42.30, Its lowest ever recorded dominance was 37.09 on January 8 2018.

Relative Strength Index (RSI)

The daily RSI is currently 36.42. Values of 70 or above indicate that an asset is becoming overbought and may be primed for a trend reversal or experience a correction in price – an RSI reading of 30 or below indicates an oversold or undervalued condition.

Convince your Nan: Soundbite of the day

“This current market pause is not unexpected. Everyone needs time to assess and digest what the community has built. We’re waiting for a new momentum to gather as we continue to build upon the foundations created by some of the greatest minds in fintech. I’m still extremely bullish in the long term about bitcoin and the long-term fundamentals and use cases of the technology.”

– Paolo Ardoino, chief technology officer of Bitfinex

What they said yesterday

Deal done, a historic moment…

Still relentless…

Good thread, not financial advice…

Crypto AM editor writes

Ripple making waves against the SEC’s confusing crypto rule book

John McAfee faces dying in prison for the same thing Elon Musk does on Twitter, says his wife

Further pain ahead for Bitcoin as environmental groups queue up to reject cryptocurrencies

How are cryptocurrencies coping this weekend?

Bruised Bitcoin heads into an uncertain weekend

China’s CMB International and Nervos Foundation launch $50m blockchain fund

Cardano teams up with Save the Children for humanitarian initiative

HMRC: We’re not clamping down on crypto

Ethiopia overhauls its educational system with IOHK blockchain partnership

Crypto AM: Longer Reads

City AM Markets: What is Decentralised Finance (DeFi) by Aave

Crypto AM: Conversation with James Bowater

Crypto AM: Market View

Crypto AM: Technically Speaking

Crypto AM: A Trader’s View with TMG

Crypto AM: Mixing in the Metaverse with Dr Chris Kacher

Crypto AM: Talking Legal

Crypto AM: Spotlight

Crypto AM: Founders Series

Crypto AM: Industry Voices

Crypto AM: Tiptoe through the Crypto with Monty Munford

Crypto AM: Definitively DeFi

Crypto AM Parliamentary Special

Part one of two – April 2021

Part two of two – April 2021

Five-part series – March 2021

Part one…

Part two…

Part three…

Part four…

Part five…

Crypto AM: Recommended Events

Crypto AM City of London Roundtable

Crypto AM DeFi & Digital Inclusion Summit

&

Crypto AM Awards 2021

September 29 and 30 2021

Cautionary Notes

It’s definitely tempting to get swept up in the excitement, but please heed these words of caution: Do your own research, only invest what you can afford, and make good decisions. The indicators contained in this article will hopefully help in this. Remember though, the content of this article is for information purposes only and is not investment advice or any form of recommendation or invitation. City AM, Crypto AM and Luno always advise you to obtain your own independent financial advice before investing or trading in cryptocurrency.

All information is correct as of 08:30am GMT.