Covid-19: why the tech giants have emerged as winners

While many businesses struggle to survive under the global lockdown, the largest technology companies remain afloat and in some cases are even thriving.

Microsoft has reported a surge in usage of its cloud computing service Azure, as millions of people work from home.

Amazon is hiring an additional 75,000 workers, on top of the 100,000 it hired last month, to cope with increased demand for its online delivery service.

The number of video calls and messaging on Facebook has exploded, while a record number of gaming apps were downloaded in China on Apple’s app store.

YouTube Kids, owned by Google, was the most streamed app in the first quarter of 2020 according to a report by Apptopia and Braze, following the closure of most nurseries and schools.

Travel restrictions and social distancing rules imposed as a result of the coronavirus have dramatically increased our reliance on these digital platforms to service our basic needs, entertain ourselves and stay connected with friends and colleagues.

However, there is a dark side to their deepening grip on society. As smaller businesses and start-ups flounder, this pandemic will likely make the largest tech firms even more powerful than before.

Tech has held up far better than the rest of the market

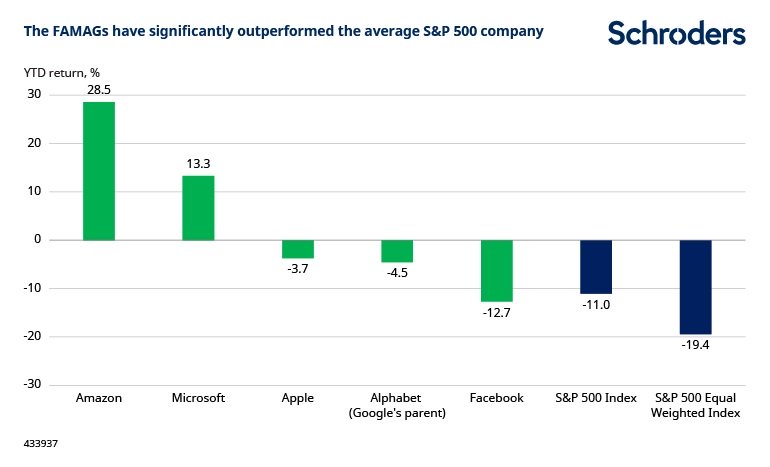

Unsurprisingly, the “FAMAG” stocks – Facebook, Amazon, Microsoft, Apple and Google – have significantly outperformed broader market indices as a result of stay-at-home orders. The more common “FAANG” acronym includes Netflix but not Microsoft. We use an alternative grouping because Microsoft is the most valuable public US company – the total value of its shares (its market capitalisation) makes it seven times larger than Netflix.

At the time of writing, Amazon and Microsoft were up 28.5% and 13.3% respectively this year, while the US stock market index, the S&P 500, was down 11%. But as the S&P 500 – which includes 500 large US companies – is heavily influenced by the FAMAG stocks themselves (they make up 20% of the index), it is slightly circular to compare their performance with this benchmark. That is, if they perform better, the S&P 500 will have a higher return, setting a higher bar for them to outperform.

For more:

– How sustainable companies have performed during the Covid-19 crisis

– What’s happening to dividends and what next? 11 questions answered

– Covid-19 and European equities: a Q&A with our fund managers

A better performance comparator is the equal-weighted S&P 500 Index, which tracks the performance of the average US company. This has fallen by 19.4%, almost twice as much as the market-capitalisation-weighted index. This indicates that the largest stocks were outperforming smaller ones. Although Facebook underperformed the other FAMAG stocks and the S&P 500, it outperformed the average company.

Past performance is not a guide to future performance and may not be repeated. Source: Refinitiv Datastream. Data as at 17 April 2020.

