Wage growth soars: What does it mean for the pensions triple lock?

UK wage growth flew over the last quarter, indicating that the labour market recovered sharply from the worst effects of the Covid crisis as restrictions eased between April and June. However, what will this mean for the state pension triple lock?

Under the policy, the state pension rises by whichever is highest out of inflation, earnings or 2.5 per cent.

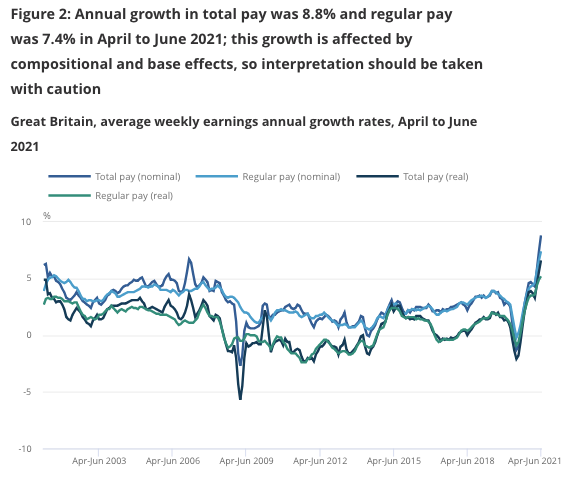

According to data released by the Office for National Statistics today, average total earnings soared 8.8 per cent over the last quarter compared to the same period last year, meaning pensioners are set to receive a marked uplift to their pensions if the government maintains its manifesto pledge to retain the policy.

However, the high rate of wage growth has been mainly driven by base effects as a result of a large proportion of the workforce moving off furlough and back into jobs, and having their pay restored in the process.

The ONS said: “Average pay growth rates have been affected upwards by a fall in the number and proportion of lower-paid jobs compared with before the coronavirus pandemic.”

Experts have pointed to the intergenerational unfairness that the triple lock produces as evidence to either temporarily suspend the policy or to scrap it altogether.

Laith Khalaf, head of investment analysis at AJ Bell, said: “The high rate of headline earnings growth does hem the government into a tight little corner on the state pension triple lock.”

“The conservative manifesto commits to maintaining the triple lock, but an 8 per cent rise in the state pension would raise questions of intergenerational fairness, as well as fiscal sustainability.”

Julian Jessop, economics fellow at the Institute for Economic Affairs, said: “The 8.8 per cent jump in average pay in the three months to June provides more ammunition for those arguing that the ‘triple lock’ on the state pension needs to be unpicked.”

“The July figure, which would normally determine the pension increase next April, is now also likely to be well above 8 per cent.”

If the government does decide to remove wages from the triple lock calculation, pensioners could still be set for a sizeable windfall.

The Bank of England expects inflation to reach at least four per cent this year. It currently stands at 2.5 per cent annually.

Steve Webb, partner at LCP and a former pensions minister, said: “This is ultimately a political judgment for the government, but the most likely option remains to look for a measure of earnings growth which strips out the effect of the pandemic.”

“This could save the chancellor several billion pounds a year whilst still allowing him to claim he had kept to the ‘spirit’ of the triple lock promise.”