Screenshot: Have the streaming wars just gone nuclear?

This week

**Media Moment of the Week: That’ll do, you donkeys

**Have the streaming wars just gone nuclear?

**Can London close the tech gap on Silicon Valley?

Media Moment of the Week: That’ll do, you donkeys

Shrek turned 20 this week. Ah lovely, an innocent reminder of youth, I bet you’re thinking. Wrong. It’s actually more unwitting fodder for the relentless culture wars in the swamp that is social media.

No sooner had the Guardian published this article branding the animated ogre saga “unfunny and overrated” than the internet was alive with vitriolic discourse. Is literally nothing sacred anymore?

Have the streaming wars just gone nuclear?

Have you ever talked idly about doing something for about a year and then, one day, suddenly decided to do it? Well, that’s what happened this week in the world of streaming. First, AT&T revealed a $43bn deal to spin off Warner Media and merge it with Discovery, creating a major new media beast in the process. A day later it emerged that Amazon was in talks to snap up iconic film studios MGM in a deal worth more than £6bn. It seems the inevitable consolidation of streaming is finally here.

Both moves make sense. For Discovery and Warner, the tie-up will combine one of Hollywood’s most powerful studios, home to the Harry Potter and Batman franchises, as well as HBO and CNN, with Discovery’s stable of unscripted home, cooking and nature and science shows. Combined, Discovery Plus and HBO Max have just under 60m subscribers. That’s short of Disney’s 100m and well behind the 200m signed up to Netflix, but it’s a pretty strong starting position. What’s more, the joint platform will have all types of content covered, from kids to nature to high-end scripted drama. It’s similar to the umbrella approach that’s worked so well for Disney. One top media banker describes this kind of offering, fittingly, as “rather like walking into a theme park”.

For Amazon, too, a takeover of MGM is a no-brainer. The studio — one of the world’s oldest — boasts everything from Gone With the Wind and The Wizard of Oz to the lucrative Bond franchise. More recently it’s also made moves into TV with hits such as The Handmaid’s Tale. Of course, Amazon is a slightly different beast, with its streaming offering also serving as a draw to its ecommerce services on Prime. In this sense, it’s less worried about leading the way on original content — a strategy that’s become increasingly important for Netflix. But a deal to snap up MGM would massively strengthen its catalogue of films, and keep it very much in the game.

For the media sector more widely, though, the deal means two things. First, there’s a clear sign that the utopian dream of telco/media tie-ups seems to be crumbling. AT&T paid more than $85bn for Warner Media in 2018. In just three years, its value has been slashed in half. Telecoms firms have often flirted with media assets, viewing them as the glamorous packaging for the nitty-gritty of their core business. For a while, marrying content with distribution was even seen as the key to conquering the modern media landscape. But as broadband and 5G have made infrastructure ever more expensive, and production costs have ballooned due to the streaming wars, the tie-up has become untenable. We’ve already seen it with BT’s efforts to sell off BT Sports, but AT&T’s humbling retreat is perhaps the clearest sign yet.

Second, the flurry of deals suggests the streaming wars are moving into their next phase. After years of new launches, during which every Tom, Dick and Harry has whacked a plus at the end of their brand and moved into streaming, the market is well and truly saturated. There’s no doubt that content is king in this game, but scale is also key. It’s now eat or be eaten, so expect a fresh wave of media mergers. In terms of platforms, Viacom CBS and Comcast-owned NBC Universal look primed for consolidation. More studios, such as Lionsgate, will surely also be on the table. Netflix, Disney, Amazon and Apple all have the firepower, so let the shopping spree commence.

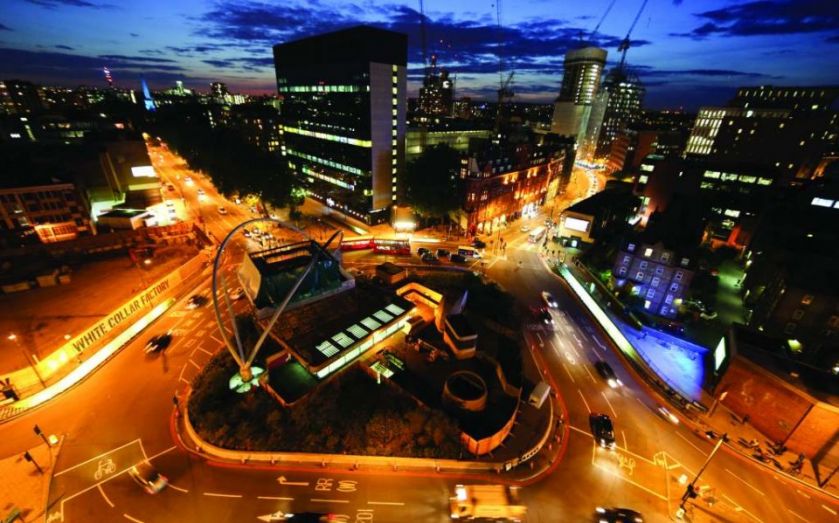

Can London close the tech gap on Silicon Valley?

In the current never-ending stream of bad news, it’s good to see a success story. Bullishness around the UK’s booming tech scene is nothing new — it’s been on the rise for years — but new figures out this week showed just how stellar that growth has been. The UK’s tech sector has grown tenfold over the last decade, both in terms of the number of unicorns and venture capital investment. The report was also positive about the outlook, as the number of tech companies nearing unicorn status (dubbed, excruciatingly, “futurecorns”) has also grown by a factor of 10.

The UK is also lightyears ahead of its European neighbours — last year venture capital investment in Britain was more than in France and Germany combined. But the thriving tech scene should now be looking ahead, not back. London is the world’s fourth-biggest tech hotspot, behind the Bay Area, Beijing and New York. Those rankings can surely be climbed.

In his Budget earlier this year chancellor Rishi Sunak put tech at the forefront of his plans for the UK’s post-pandemic recovery, outlining a number of tech-friendly initiatives including visa reforms and a new £375m startup fund. At the other end of the scale, the government is also looking to relax listing laws in a bid to attract tech firms to London. Whether or not the capital is ready for this — as demonstrated by Deliveroo’s dismal debut — is another question. But the willingness is certainly there.

Yet there’s another part of our tech economy that must not be overlooked. Ensuring the UK has the right education and workplace training in place is key to ensuring tech roles are accessible to everyone. What’s more, research published by Samsung this week found that the sector still has a major issue with gender equality, proving a potential barrier to entry for top talent. Tech was the fourth most likely industry to be associated with men — behind only engineering, law enforcement and trade. That’s not to mention the challenges facing women already in the sector.

There’s no doubt that tech is the shining star of the UK economy. A strong research and development backdrop, top universities and solid government support have all driven the boom over the last decade. But if it wants to take the next step, the sector must ensure it’s open to all.

The algorithm recommends

- The BBC covered up what it knew about report Martin Bashir’s deceitful tactics in landing that 1995 Princess Diana interview. That’s according to a damning report published yesterday.

- Just when you thought the Spac crazy couldn’t get crazier, it emerged this week that Softbank is mulling a $300bn blank-cheque listing for its mammoth Vision Fund.

- After yet another volatile week for Bitcoin, here’s a nice little gem of crypto madness — the US FTC reckons crypto scammers have swindled consumers out of $2m in the last six months alone by impersonating Tesla chief Elon Musk.

Got a story? Drop me a line at james.warrington@cityam.com or on Twitter