What motivates women to invest? Our survey results are in

What motivates women to invest? This was the question at the heart of a survey of more than 200 women across 24 countries undertaken to explore what shapes women’s attitudes to personal investment.

I have been researching women and finance for a decade, and set out to bust several myths: that women didn’t invest because they were not confident/independent enough; that they were afraid of risk; and that they needed to be ‘educated’ on how to invest. The hunch at the time? That all three of these generalisations were not just slightly off, but totally backwards. And research interviews have since borne this out.

Our new quantitative online survey ran from 25 November 2019 to 31 December 2019, and was timed to mark a decade since Rich Thinking, my first white paper on women and finance. Related research recently published here at CFA Institute Talk has looked at women’s preferred communication style for investing, the types of investments that appeal to most women and attitudes to risk-taking.

Independent thinkers

Just under two-thirds of respondents said they make their investment decisions either entirely by themselves (26%) or mainly by themselves with some input from others (39%). Those numbers were even higher for non-investment financial decisions such as banking, loans and mortgages: 50% of women make those decisions on their own, and 26% say they make them mainly on their own. That adds up to a combined three quarters of women!

Our survey asked women to pick the top reason why they began investing. The most common answer, chosen by one in three, was hardly a surprise: to fund their retirement. But the second place answer, selected by more than 30%, was to become more financially independent. As I pointed out in a 2017 article: “You can’t be an independent woman without being a financially independent woman!”

Risky business

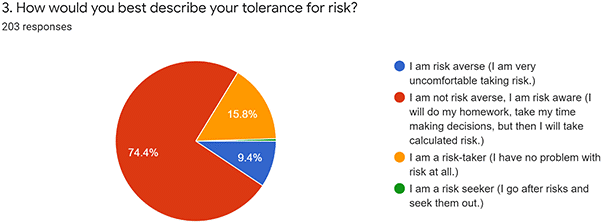

If it was ever true that women were excessively fearful about risk, it’s not true anymore. Fewer than one in 10 women said they were risk averse, while nearly three quarters said they were risk aware, not risk averse. And about 16% self-identified as a risk taker and said they had no problem with risk at all.

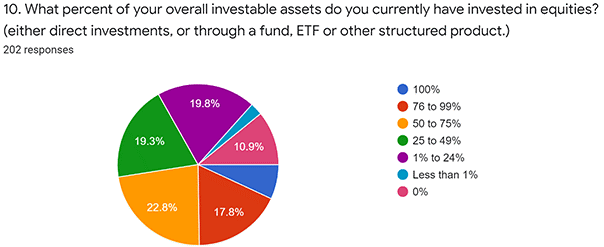

Given that equities are currently at all-time highs in the US, this ‘risk aware not risk averse’ mindset shows up in asset allocation. Although women have historically been seen as badly underweight in equity investing, just under half of survey respondents indicated that more than 50% of their investable assets are currently in stocks, whether through shares, funds, or exchange-traded funds (ETFs), and a quarter say their equity exposure is more than 75%.

Beginning your investment journey

There are various triggers to start investing. Most credited mentors (18%), family and friends (8%), or self-service online/social trading (18%). Just under one fifth of respondents said they began investing because of a course (10%) or a book (9%). The survey gave respondents seven different pre-set responses, and nearly 30% picked ‘Other’.

The top choice when we asked what path was most important for their investing success was ‘just get started investing as soon as possible’, with nearly half (45%) of all respondents picking this answer.

We are excited to see how women’s attitudes to finance will change as through the 2020s.

The survey was designed by Çiğdem Penn of XSIGHTS. In terms of our sample’s age, about half were aged 35–54, more than a quarter were 18–34 and 20% were 55 and above. In terms of education, only 5% had not completed some post-secondary education. In terms of income, about 30% had personal annual income of less than US$75,000 (about £57,400), 43% made US$125K (about £95,700) or more, and just over a quarter were in between.

Visit CFA Institute for more industry research and analysis.

If you liked this post, don’t forget to subscribe to the Enterprising Investor.

By Barbara Stewart, CFA and Duncan Stewart, CFA

All posts are the opinion of the author. As such, they should not be construed as investment advice, nor do the opinions expressed necessarily reflect the views of CFA Institute or the author’s employer.

Image credit: ©Getty Images/d3sign