A data-driven Fed could well taper in December

But whenever the QE wind-down begins, a dramatic pull-back for equities will not necessarily follow

In a data-heavy week for the US, investors will scrutinise consumer sentiment, revised GDP figures, and the crucial non-farm payroll report on Friday for signs that the Federal Reserve could judge the US economy ready for the start of tapering this month – despite the current consensus for a 2014 taper.

Many institutions, including Bank of America Merrill Lynch and Societe Generale, don’t expect the Fed to start winding down its monthly $85bn (£52bn) of asset purchases until March 2014. But as Michael Hewson of CMC Markets says, “the case for a December taper could improve with a better-than-expected jobs report this week.” And with 10-year US Treasury yields hitting a 10-week high yesterday, some fixed income traders seem to be pricing in some sort of reduction already.

But beyond the question of timing, there is a growing sense that an obsessive focus on central bank policy could blind markets to the strength of the global recovery. As Will Hobbs of Barclays says, “We do not see the taper as changing the trajectory for equities in the long term. Investors may have been placing too much faith in central bankers, and not enough in the global economy.”

A DECEMBER TO REMEMBER

According to Hewson, “Most feel that the Fed will err on the side of caution and not begin to taper on 18 December. With the prospect of another debt ceiling standoff in Congress just around the corner, it could be seen as a risky time to start the process.” The S&P 500 fell from over 1,725 to less than 1,660 during the last budget impasse in the Autumn. And the Fed may not want to add to uncertainty, with the US due to hit the debt ceiling again in the middle of January.

But according to Andrew Kenningham of Capital Economics, “The Fed’s decision on whether to begin its taper in December is finely balanced, and may be determined by the strength of payroll data due on 6 December.” The consensus is that the release will show just over 180,000 jobs added, but Barclays forecasts an increase of 200,000, a number that would likely fuel further speculation of a December taper. And with November’s ISM manufacturing index rising to a two-and-a-half year high of 57.3 yesterday, a healthy week of data could give the Fed some serious food for thought.

IGNORING GROWTH

Regardless of exactly when QE will be wound down, questions remain about its likely market impact. When Bernanke first raised the prospect in May, the S&P 500 fell by 6 per cent in 24 days. But it had recovered, and was up by over 2 per cent by September. After the release of some hawkish Fed minutes a couple of weeks ago, the S&P 500 fell by just 0.4 per cent, and the Dow Jones was back pushing above record highs of 16,000 in a matter of days.

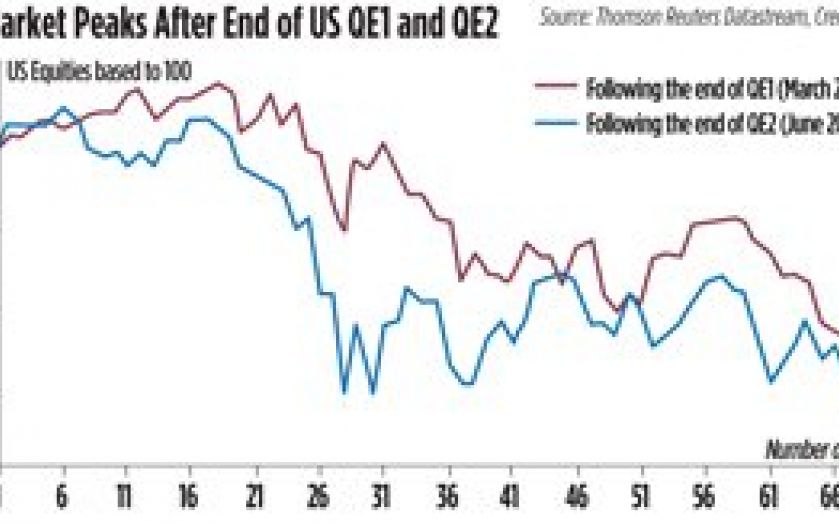

The end of the previous iterations of QE had differing impacts on US equities (see chart), but the resulting pull-backs came weeks after the announcements. A dramatic decline in equities is not a certainty this time around.

The Fed looks likely to accompany any tapering announcement with stronger forward guidance on rate hikes, which Hobbs points out are still a long way off. “For us, the main factors are the business cycle and appetite for risk,” he says. If this week’s US data continue to beat expectations, these factors could see equities weather the Fed’s taper storm.