Why inflation staying stuck at four per cent is actually good news

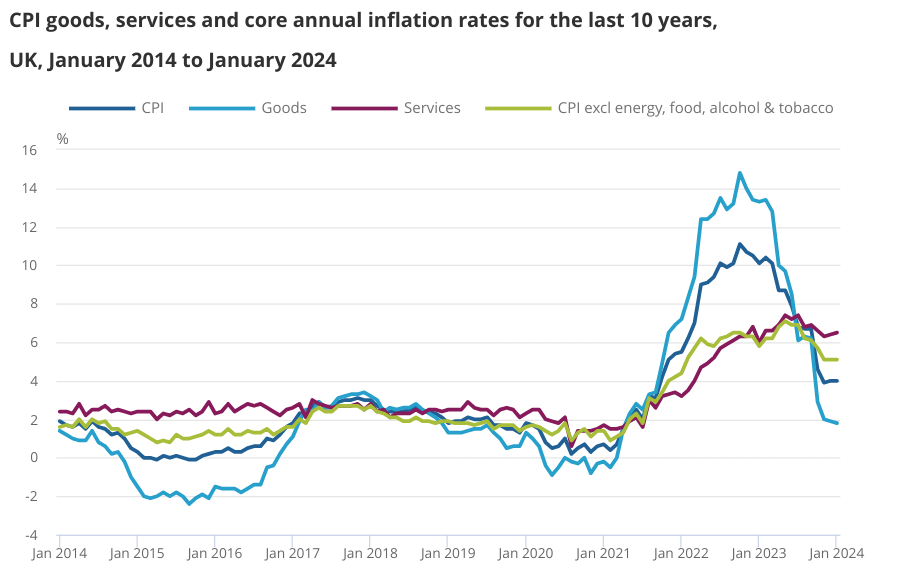

Inflation remained stuck at four per cent in January, according to new figures released on Wednesday morning, but this actually obscures the fact that price pressures are abating.

Economists had expected inflation to rise to 4.2 per cent in January reflecting two factors. The first is that Ofgem increased its energy price cap by five per cent at the start of the year making household bills more expensive.

Reflecting this, the figures showed that gas prices rose by 6.8 per cent in January while electricity prices rose by four per cent.

The second price pressure forecast by economists was in services inflation. Services inflation fell unusually fast this time last year, which distorts the annual comparison since prices in January 2024 are measured against prices a year earlier.

As a result, the annual rate of services inflation rose to 6.5 per cent from 6.4 per cent last month.

Neither of these factors are a cause for concern though. Its likely that Ofgem will reduce its price cap by 14 per cent by April, which will be a significant drag on inflation over the year.

And although the level of services inflation remains far too high to be consistent with the Bank’s two per cent target, this month’s increase should not be the start of a renewed trend of price increases.

Wage growth, the most important driver of costs in the services sector, is on its way down – if slightly more slowly than expected.

Samuel Tombs, chief UK economist at Pantheon Macroeconomics, said the increase in services inflation was “entirely due to a base effect…rather than due to a pick-up in near-term momentum.”

The fact that the headline rate of inflation remained steady in January despite these increases points to stronger than anticipated disinflationary pressures elsewhere.

These can be seen in food prices most clearly, which posted their first drop in over two years. The ONS said that the prices of cream crackers, chocolate biscuits and sponge cakes all dragged food prices lower.

Lalitha Try, economist at the Resolution Foundation, weighed in saying the fall in food prices was particularly “welcome news for low-income households who spend a higher proportion of their income on food”.

Food prices have increased by around 25 per cent over the past two years, the ONS noted.

Household goods were the other key downward contributor to January’s inflation figures. Furniture and household goods prices dropped 3.1 per cent in the month.

A note of caution is due here as January’s data can often be impacted by post-Christmas discounts, and this is likely to have played out in household goods. Simon French, head of research at Panmure Gordon, suggested that January is “always the hardest month to draw insight from.”

Looking over the longer term, however, inflationary pressures are clearly dissipating in those categories. Chris Hare, senior economist at HSBC said they are in “clear decline”.

It therefore seems clear that inflation will resume its descent next month at a healthy clip, paving the way for interest rate cuts in the second quarter of the year.