Cash is king

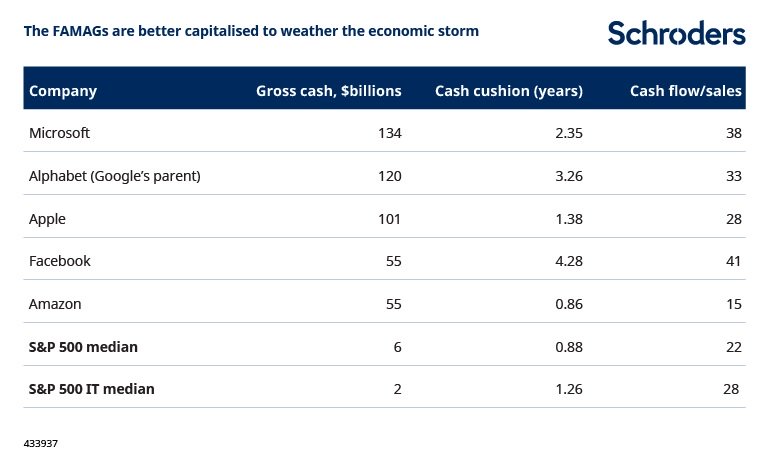

For many businesses that have been forced to shut, sales have literally collapsed to zero. So what matters now is not so much revenues, but whether a company has stockpiled enough cash to survive the global lockdown. On this metric, the FAMAGs are relative winners – most of them have above-average cash buffers, relatively few short-term liabilities and strong cash generation capabilities. This is true relative to both the broad market and the rest of the technology sector.

Take Microsoft – it is sitting on $134 billion of cash and cash equivalents, which is enough to fund 2 years and 4 months of its contractual obligations (e.g. short-term debt, wages and other accounts payables). This is significantly higher than the median $6 billion cash balance and cash cushion of 0.88 years (10.5 months) for the S&P 500. Microsoft is also better able to translate its sales into cash compared to other companies. For example, its operating cash flow to sales ratio was 38 meaning it collected $38 of cash for every $100 of sales. This compares with only $22 for the S&P 500.

Source: Refinitiv Datastream. Data as at 17th April 2020 based on most recent filing date. Notes: Gross cash = cash and cash equivalents, cash cushion = quick ratio (cash + cash equivalents + net receivables/1-year liabilities), cash flows/sales = operating cash flow/sales.

In contrast, although Amazon has a substantial amount of cash on hand, it is dwarfed by its relatively high operational costs and near-term liabilities. But given the surge in its stock price this year, investors are not placing much weight on this. After all, sales are expected to hold up relatively well compared to most companies and it can also easily tap other sources of liquidity if needed, such as short-term borrowing.

The balance sheets of other companies are not in such resilient shape. One consequence is that vulnerable, but promising, firms that may have otherwise mounted competition against the dominant tech incumbents could be wiped out or acquired. This would further entrench their market dominance. The news that the UK competition watchdog has now approved Amazon’s investment in food-delivery company Deliveroo to avoid the risk of its collapse only serves to confirm this.

How immune are the largest tech companies?

None of this, however, means the major tech companies are completely shielded from the economic effects of the global lockdown.

For example, despite traffic going up on social media platforms, many advertisers have cut spending as more people at home has meant that they are not spending on products and services they normally would have. This has been a problem for Google and Facebook because they generate 83% and 98% of their revenues from advertising respectively.

Apple was also dealt a heavy blow because of its reliance on iPhone demand from Chinese consumers and supply from Chinese factories, many of which have been temporarily shut.

Tech companies could emerge stronger

But once lockdowns are lifted and the global economy improves, the FAMAGs could benefit from changes in consumer behaviour forged during the crisis.

Social media platforms are gaining new audiences, people are spending more time on their smartphones and shoppers are getting accustomed to ordering groceries online. These changes in digital consumption trends could result in permanent shifts in consumer habits.

To safeguard against future shutdowns and cut costs, companies are also looking to shift their computing workloads online so that employees can access their data from home. This would be a boon for major cloud server providers such as Microsoft and Amazon.

In addition, contact tracing apps are being developed by Apple and Google – a system whereby those who have come in contact with a person who has tested positive for Covid-19 can be alerted. Together they have access to around 1.5 billion devices globally that are compatible with the tracking software.

Although governments in China and Israel are already using personal mobile data to trace infected individuals and their interactions, there are privacy concerns that this data could be harnessed once the pandemic is over.

Markets are increasingly dependent on the largest tech stocks

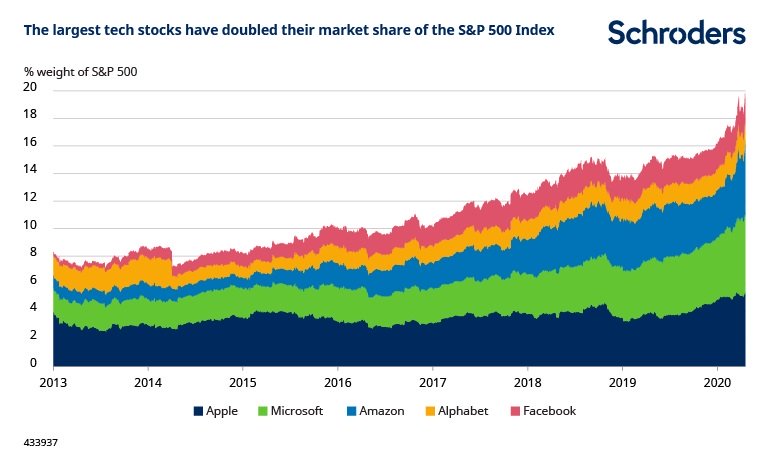

Above all, what is most alarming is the extent to which US equity returns have become so reliant lately on the largest tech companies. This has served many investors well. Between 2015 and 2019, the S&P 500 Index climbed 74%, of which the FAMAG stocks – just five companies out of 500 – contributed 22%, or around a third of the total return. These companies have become so large that they are essentially driving the market.

