Why the FTSE 100 rises when sterling falls – explained in two charts

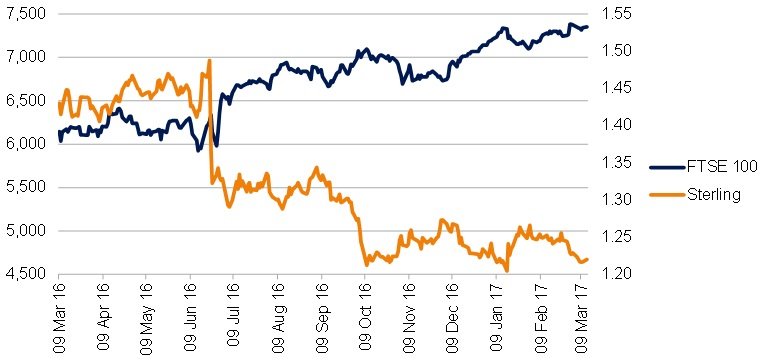

The FTSE 100's strong recovery after the Brexit verdict in last June's referendum caught some investors off guard.

After an initial wobble, the index surged. Three months later, it was 10.4% higher. But why?

There may have been some other factors at play in those months, but one of the strongest drivers in the fortunes of the FTSE, the leading measure of UK stock market performance, was the direction of the pound.

This is because such a large proportion of profits for FTSE 100 companies is made in dollars. If sterling weakens then dollar revenues, once converted back into sterling, are worth more.

In three months when the FTSE 100 rose 10.4%, the pound fell 12.8% against the dollar.

How the FTSE 100 has risen as sterling has fallen

Source: Schroders. Bloomberg data as at 13/03/2017, showing sterling vs the dollar. For information purposes only. The material is not intended to provide advice of any kind. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Past performance is not a guide to future performance and may not be repeated. There can be no guarantee as to the magnitude of any future market movements.

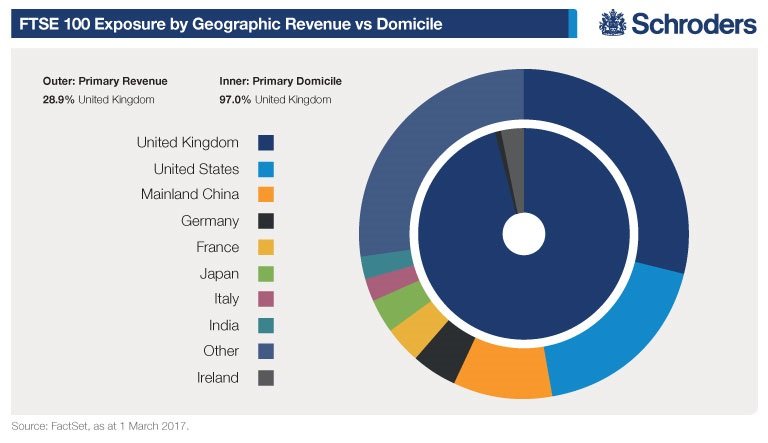

This effect has become more pronounced given the sheer volume of profits earned overseas.

As the chart below shows, 71% of revenues generated by FTSE 100 companies come from outside the UK. The strength of sterling against the euro is also important given the large chunks of revenue accounted for by France, Germany, Italy and other eurozone countries.

- How Brexit might affect stock markets, sterling and property

- What next for dividends? … the safety test

The inner ring illustrates that 97% of the companies on the FTSE 100 have registered head offices (i.e. they are domiciled) in the UK.

The outer ring is the important part. It shows the regions from which FTSE 100 companies generate their revenues. All but 28.9% are generated outside the UK.

Consider a simplified scenario of currency movement. If the exchange rate was $2 to the pound then every $1,000 of revenue would be worth £500. However, if sterling weakened and the exchange rate moved to $1.5 to the pound, then every $1000 of revenue would be worth £667. The outcome is that revenues increased 33% as a result of the fall in sterling.

- What next for inflation in the UK, US and eurozone?

- After the FTSE 100's 37% return, should I still invest?

Advertising firm WPP is among a number of UK-listed companies which have recently announced that their earnings have benefited from sterling weakness.

It can have the opposite effect too. Engine maker Rolls Royce recently announced that its profits were being affected by a weak sterling exchange rarte.

The notion that a falling currency boosts the local stock market applies to most markets, but the extent depends on the market's reliance on foreign revenues. The FTSE 100 is a particularly strong example of this, with the dramatic effects of Brexit underlining the point in 2016.

- Read more at Schroders.com or follow us on Twitter @schroders

Important Information: The views and opinions contained herein are those of David Brett, Investment Writer, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. The sectors and securities shown above are for illustrative purposes only and are not to be considered a recommendation to buy or sell. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The material is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a guide to future performance and may not be repeated. The value of investments and the income from them may go down as well as up and investors may not get back the amounts originally invested. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. The opinions in this document include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realised. These views and opinions may change. Issued by Schroder Investment Management Limited, 31 Gresham Street, London EC2V 7QA. Registration No. 1893220 England. Authorised and regulated by the Financial Conduct Authority.