Bank of England Mann warns interest rates need to keep rising to squash inflation

Interest rates in the UK will have to keep rising to prevent inflation sticking around for too long, a member of the Bank of England’s monetary policy committee (MPC) warned today.

Catherine Mann, who joined the rate setting group in September 2021 as an external member, said at an event hosted by the Resolution Foundation that she does not think the current level of rates are “in a restrictive stance”.

Mann, who has backed multiple outsized rate rises to front-load tightening, said she is concerned a “premature loosening of [financial] conditions” risks the Bank’s ten successive rate increases not sufficiently feeding through the economy to tame inflation.

That marked a climbdown from opting for either 50 basis point or 75 basis point rises in several prior MPC meetings.

There is growing possibility businesses and households will assume the last year’s historic inflation surge, which took the rate to a peak of 11.1 per cent in October, a 41-year high, may carry on, albeit in an watered-down form, over the coming year, Mann argued.

This risks strengthening incentives for companies to raise prices and workers to demand high pay increases, keeping inflation elevated for longer.

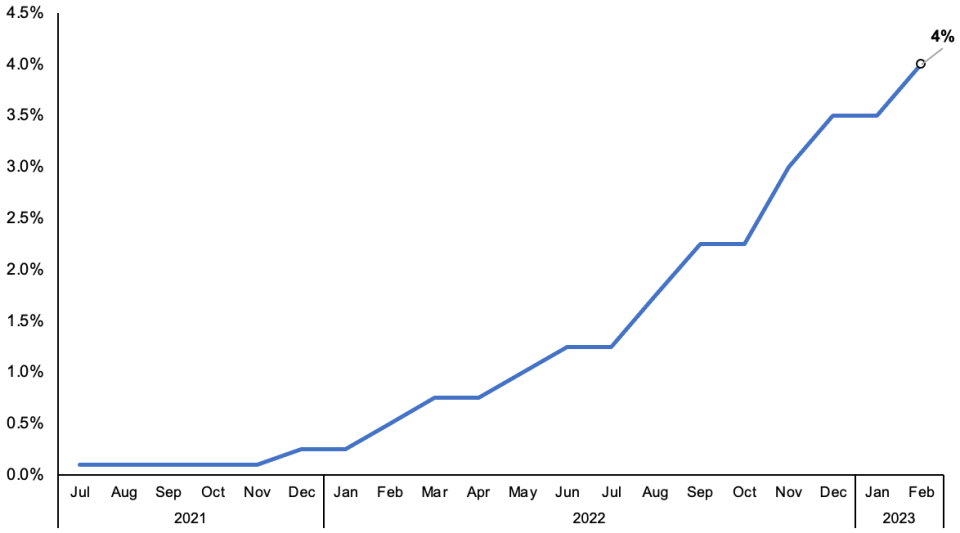

Rates have risen sharply over the last year

In order to prevent that scenario from playing out, Mann hinted that the Bank needs to heap more pressure on households and businesses.

“We have an inflation remit, and we will achieve it one way or another. Failing to do enough now risks the worst of both worlds – the higher inflation and lower activity,” she said.

Private sector pay is growing around seven per cent, a record high, while inflation has eased for three straight months to 10.1 per cent.

Bank economists reckon the rate of price increases is poised to more than halve to around four per cent by the end of the year, while experts at consultancy Pantheon Macroeconomics and fund manager Investec think it could fall below the Bank’s two per cent at the end of the year.

Markets suspect the MPC will hoist rates to a peak of around 4.5 per cent before cutting them at the end of the year, mainly to stimulate the economy, which is widely tipped to fall into recession.

The language in the MPC’s statement accompanying the rate decision at their meeting earlier this month softened from recent months, sparking expectations that the Bank could mark the end of its current hiking cycle with a final 25 basis point rise at the next meeting on 23 March.