Since the outbreak of the virus, however, most share prices have fallen off a cliff while the FAMAGs have held up much better. As a consequence, their combined market-cap weight has more than doubled from roughly 8% of the S&P 500 Index in 2015 to nearly 20% today. The five largest US stocks now account for a larger slice of the market than at the peak of the dot-com bubble in 1999.

Source: Refinitiv Datastream. Data as at 17 April 2020

To put this in context, let’s suppose that hypothetically the FAMAGs all fell 10%. That would mean that all remaining 455 stocks in the S&P 500 would need to increase by at least 2.5% just for the whole index level to stay the same. This is how important the largest tech stocks have become.

A market this narrow should give cause for concern. Investors seem to think that these companies are unstoppable. But what happens when these companies stop doing well? These outsized gains could lead to outsized losses.

Regulation could eventually hone in on the tech giants

Weaker advertising revenues and supply chain disruption are near term negative influences on the FAMAGs, but they also face a number of pressures which could have a longer-term negative impact on their business models. Regulatory concern over their growing power is at the epicentre.

Over the past 18 months, the FAMAGs have already faced a barrage of criticism over their anticompetitive behaviour. The bigger tech becomes, the more likely they will become more heavily regulated. History is replete with such examples. At some point, this could have serious implications for their growth prospects.

With a number of governments turning to tech companies to help manage the virus outbreak, one possibility is that the major digital platforms could become regulated like public utilities given their increasing size and influence. In the past, governments did not hesitate to regulate services that were deemed essential public goods such as railways and energy suppliers. New regulations could be imposed that limit how these firms monetise data and which markets they can participate in.

US regulators have already signalled that they would like to expand their antitrust scrutiny of the FAMAGs and many investigations into anticompetitive behaviour are already underway. Although unlikely in the short-term, more scrutiny could slow down future M&A expansion, which has been an important ingredient for their success.

Increasing market concentration should be ringing alarm bells

Despite the shock that the pandemic has cast on the business world, the FAMAG stocks have emerged as relative winners. Their superior balance sheet strength combined with increased demand for their services has been clearly reflected in their stock prices.

Lifestyle shifts could stick after the crisis is over, while failing businesses could open up opportunities for expansion. If that happens, the FAMAGs could emerge even more powerful than before.

This, however, does not mean that regulators will look the other way. If anything, it increases the likelihood of action being taken at some point to suppress their market control.

There is also the poor track record of dominant firms maintaining their dominance over time. According to the McKinsey Global Institute, nearly 50% of all market leaders fall out of the top 10% during the business cycle. Today’s dominant firms could be tomorrow’s Nokia or Blackberry.

Given their high benchmark weights, it could drag down the whole market if confidence in them collapses for any reason. The closer a portfolio’s weights are to the benchmark, the bigger this risk. Passive strategies are most exposed. As a minimum, investors should at least be aware of the risk they are running in a portfolio, whether they are comfortable running those risks, and ideally, whether they are being rewarded for taking those risks.

Any references to Stocks/companies are for illustrative purposes only and not a recommendation to buy and/or sell. Reliance should not be placed on any views or information in the material when taking individual investment and/or strategic decisions. If you are unsure as to the suitability of any investment speak to a independent financial advisor

The value of investments and the income from them may go down as well as up and investors may not get back the amounts originally invested.

Important Information: The views and opinions contained herein are of those named in the article and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. The sectors and securities shown above are for illustrative purposes only and are not to be considered a recommendation to buy or sell. This communication is marketing material.

This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The material is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a guide to future performance and may not be repeated. The value of investments and the income from them may go down as well as up and investors may not get back the amounts originally invested. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. The opinions in this document include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realised. These views and opinions may change. Issued by Schroder Investment Management Limited, 1 London Wall Place, London, EC2Y 5AU. Registration No. 1893220 England. Authorised and regulated by the Financial Conduct Authority.