Will interests rates rise early after No vote in the Scottish independence referendum?

The No vote in the Scottish independence referendum could make an interest rate next spring more likely.

Despite the No vote, however, the consensus is that it remains unlikely that rates will rise before then. A Yes vote could well have postponed any hike.

In a recent speech Mark Carney said he saw a rate rise next spring as the Bank of England completing its mandate.

Scotland's decision to stay with the rest of the UK is seen to be positive news for the British economy for several reasons.

As Howard Archer of IHS Economics and Country Risk says:

The relief of the markets is already evident in sterling seeing early gains and we would expect to see a relief rally for the pound allowing it to recoup some of thelosses it suffered as the polls showed the independence side gaining.Economic fundamentals still look broadly supportive to the pound, particularly against the euro. Furthermore, the no vote for independence removes one factor that could have delayed the Bank of England raising interest rates.The no vote to independence dilutes the risk to the UK ‘s recovery coming from heightened economic and political uncertainty. Of course, there are a lot of uncertainties over how more devolution for Scotland will pan out over the coming months – but the economic risks have been much reduced.

This would likely have been magnified if the Scottish vote for independence led to major political uncertainty in the UK, over the survival of David Cameron and the government. Consumer confidence could also well have taken a hit, leading to increased caution in personal expenditure.There is also the risk that gilt yields could have risen markedly due to foreign investors being wary about what would happen with UK debt. However, the Bank of England could have countered this by delaying an interest rate hike and possibly even resuming Quantitative Easing.On the positive side, the likely further weakening of sterling would have been helpful to UK exports.

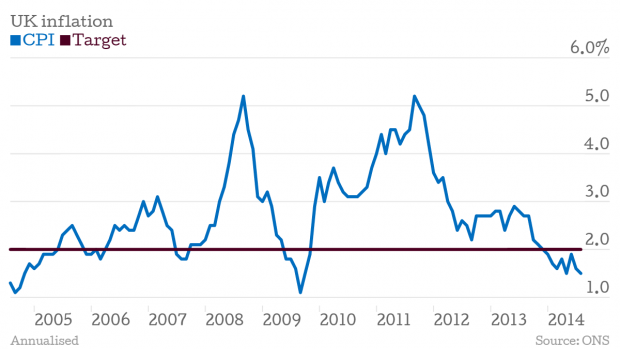

The first is inflation. It's part of the Bank's mandate to keep inflation at two per cent. It's currently sitting at around 1.5 per cent annualised, which makes a rate rise less likely.

The second is the labour market. At a speech earlier this month, Mark Carney said that he and the Bank believed there was still plenty of slack in the labour market, which is a factor in a hike being put of thus far.

Despite unemployment being at 6.2 per cent, wages have not caught up with inflation. In the minutes of its latest monetary policy committee meeting, the Bank indicated that low wages could well be the result of a rise in the number of lower-skilled workers in the labour force. Such workers typically command lower salaries.

Thirdly, there is the housing market, which has been a strong driver behind the recovery. Prices in London have topped £500,000, even under the more conservative ONS measures. A rise would dampen the market and so healthy or high prices are preferable when considering a hike.