UK borrowing costs fall after Sunak wins race to No 10

UK borrowing costs fell sharply today after former chancellor Rishi Sunak seized the keys to Number 10 following leadership contender Penny Mordaunt’s withdrawal.

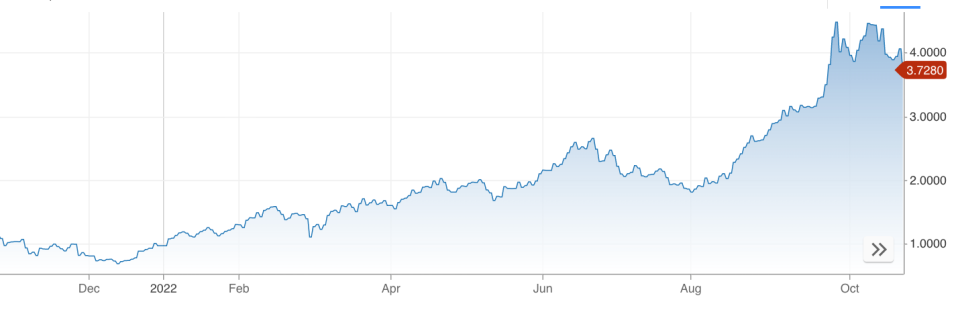

Yields on the 10-year gilt fell around 30 basis points today to below four per cent. Yields and prices move inversely.

They had been falling in early morning trading after Boris Johnson ruled himself out of the race to become Britain’s third prime minister this year late last night.

On the 30-year gilt, rates also slumped around 30 basis points, while yields on the 5-year gilt also dipped.

The downward move is likely being driven by investors warming to the idea of former chancellor Rishi Sunak seizing the keys to Number 10. He will become the third prime minister this year.

The incoming PM warned Britain is facing a “profound” economic challenge. Analysts think the country is teetering on the edge of a recession and have predicted Sunak and chancellor Jeremy Hunt need to plug an around £30bn hole in the public finances.

At the back end of last week, yields climbed higher and the pound fell sharply against the US dollar as Johnson emerged as the front runner to win the second Tory leadership race this year.

Yield on 10-year gilt

Sterling fell 0.13 per cent against the US dollar.

Late last night, Johnson said he would not run in the contest, despite claiming he had passed the 100 threshold of supporting MPs needed to put himself on the ballot.

“Sunak should be viewed as the “continuity candidate”,” analysts at NatWest said.

UK financial markets have been extremely choppy since former prime minister Liz Truss last month launched £45bn of unfunded tax cuts and ramped up government borrowing in her mini-budget.

The pound dropped to a record low and yields touched their highest level in over 20 years in the days after the mini-budget on 23 September.

She was eventually forced to ditch nearly all of her flagship package and was forced to quit Number 10 after just 44 days in charge.

Beyond the Westminster drama, gilt traders will also be closely watching a speech from a top Bank of England official this week.

Huw Pill, Threadneedle Street’s chief economist, is speaking at an event on Tuesday hosted by the Office for National Statistics on how to interpret cost of living figures.

Pill has doubled down on the insisting a “significant” monetary policy response at the Bank’s next meeting on 3 November is needed to tame inflation, running at a 40-year high of 10.1 per cent, and shore up financial markets.

Investors now expect UK borrowing costs to peak at just under five per cent. After the mini-budget, peak rate expectations topped six per cent.

The Bank has lifted rates seven times in a row, including two back-to-back 50 basis point hikes, to 2.25 per cent.